Back

More like this

Recommendations from Medial

Reyansh Rathod

Entrepreneur • 10m

Friends, have you ever thought that paying tax is our responsibility, but why does it seem like a deep trap? India's tax system is so complicated that the common man gets confused! On one hand, the changing rules of GST, on the other hand, the high r

See MoreAccount Deleted

Hey I am on Medial • 1y

Now , AI Space is cluttered With Companies like OpenAI,Google,X.Ai , Claude, Perplexity AI and many more and in EV race China is leading Worldwide with Companies like BYD , Xiaomi etc. Do you think, India will Catch up with this countries in the rac

See MoreAccount Deleted

Hey I am on Medial • 7m

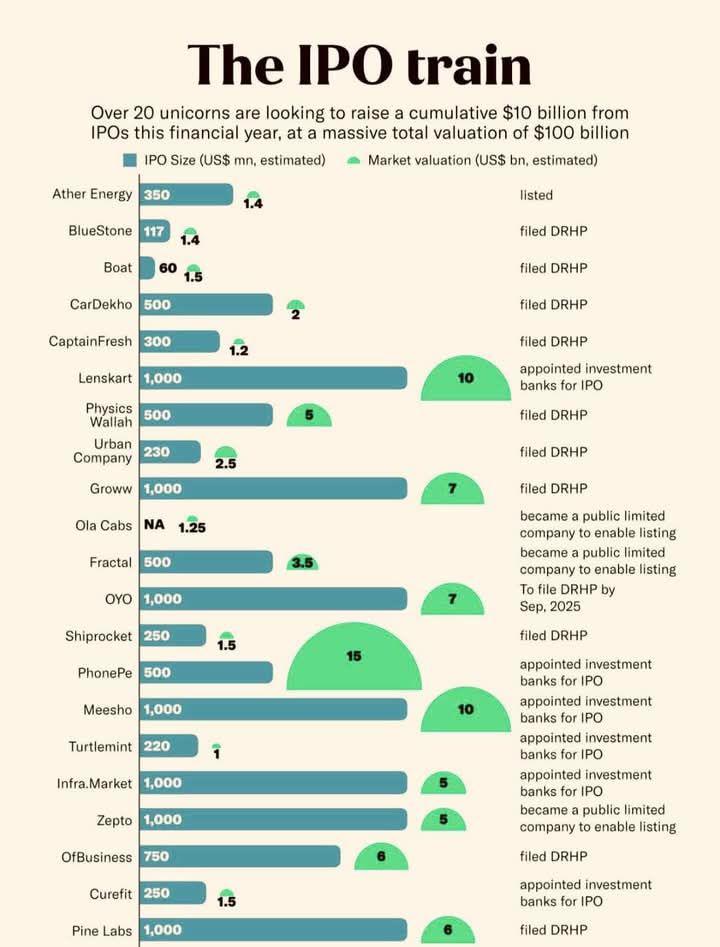

The IPO train is getting crowded. Over 20 Indian unicorns are gearing up to hit the public markets. Together, they plan to raise around $10 Billion,with a combined valuation of $100 Billion+ From Zepto and Lenskart to Physics Wallah and Groww — ev

See More

Download the medial app to read full posts, comements and news.