Back

Replies (1)

More like this

Recommendations from Medial

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

If your income is 12L, You pay 0 for the first 4L. From 4L - 8L i.e. next 4L, you pay 5% = 20,000. From 8L - 12 i.e. another 4L, you pay 10% = 40,000. Total Tax Payable= 60,000. Standard Deduction -75,000. So NO TAX FOR INCOME UP TO 12L. Get it?

CA Kakul Gupta

Chartered Accountant... • 1y

The Central Board of Direct Taxes (CBDT) has specified that no tax deduction at source (TDS) under Section 194Q of the Income Tax Act, 1961, will be required for purchases made from units of International Financial Services Centres (IFSC), provided b

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

I won’t waste time on old tax regime for two reasons: -> 70%+ income taxpayers had already switched from it by the end of FY24 -> With what’s announced today, it’s anyway dead. One would have to be a fool to stick with it So, what about the News T

See More

Havish Gupta

Figuring Out • 2y

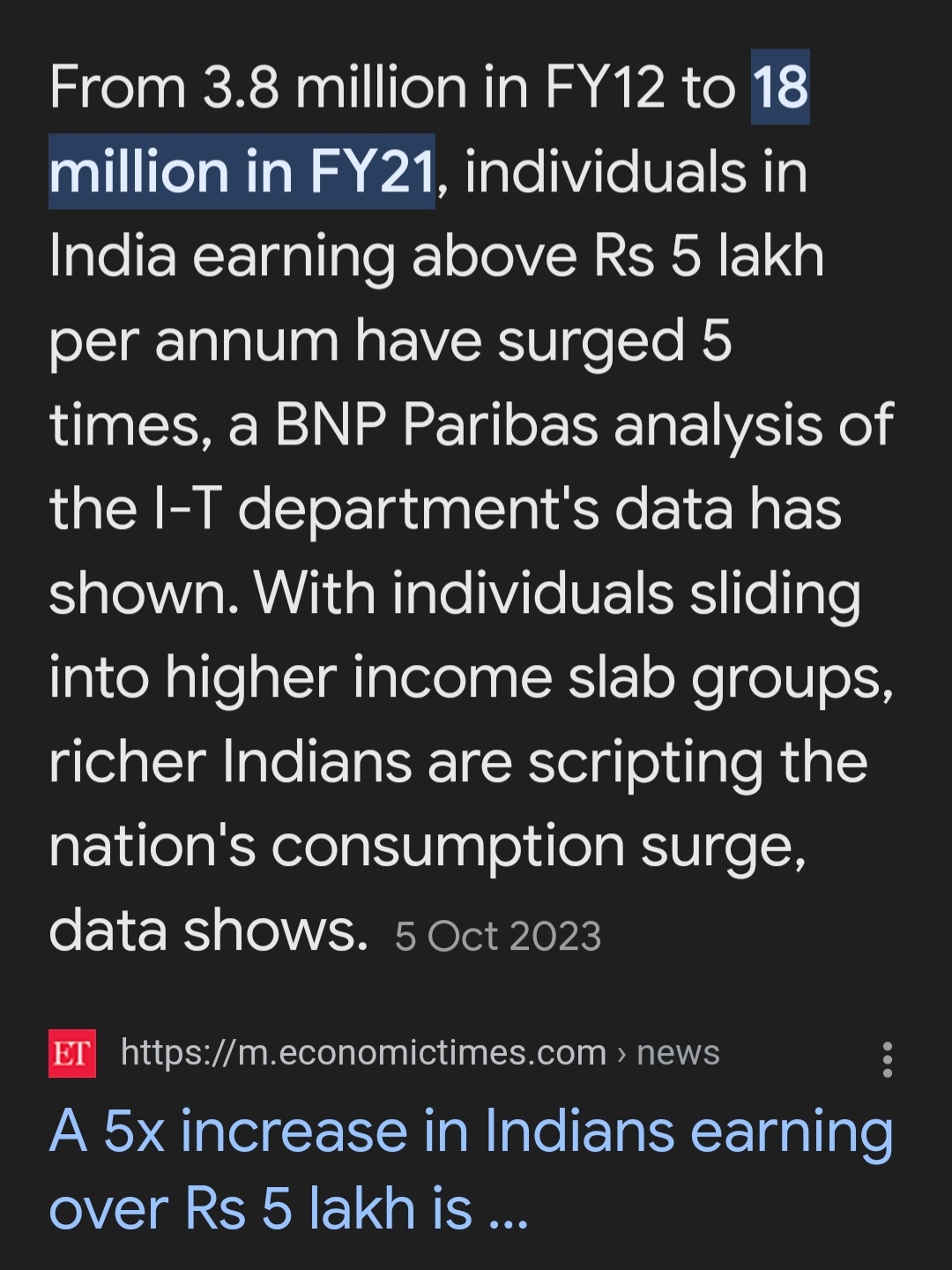

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Suman solopreneur

Exploring peace of m... • 1y

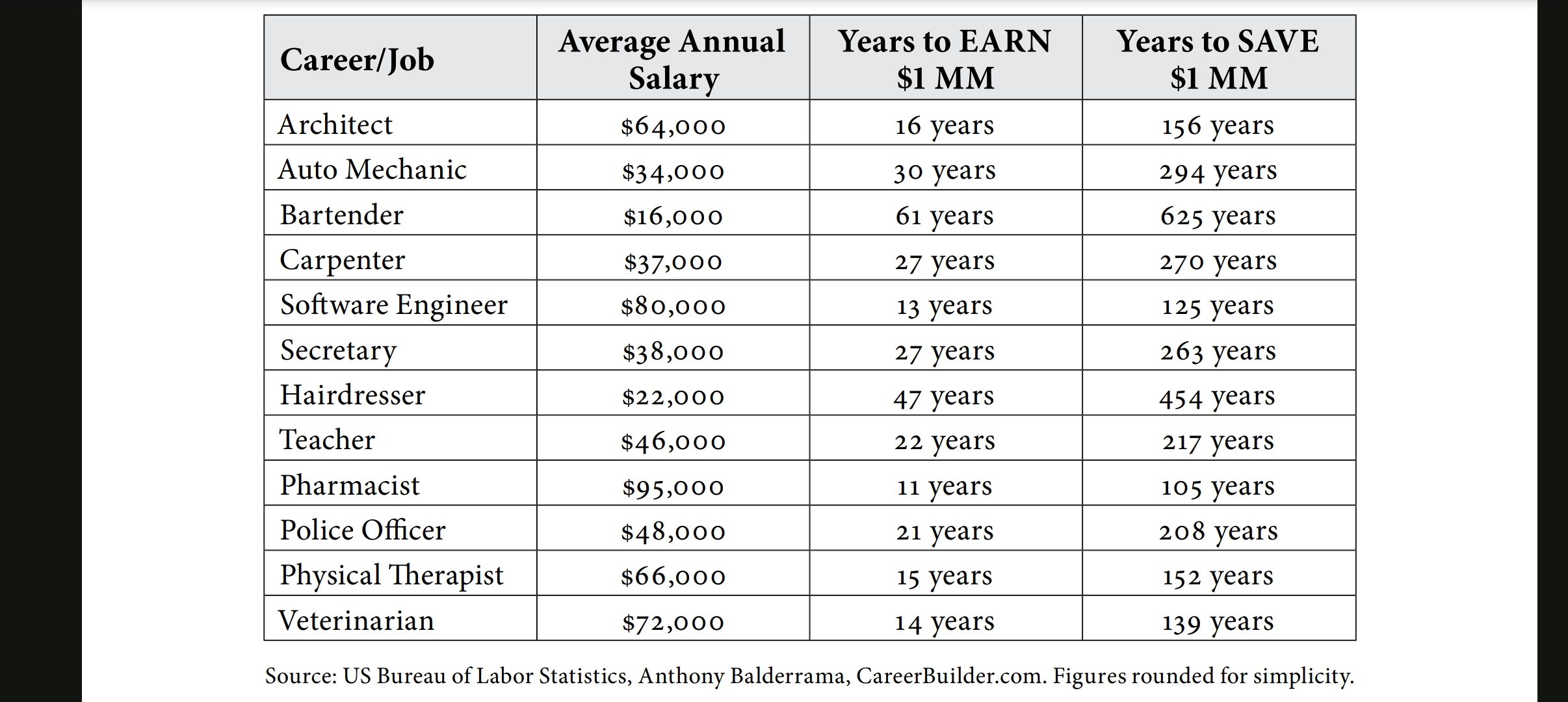

(millionaire fastlane) Jobs constrain learning, offer modest income growth, and exchange time for money, all of which reduce wealth. Workers are subject to office politics, pay high taxes, and have no influence over their income. Since there are so f

See More

Ritesh Jangale

Hey I am on Medial • 1y

FUND CHANNEL for those who r struggling with paying taxes and show foreign income in their sheets. Ur foreign income will go though an fund channel where ur funds will be registered in an organization which help small businesses to grow and maintain

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)