Back

Nawal

Entrepreneur | Build... • 1y

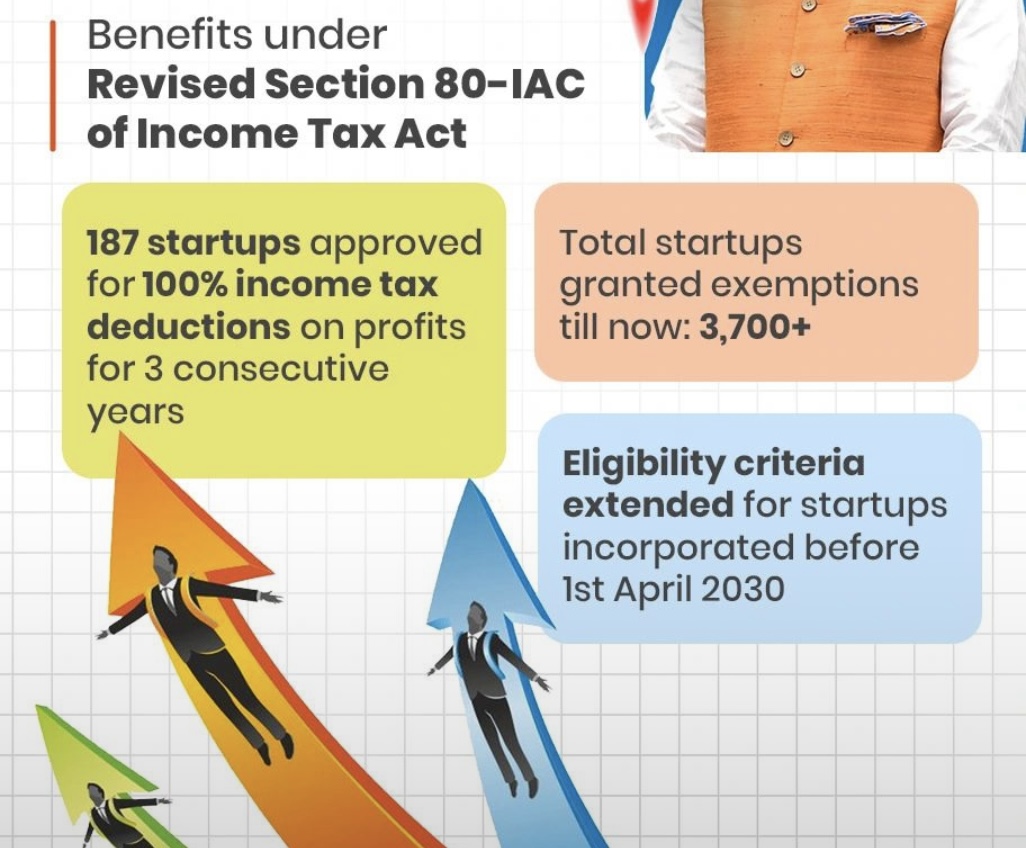

Reality of startup india scheme Core Features of the Startup India Initiative according to the Government of India: Ease of Doing Business: Simplified compliance, self-certification, and single-window clearances streamline processes for startups. Tax Benefits: Eligible startups enjoy tax exemptions for three consecutive financial years. Funding Support: The ₹10,000 crore Fund of Funds for Startups (FFS) supports early-stage funding. Sector-Specific Policies: Focused policies for sectors like biotechnology, agriculture, and renewable energy foster targeted growth. But in reality: 15 days for name approval, nearly 30 days for incorporation application filing in progress, and more delays. Tax benefits: Requires previous 3 years of financial statements, so startups can’t claim benefits for the first 3 years. Even then, only 20% of companies manage to qualify for these benefits. Funding: Did you actually get the grant? Policies: Great in PDFs, less so in practice.

Replies (12)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Hello Everyone, What do you think, India will be the next destination for startups because government is coming with some great policies for startups , let's take example of GIFT city where startups have 0% GST and first 10 years no tax for Startups.

