Back

Suman solopreneur

Exploring peace of m... • 1y

Meet Anjali, a young marketing professional in Mumbai. Every month, she feels like her salary vanishes before she even knows where it’s gone. She buys groceries, eats out with friends, pays her rent, and shops online, but by the 20th of the month, she’s left wondering, “Where did all my money go?” Then there’s Arjun, her flatmate. He earns the same salary but never seems to stress about money. Why? Because Arjun follows a simple budget. At the start of every month, he divides his salary into categories: ₹25,000 for essentials, ₹10,000 for entertainment, ₹5,000 for savings, and ₹5,000 for emergencies. He tracks his spending weekly, adjusting as needed. The result? Arjun has control over his money, while Anjali is always guessing. A budget isn’t about restrictions—it’s about giving every rupee a purpose. It helps you plan, avoid overspending, and save for what truly matters. Want to break the cycle of paycheck-to-paycheck living? Start budgeting today.

Replies (13)

More like this

Recommendations from Medial

Sanskar

Keen Learner and Exp... • 1y

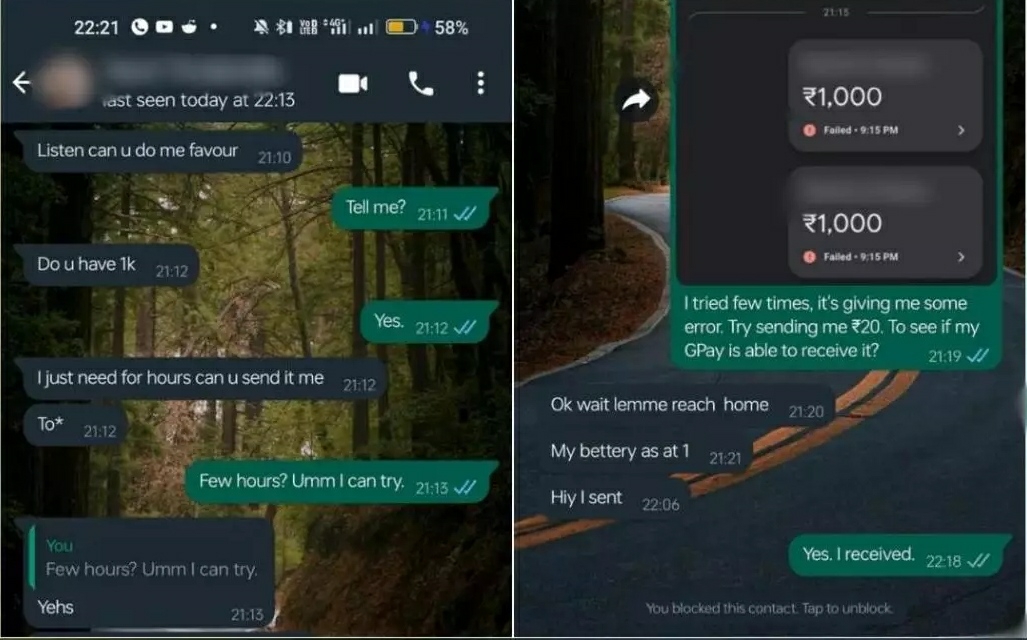

How to scam a scammer. A man shared a screenshot on his X account showing a a conversation of his with a girl he chatted on a dating app, the girl asked the man to Gpay her ₹1000, after sharing the screenshot of failed transaction he asked her to s

See More

Suman solopreneur

Exploring peace of m... • 1y

Sitting at a dealership, Ravi eyed a high-end vehicle of his dreams. Though he understood in his heart that it came with invisible chains—monthly payments and stress—he was able to afford it on paper. One lesson he remembered was that you can't

See More

Anonymous

Hey I am on Medial • 1y

My sister got PIP. (Performance improvement plan) She is a data scientist in a company and suddenly out of the blue the HR tells her she is put on PIP. The company isn’t paying salary on time to the employees and they put her on PIP. What should she

See More

Anonymous

•

Ansec Human Resources • 1y

I am in a very complicated situation. After my brother's arranged marriage, I fell in love with his wife just 10 days into their marriage. My brother is 37, she is 18, and I am 21. She felt the same way, and we were caught by my brother while sharin

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)