Back

Ramesh Chartered Accountant

Investor in start-up... • 1y

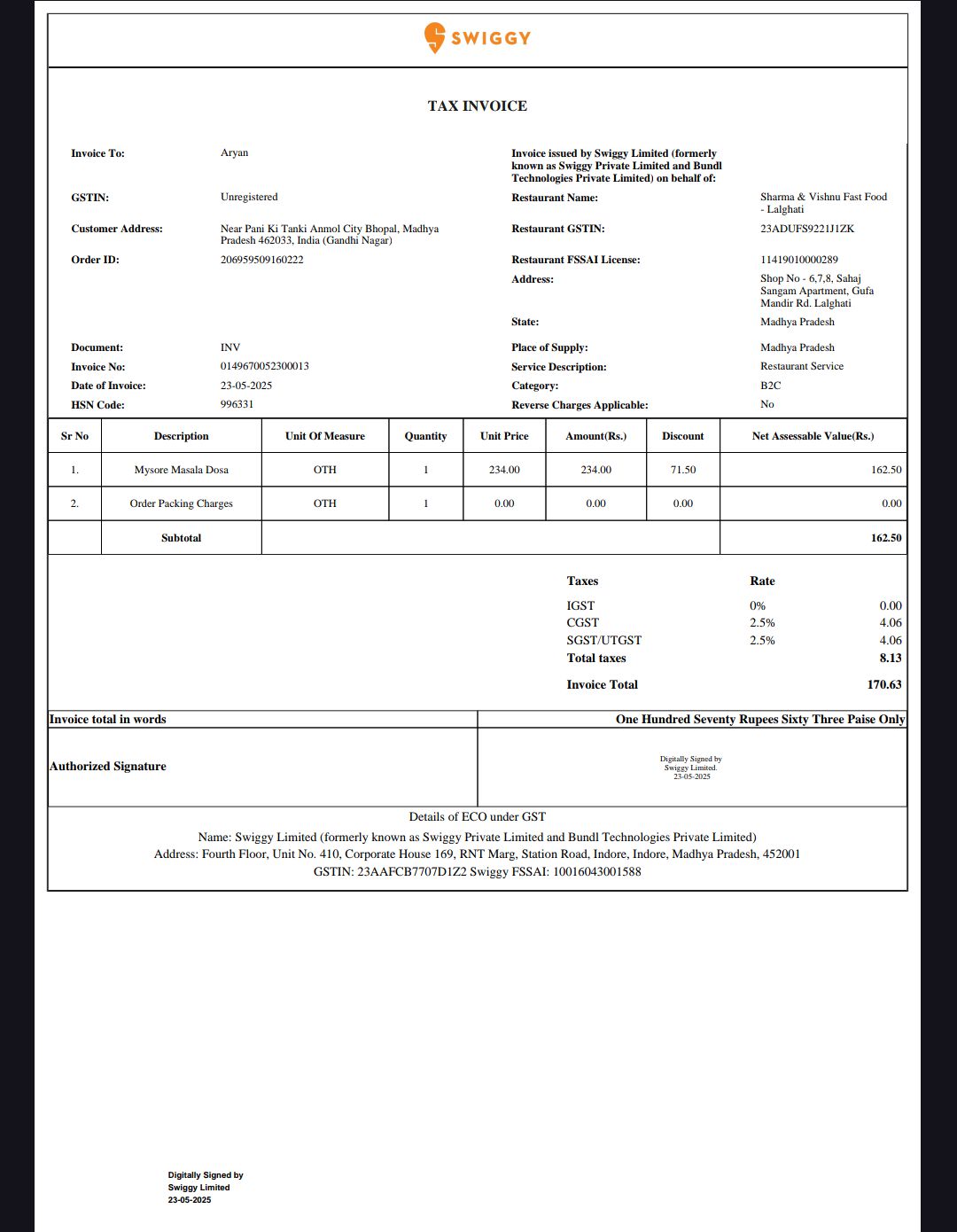

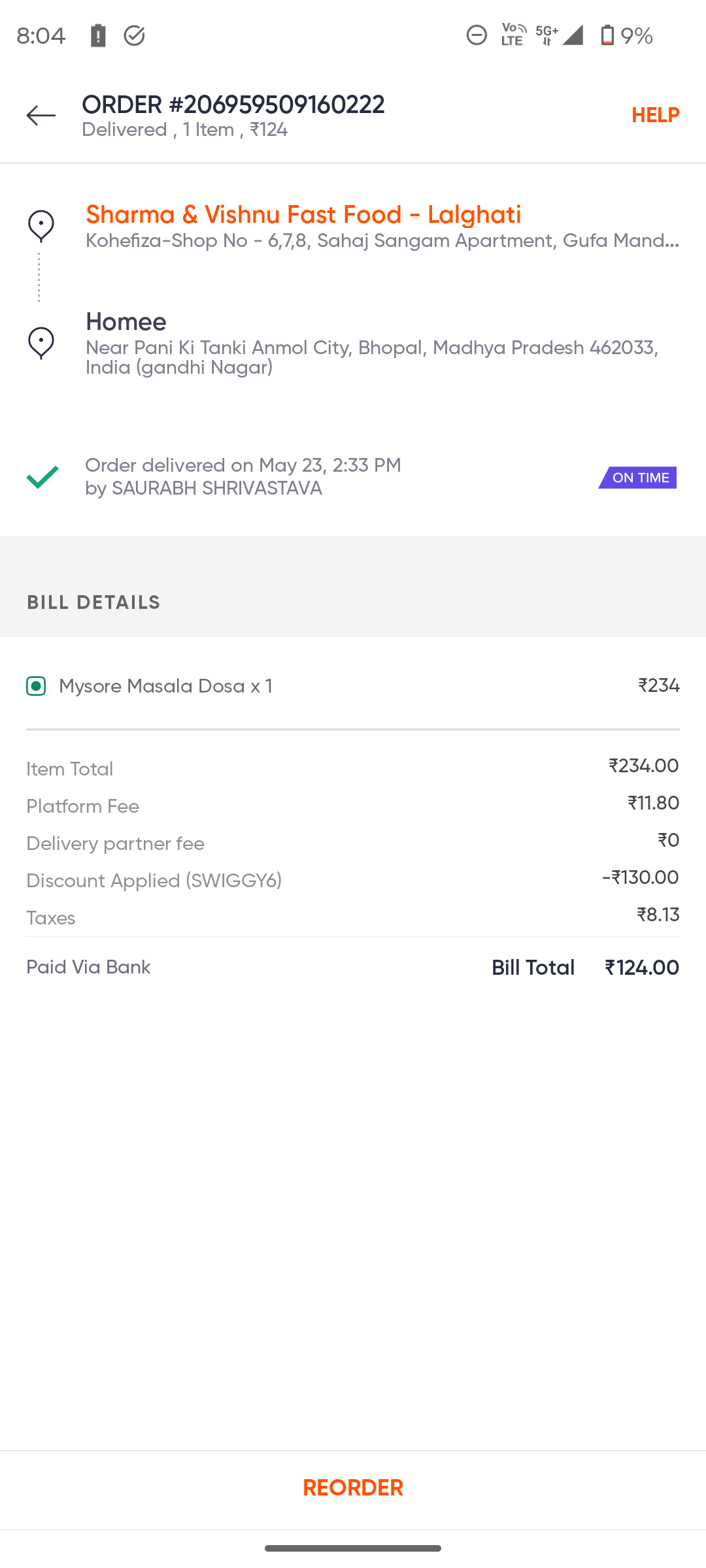

he has reached from 50lak order value in aug 24 to 1 cr in Jan25..so it's a monthly order value...and these are reflected in the GST returns once invoice is raised

Replies (1)

More like this

Recommendations from Medial

Shubham

Start small Dream Bi... • 1m

Need GST registration, company incorporation, or help in filing GST returns, corporate returns? Our team of chartered accountants & company secretaries handles it all—fast and hassle‑free. DM for more information. #GST #Incorporation #TaxReturns #S

