Back

PRATHAM

Experimenting On lea... • 1y

The Snapdeal Saga Snapdeal - a company that went from being the country’s most promising unicorn to nearly shutting down. Kunal Bahl ( yes the Latest Shark ) and Rohit Bansal, two college friends who took on Flipkart and Amazon in a battle Snapdeal wasn’t even supposed to be an e-commerce platform. Back in 2010, Kunal Bahl and Rohit Bansal launched it as a daily deals and discount coupon platform just like Groupon.. But in 2012, they had one of the smartest pivots in Indian startup history, shifting from a deals site to a full-fledged online marketplace. And boom Snapdeal 2.0 was born. With the e-commerce wave hitting India hard and Flipkart still focused on selling books, Snapdeal became the go-to platform for thousands of small businesses and sellers who wanted to go online but didn’t have the resources to build their own websites. Consider that like Messho. By 2014-2015, Snapdeal was on 🔥 Raised over $1.8 billion from investors like SoftBank, eBay, Alibaba, and Nexus Venture Partners. Is it possible that they'd still lose ? well you will know about it further. Was doing millions of daily transactions with over 3 lakh sellers on the platform. At its peak, Snapdeal was valued at nearly $6.5 billion, making it India’s second-largest e-commerce platform after Flipkart. Even Once Kunal Bahl said that they will be Number 1 dominating Flipkart. It was a bold statement by him. Kunal Bahl even boldly declared, “We will be the Alibaba of India.” Everything looked perfect BACK THEN Then came 2016, the year everything started going down Bald Bezos went all-in on India with Amazon haunting both Flipkart and Snapdeal. SoftBank, one of Snapdeal’s biggest investors, wanted to merge Snapdeal with Flipkart to create a stronger competitor against Amazon. But Kunal Bahl refused to sell, leading to a major fallout with investors. The valuation was Pretty good ( Ig $950 Million) They launched Snapdeal Gold, FreeCharge (a digital payments company bought for $400M), and other services, but none gained traction. FreeCharge itself was later sold to Axis Bank for just $60M crazy loss. Btw Free charge was established by Kunal Shah of Cred. By 2017, Snapdeal had gone from a $6.5 billion giant to near bankruptcy. The company laid off hundreds of employees, cut costs aggressively, and investors abandoned ship. Unfortunately, The dream of becoming India’s Alibaba had crashed. Now, Snapdeal is still alive and profitable as they have pivoted to a value driven approach to Tier 2 and 3 and had taken gutsy decisions to revive it. Hopefully they will come back hard.

Replies (9)

More like this

Recommendations from Medial

Pritam Mondal

Build. Don't talk • 1y

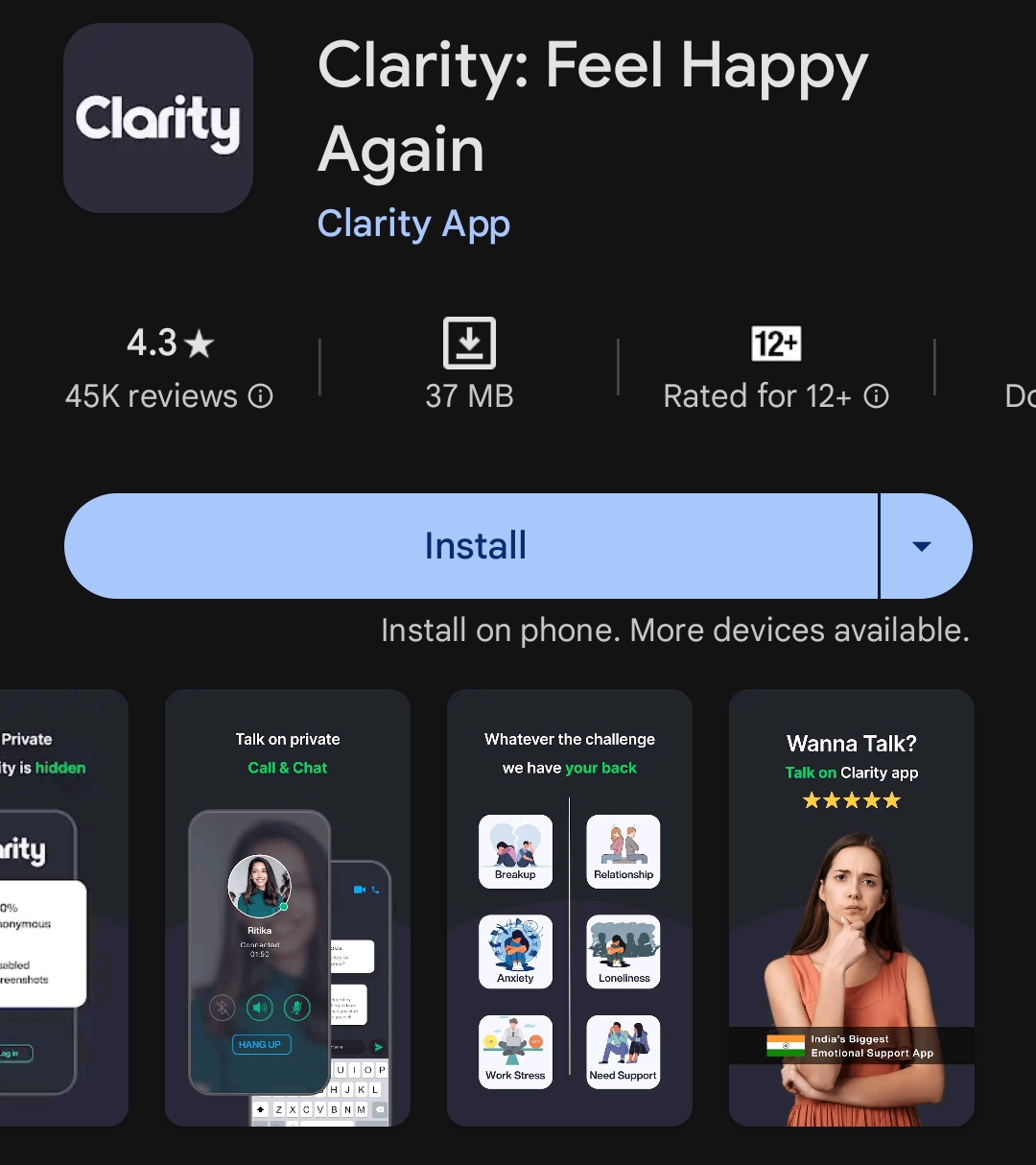

Everybody's Life is quite fucked up. Someone is dealing with work stress. Someone is dealing with relationship issue. But indian entrepreneurs are next level Someone build this app for emotional support and got funded Do you know their investors?

See More

Aditya Arora

•

Faad Network • 1y

It was a great pleasure to meet Kunal Bahl finally. Our firms have invested in 350+ Startups across different sectors and geographies for many years. 💰 It was finally a great experience to meet and discuss potential synergies, reflect on our exper

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)