Back

PRATHAM

•

Medial • 1y

it's the pressure of investors to increase the valuation so that they can have good gains. Therefore people burn cash in scaling. nobody is that dumb

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 8m

No Investors. No Burn. Just Purpose. We know investors won’t fund us — and that’s okay. Why? Because we’re not trying to become a unicorn by burning cash. At Delfo, we're not building for hype. We're building for underrated local restaurants and ha

See More

VIJAY PANJWANI

Learning is a key to... • 15d

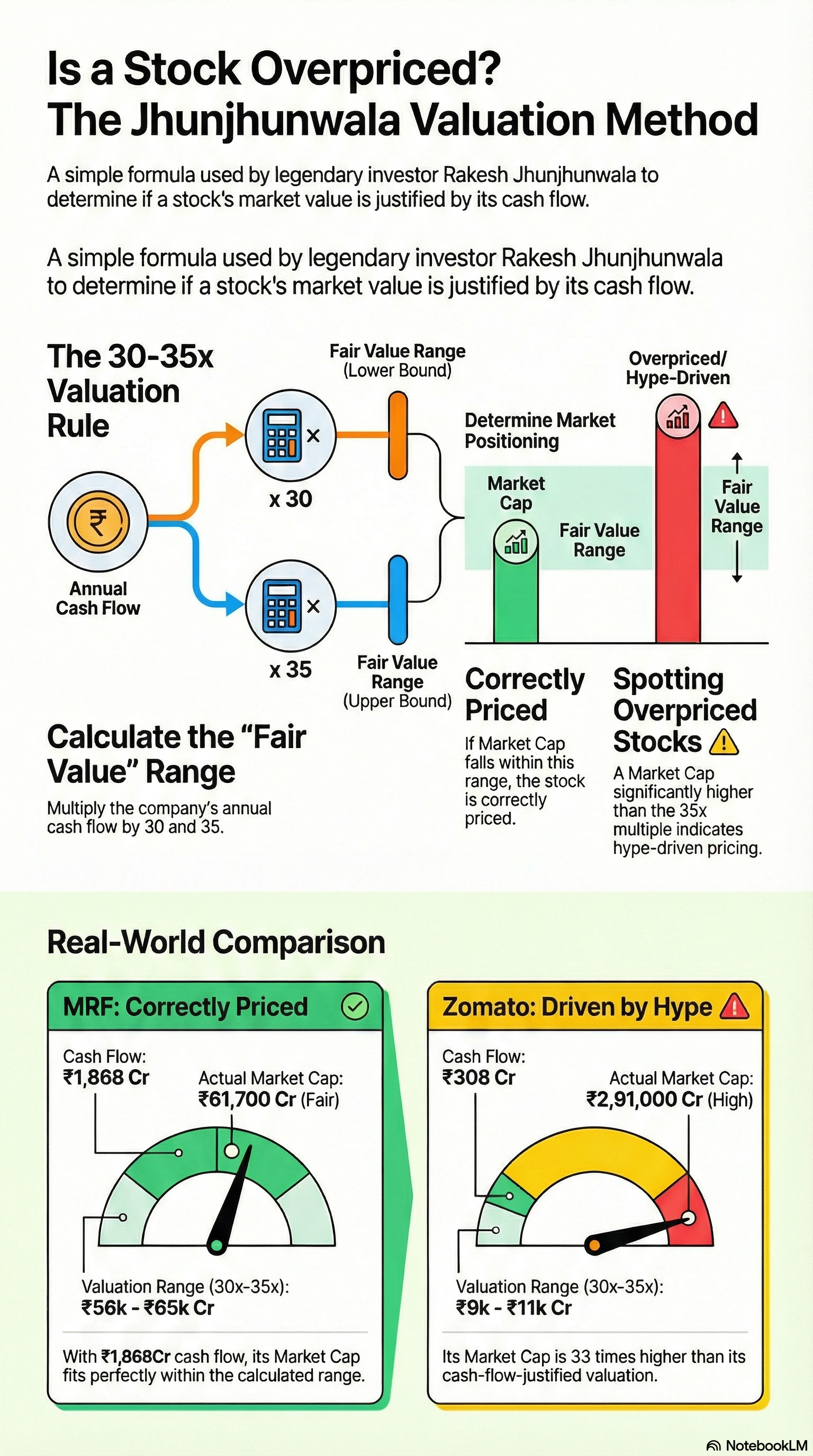

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreAnonymous

Hey I am on Medial • 1y

Valuation is not just about numbers, but about understanding the biases, uncertainties, and complexities that can impact the valuation. It is important to recognize and address these factors in order to make more accurate valuations. The three big p

