Back

Batman

Hey I am on Medial • 1y

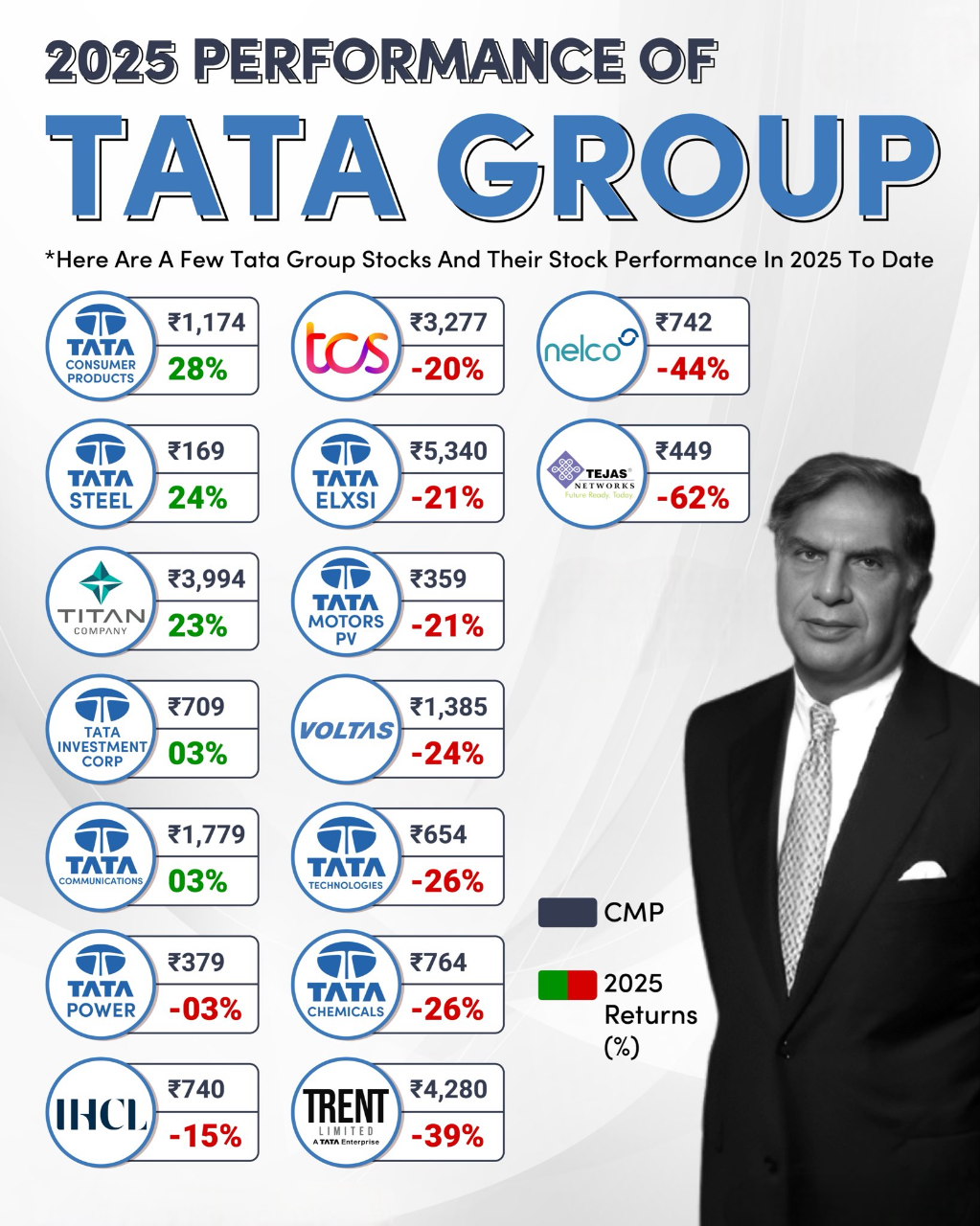

Any thoughts about Tata Motors stock ?

1 Reply

4

Replies (1)

More like this

Recommendations from Medial

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

"Ratan Tata's 2.3 Billion Dollar Revenge" Bankruptcy to Billions #4 Tata Motors Turnaround Story In 1998, Tata Motors had launched Tata Indica.A dream project of Ratan Tata. Due to low sales, Tata Motors decided to sell off its car business to Ford

See More

18 Replies

2

23

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)