Back

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 11m

jo indians bolte hai na ki indian market me bobble chal raha hai ye lo uska proof ki hamara market starting se hi tha, koyi bobble nahi hai india, india me jitni companies hai unn sabko stock market ki jarurat hai, not like some other countries like

See More

Rohan Saha

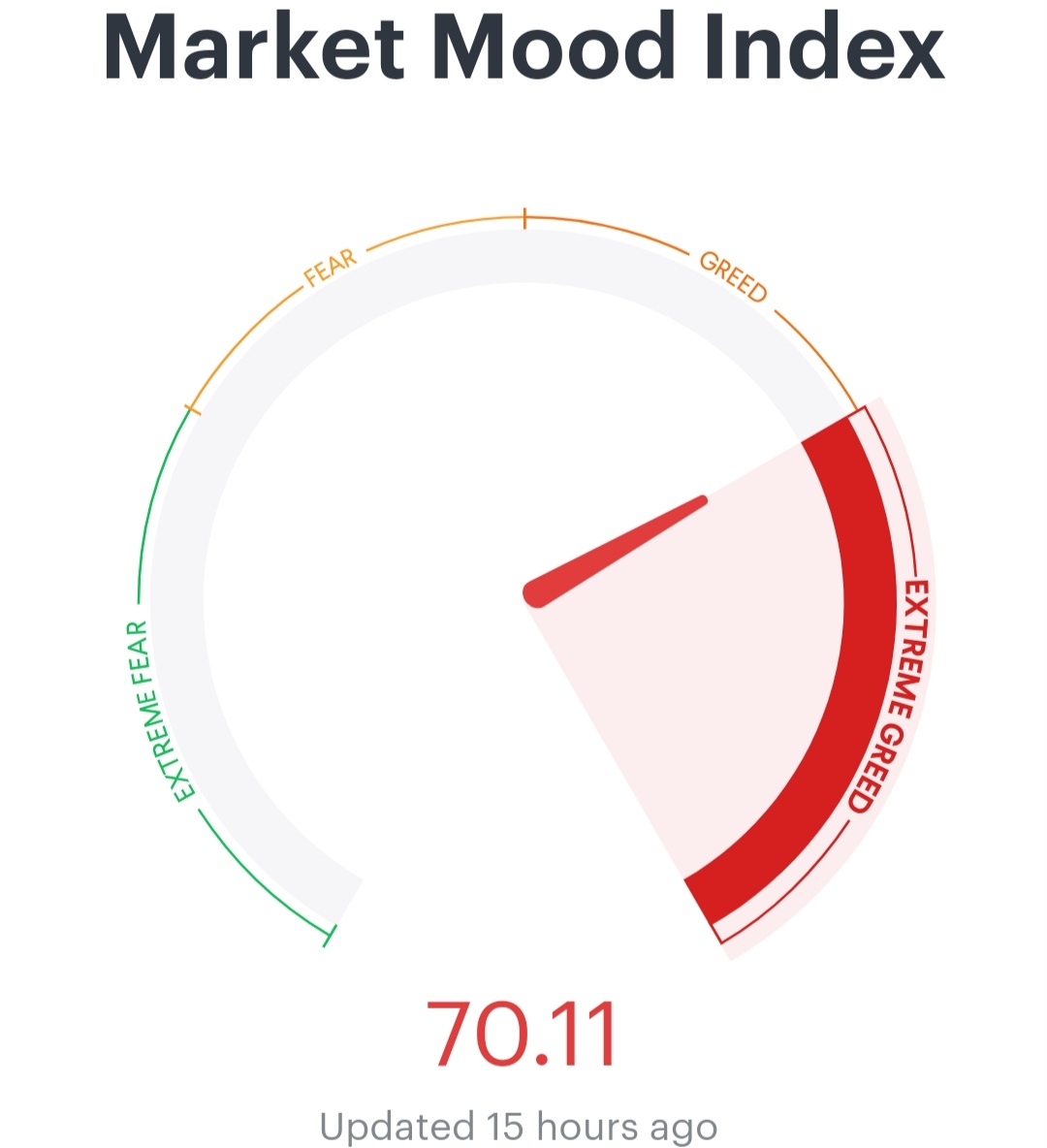

Founder - Burn Inves... • 1y

Ajj kal bohot log kuch experts ye boll rahe he ki indian market overvalued ho geya he.... Lakin indian market ka PE ratio avi 5 years ke average ke ass pass hi ghum raha he.... Or bank nifty ka PE to 5 years average se bohot nicea hai... Indian mar

See MoreRohan Saha

Founder - Burn Inves... • 1y

INDMONEY Ki fat gayi merese... Bina bataye mere name pe koyi vi bank account add kardiya demat account me jab sabal pucha or kuch gali diya bo un logo ne tickets raise karne ka option hi band kar diya merese... Batao mere name pe bank account banaya

See More

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreVijay Sahu

First Learn Then Ear... • 7m

I have a million dollars idea , Create a crypto broker company like Delta Exchange, jisme log Crypto me F&O trading kar sake becouse iss par 30% Tax nahi lagta hai , Ek already platform hai Delta Exchange but usme fees bahut jyada hai , 0.05% Buy and

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)