Back

Mohd Kaif Alvi

Hey I am on Medial • 1y

If you want to earn money then join me, I will give you 5 to 10 times more money in propertyWith 100% guarante. Investing in property near Jewar International Airport in Noida, Uttar Pradesh can offer several benefits, including: Connectivity The airport will be well-connected to expressways and roads, and will be linked to the Delhi-Mumbai Expressway by a 75 m wide link road. Economic growth The airport's potential to drive economic growth will attract commercial investment and improve connectivity. Rapid growth The region is expected to grow rapidly, with upcoming projects like expressways, metro lines, and industrial corridors. High returns Property values are expected to rise significantly as infrastructure develops, offering high returns on investment for early buyers. Growing sectors & Village Sectors like Sector 150, 128, 22D, 142,140A, and Jattari are positioned to become prime investment destinations.

Replies (4)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 11m

India’s low-cost carriers, including IndiGo, Air India Express, SpiceJet, and Akasa Air, are preparing to shift their operations to the upcoming Navi Mumbai International Airport. With the new airport targeting a May opening, these budget airlines

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

India's Budget 2025-26: Sectoral Impacts Finance Minister Nirmala Sitharaman presented the annual budget focusing on increasing middle-class spending, promoting inclusive development, and encouraging private investment. Consumer goods and automaker

See More

Ashish Singh

Finding my self 😶�... • 1y

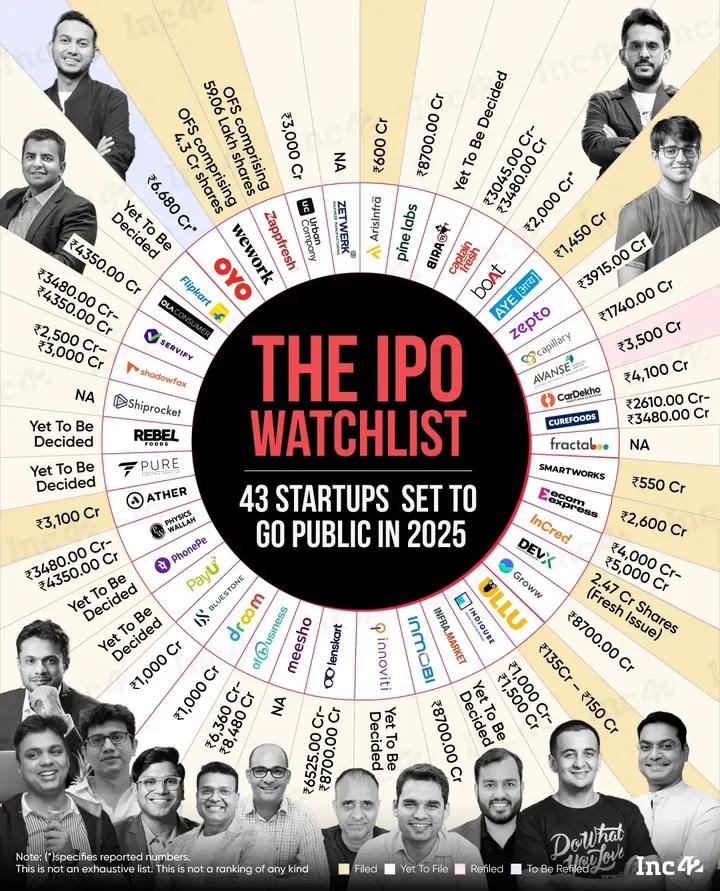

In 2025, the sectors expected to see the most startup IPOs include: 1. Fintech: Leading with six companies, including Aye Finance and Pine Labs. 2. Quick Commerce: Significant growth anticipated, with major players likely to list. 3. Edtech: Co

See MoreAccount Deleted

Hey I am on Medial • 12m

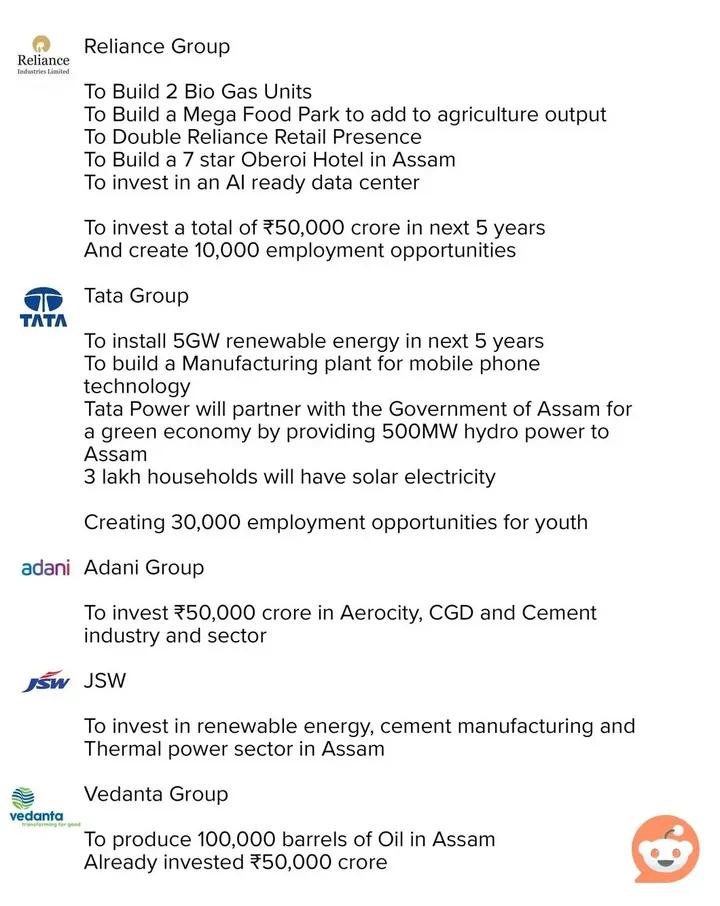

Several major business conglomerates announced significant investment commitments at the Assam Summit yesterday, promising substantial economic growth and job creation in the state. Reliance Group: The company pledged an investment of ₹50,000 crore

See More

Tony martin

The way to develop c... • 11m

Economic policies: 1.Road system: Improve roads in both urban and rural area.Made new roads instead of repairing highways. Economic Policies:Implemented policies that promote economic growth such as investment in infrastructure,reduce trade barrier,

See More

Account Deleted

Hey I am on Medial • 1y

India's IPO Boom: 43 Startups Set to Go Public in 2025! Spanning sectors from fintech to e-commerce, these anticipated listings could reshape the stock market and unlock new investment opportunities. From Zepto to Boat, here’s a look at the most

See More

Manjunath Pai

Inquisitive and ente... • 11m

🌟 *Stunning Residential Property for Sale!* 🌟(Can be converted into commercial/office as it is facing the main road, near to airport and other tranport location) Looking for your dream home? 🏡✨ We’ve got just the place for you! 🔑 *Property Deta

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)