Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

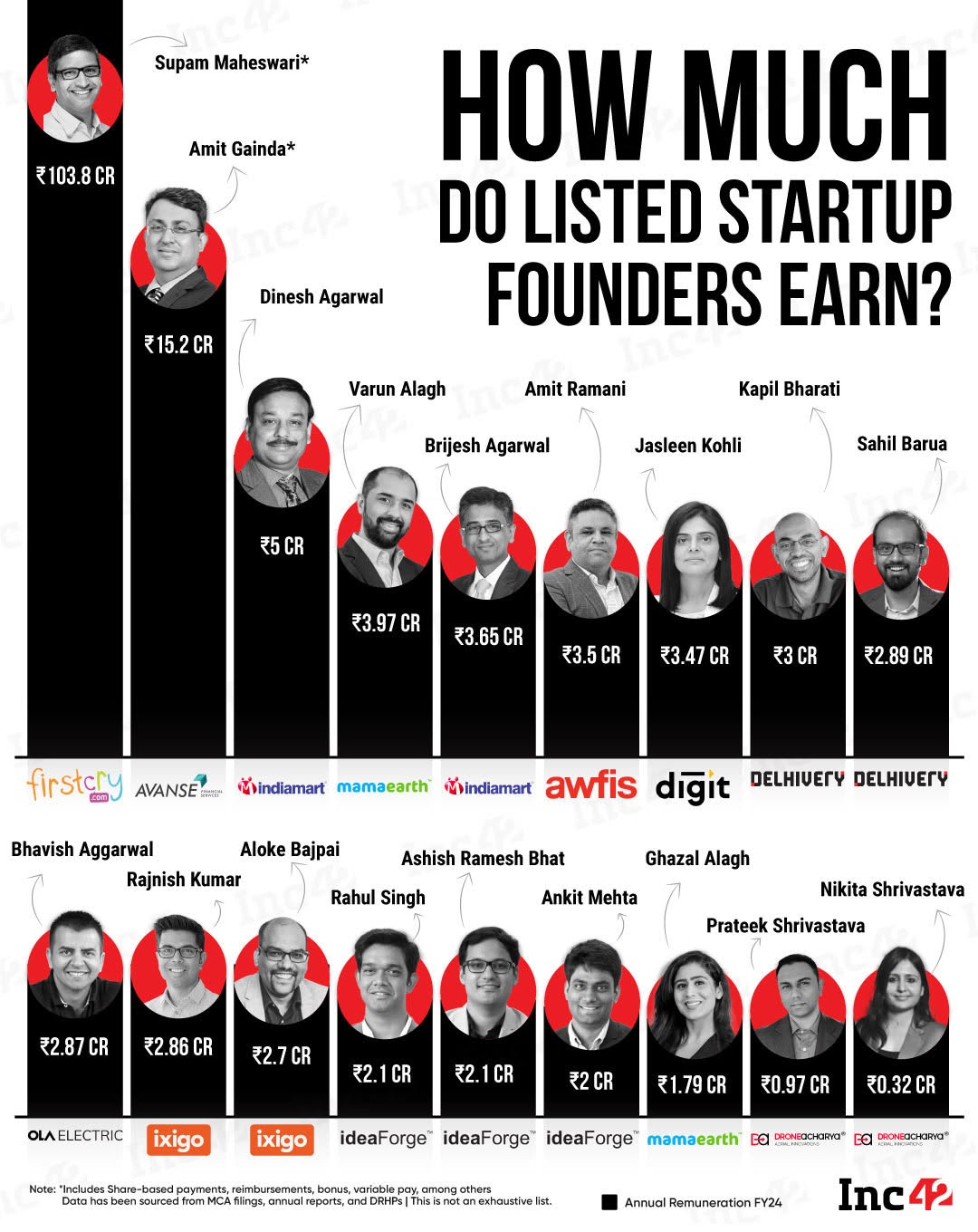

Then they pay 30% tax to gov. and surcharge as well 😂.

1 Reply

1

1

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See More1 Reply

1

9

Account Deleted

Hey I am on Medial • 8m

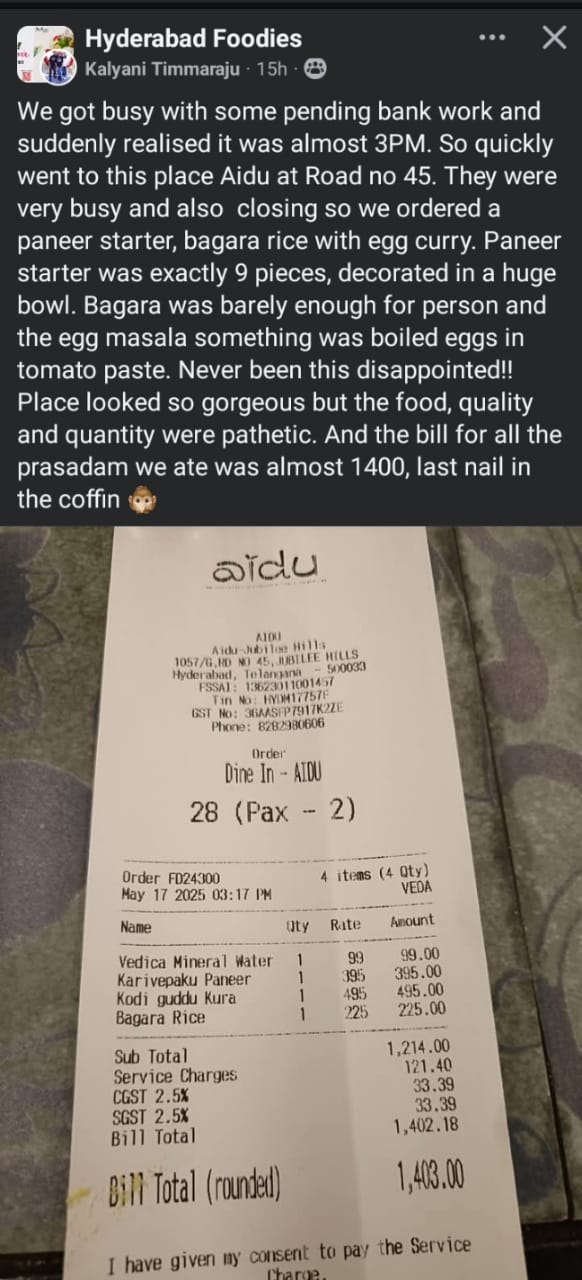

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

7 Replies

3

20

Download the medial app to read full posts, comements and news.