Back

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 4m

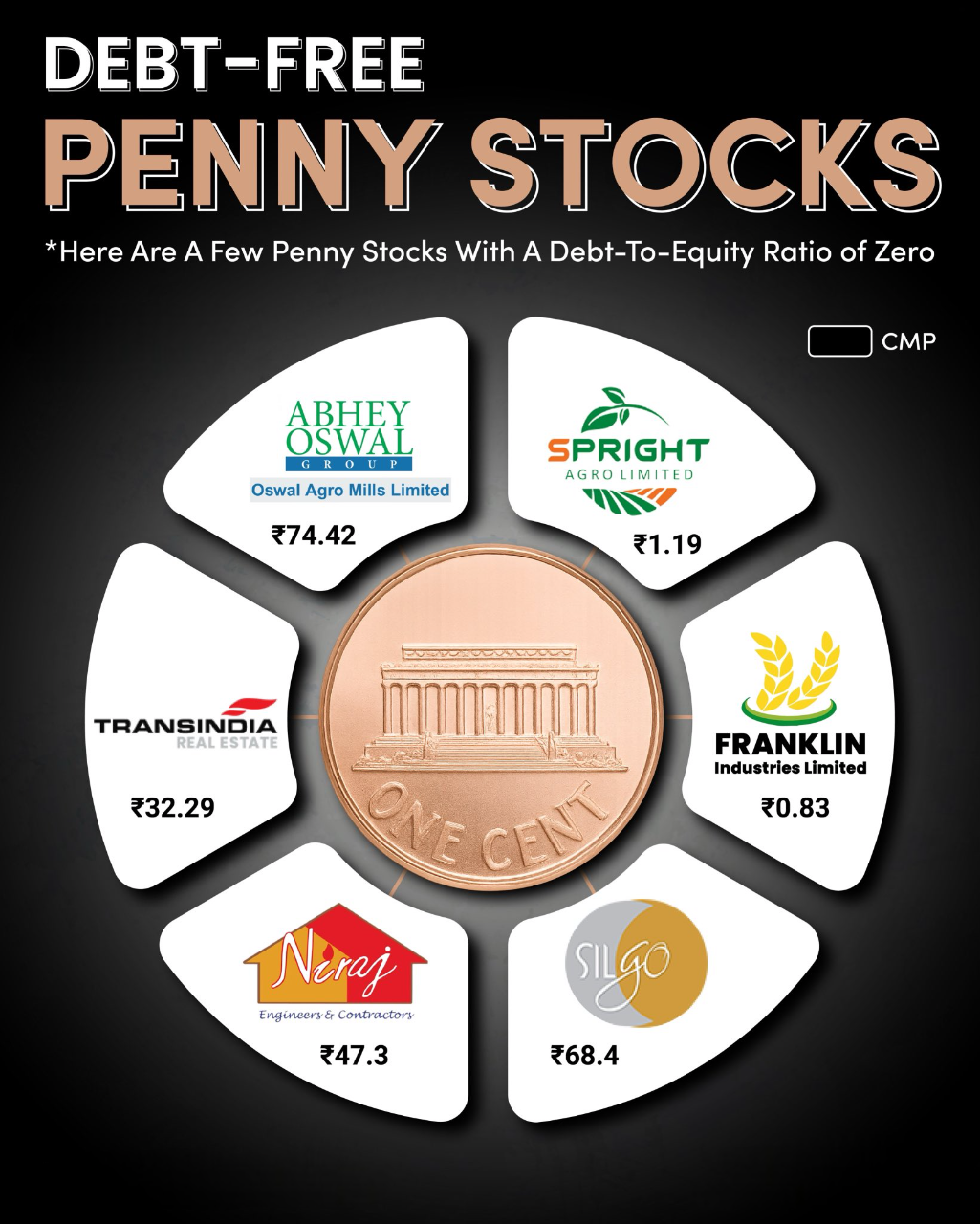

Debt-Free Penny Stocks to Watch in 2025 When it comes to penny stocks, financial health matters the most. One strong indicator is the Debt-to-Equity Ratio – and a zero debt ratio signals a company with no debt burden. Here are a few debt-free penn

See More

Dev Prakash Pandey

Learner || Content W... • 1y

Congratulations to the Medial team on the fantastic achievement! Crossing 50k users is no small feat, and it is a testament to the quality and utility of the Medial app. Keep up the good work, and I wish you all the success in your future endeavors!

Gautam Ambani

Money Magnet • 1y

How can a small chocolate manufacturers Market themselves? Hi all, I'm running a small chocolate manufacturing facility. ( In 1 BHK flat ) I've no idea how do I start selling my product into market. I've tried to market it within a apartment where I

See MoreRohan Saha

Founder - Burn Inves... • 10m

A few months ago, SEBI reduced the face value of private NCD placements from ₹1 lakh to ₹10,000. The main reason behind this move was to encourage retail participation in the debt market. At the time, my concern was whether companies would lower the

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)