See MoreIndradev Singh

Searching invester • 8m

I have a startup idea, if you want to invest in my project then you can message me. Startup India is a flagship initiative by the Indian government focused on fostering innovation and entrepreneurship. It offers various programs, schemes, and support

See More

Kiran aiwale

The business solutio... • 9m

Bajaj Allianz Life insurance Term insurance 1. *Affordable premiums*: Lower premiums compared to whole life insurance. 2. *High coverage*: Provides a high death benefit to ensure financial security for loved ones. 3. *Flexibility*: Choose term le

See MoreSai Charan

Hard work beats tale... • 1y

Modi government startup FAKERY - Congress president Mallikarjun Kharge targeted the Modi government for providing the Indian startups with"almost negligible support, which he called a "STARTUP OF FAKERY." - Barely1.58% of the accredited startups

See MoreCA Jasmeet Singh

In God We Trust, The... • 1y

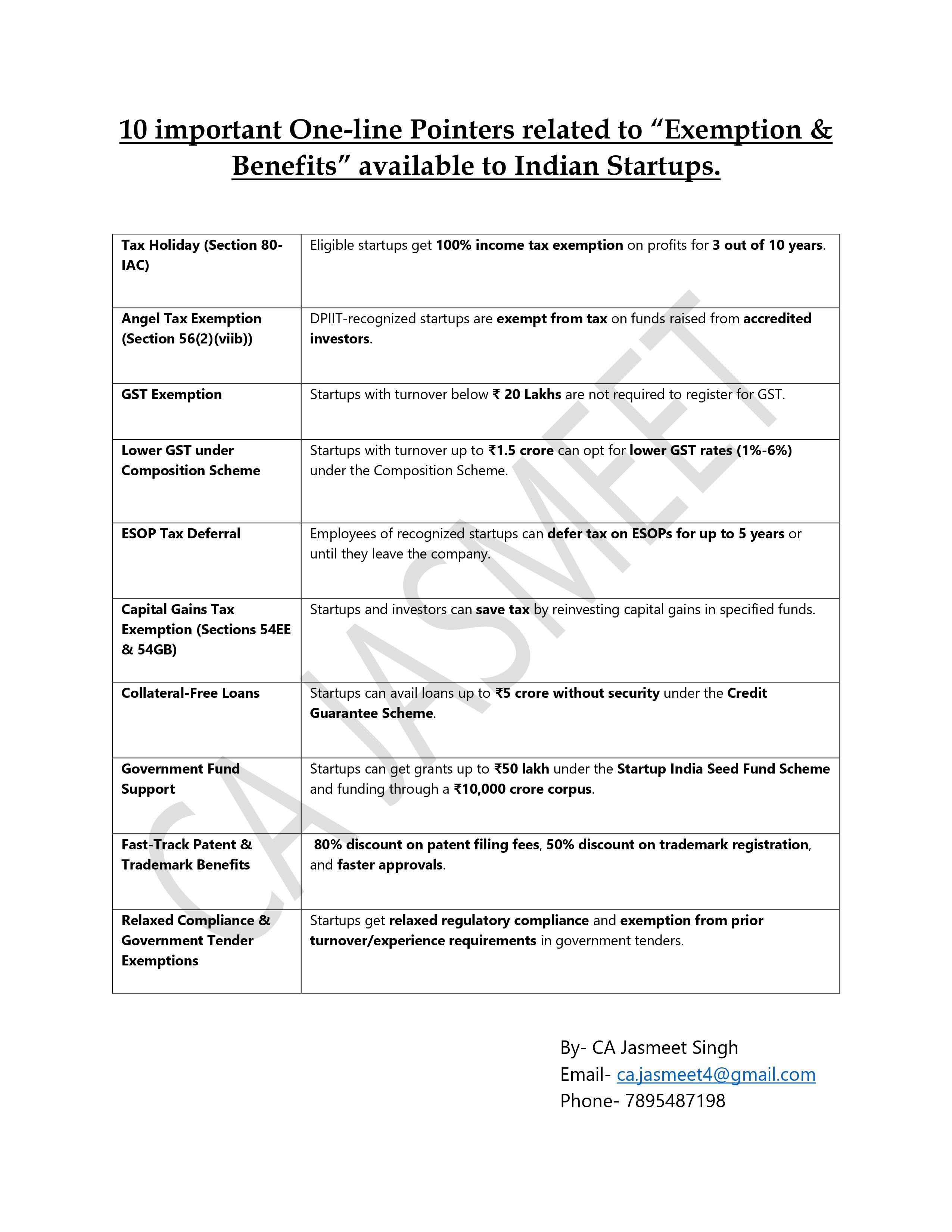

🌟 Big News for Startups! 🚀💼 Did you know Indian startups get amazing tax breaks, funding support, and compliance relaxations? 🏦📊 From 100% tax exemptions to collateral-free loans, here are 10 key benefits every entrepreneur must know! 💡✅ 🔥 C

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)