See MoreCA Kakul Gupta

Chartered Accountant... • 5m

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreDinesh H

Mission to Quit 9 to... • 7m

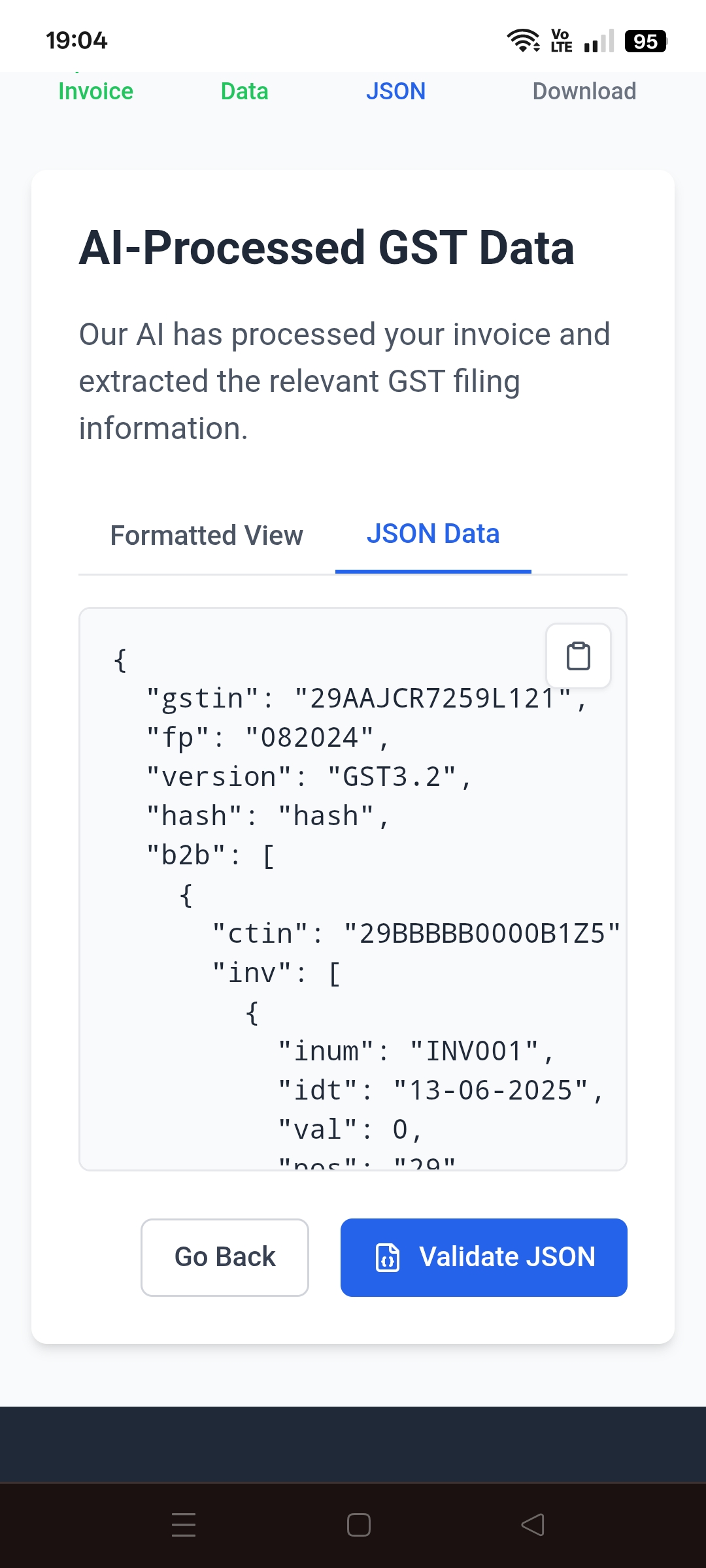

I am looking for some funding to my SaaS startups. so are there any hackathons or some competition to participate and get funds related to Fintech and Gst solution products ? my product is: AI GST Filling Automation helps the gst filling process si

See More

Mesride Tech

Software hamara, bus... • 1y

Must have softwares for startups : 1. CRM : Manage your relationship with customers 2. Accounting : have a check on in & out financials 3. Invoice : to make invoices fast 4. GST billing : to manage GST 5. HR Management: to manage your human resource

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)