Back

Anonymous 5

Hey I am on Medial • 1y

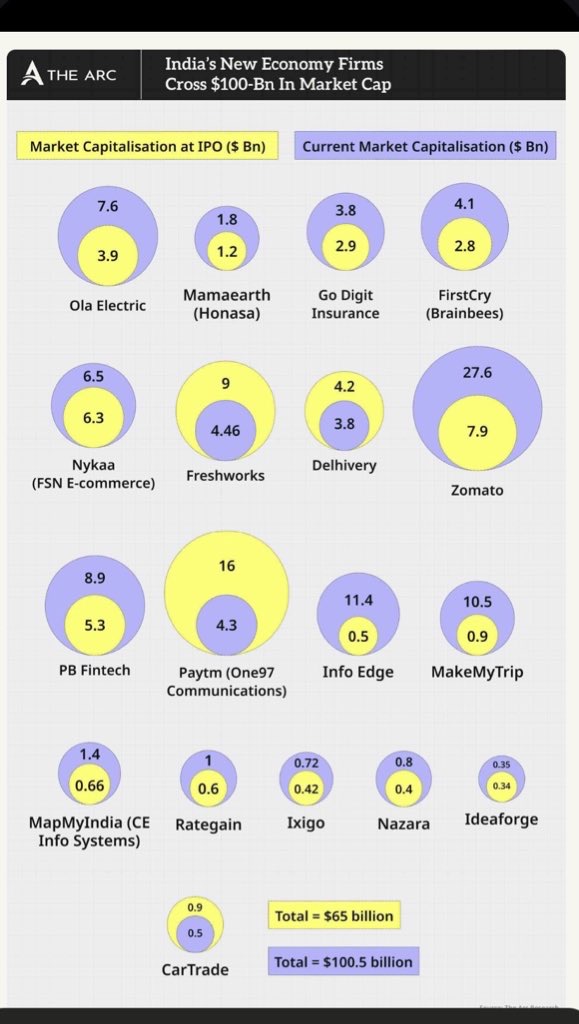

It’s crazy how just 4 companies hold half of the total valuation but then again, 20% will give 80% of the returns is something I have heard a lot of VCs talking about

Reply

1

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-15 What are Additional Returns? What is the Catch-Up Clause? In Developed Markets, The structure is in 2-20% where 2 is Management Fees & 20 is Additional Returns.Additional Returns & 2-20 structure is not ideal in Indian AIF Market

See More1 Reply

1

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)