See MoreRohan Saha

Founder - Burn Inves... • 11m

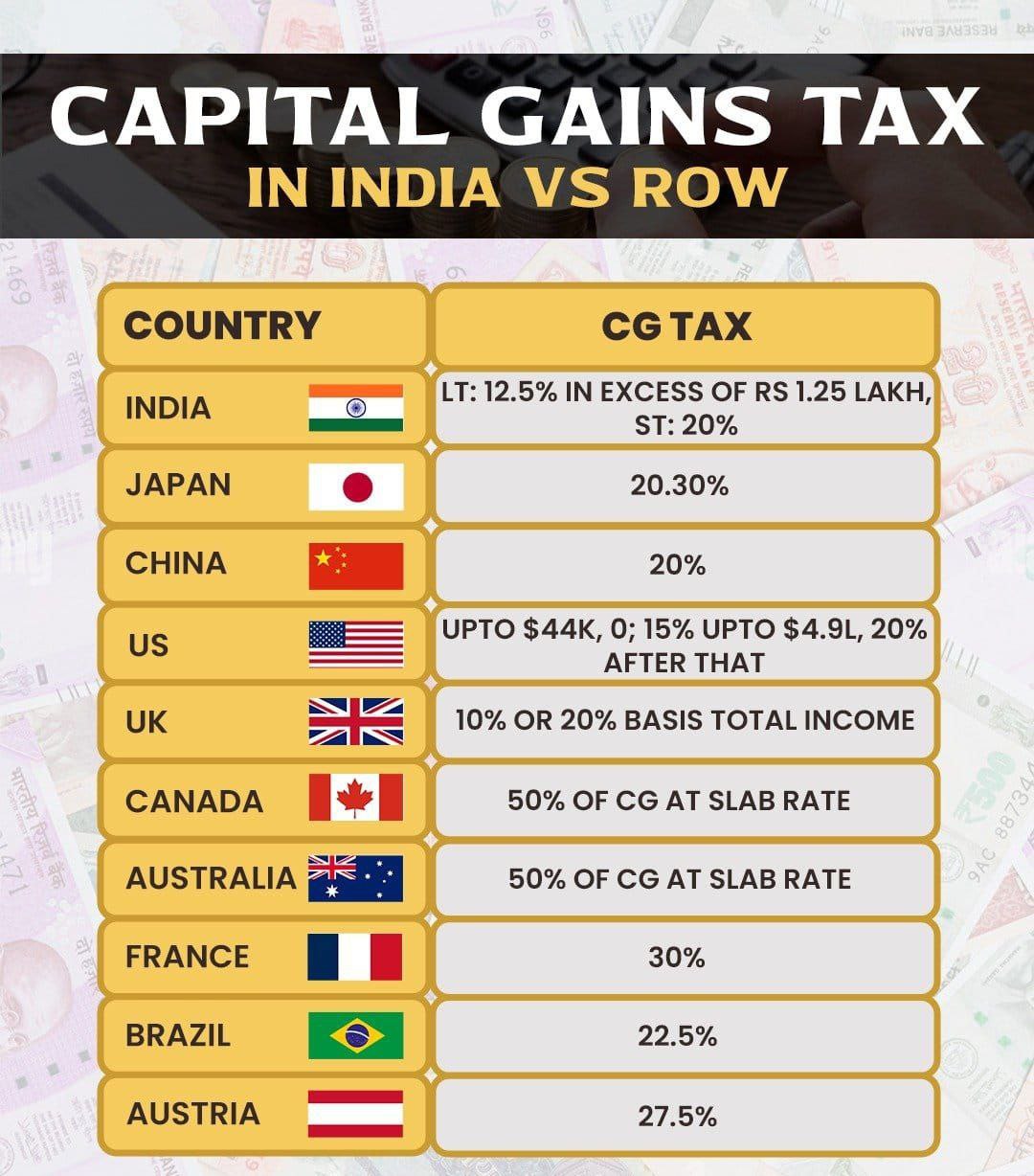

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

In this thought-provoking video, we explore the 'Unicorn' Paradox: the idea that achieving a $1 billion valuation may not be the ultimate goal for startups. While massive funding rounds can fuel hyper-growth, they also come with significant financial

See MoreAbhik Paul

Explorer 🌍 | Tech E... • 5m

Tuesday Horizon by Abhik • Edition 02 U.S. markets hit fresh highs last week driven by gains in AI and big tech. Investor sentiment—propelled by favorable macro signals and large-cap tech developments—pushed indexes to record levels. For founders an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)