Back

The next billionaire

Unfiltered and real ... • 1y

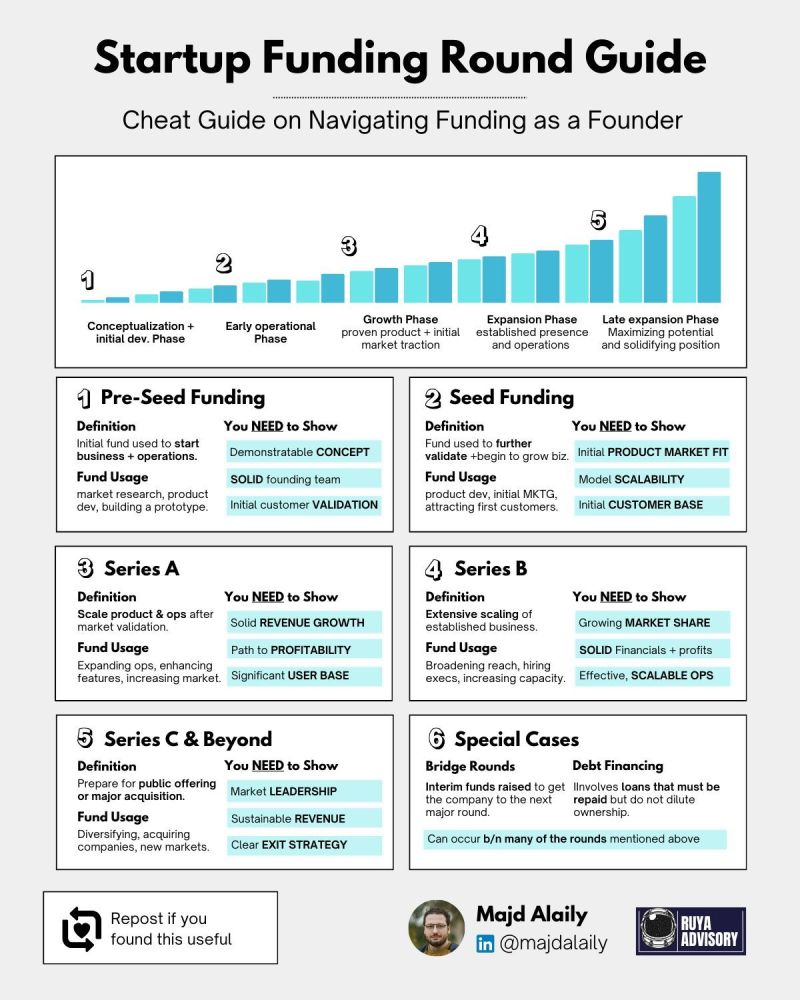

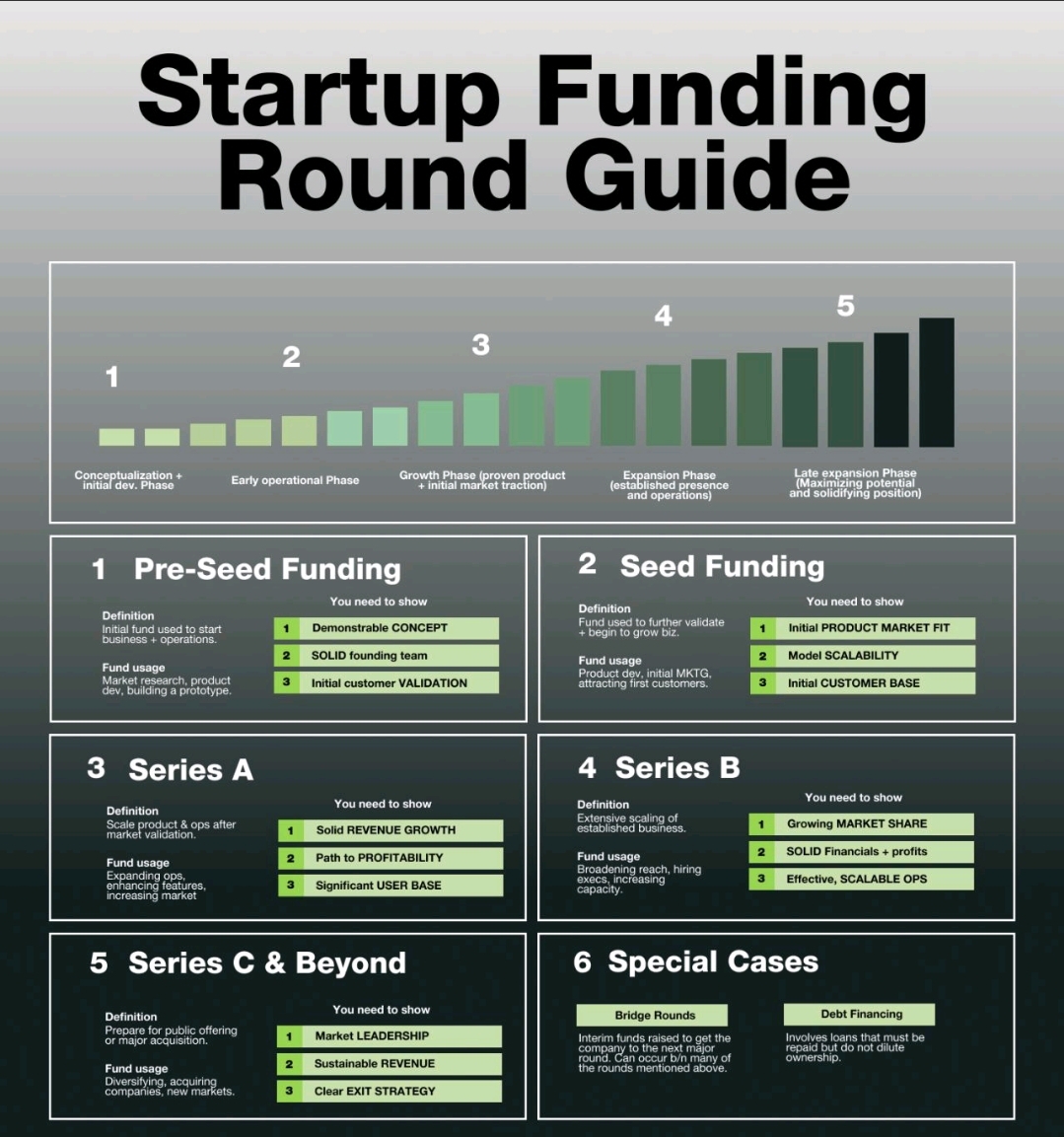

Fundraising Simplified: What to Show Investors at Each Stage.... Raising capital can feel overwhelming, but it doesn’t have to. The key? Knowing what matters most to investors at every step of the journey. Here’s a straightforward breakdown from Majd Alaily: 1️⃣ Pre-Seed: Show that the problem is real and worth solving. Investors want to see a solid founding team and genuine early feedback from your target audience. 2️⃣ Seed: This is where traction comes into play. Prove there’s demand for your product and explain why your solution can scale. 3️⃣ Series A: Focus on consistent revenue growth and demonstrate how you’ll move toward profitability. 4️⃣ Series B: It’s all about scale. Show you can handle growth without losing operational efficiency. 5️⃣ Series C and Beyond: Be the market leader. Show sustainable revenue, dominance in your space, and a clear path to a successful exit. Each round has a milestone—hit it, and you’re far more likely to win over the right investors. What’s the most compelling signal you think founders can give at each stage? Credits: Sahil S/linkedin

Replies (5)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

derek almeida

Founder ,Ceo , Entre... • 1y

Headline: Calling All Startups: Venture Wolf Invests in YOU (Seed to Series C)! Dreaming of taking your innovative idea to the next level? At Venture Wolf, we're industry agnostic investors, believing in the power of disruptive ideas across the b

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)