Back

More like this

Recommendations from Medial

Kimiko

Startups | AI | info... • 9m

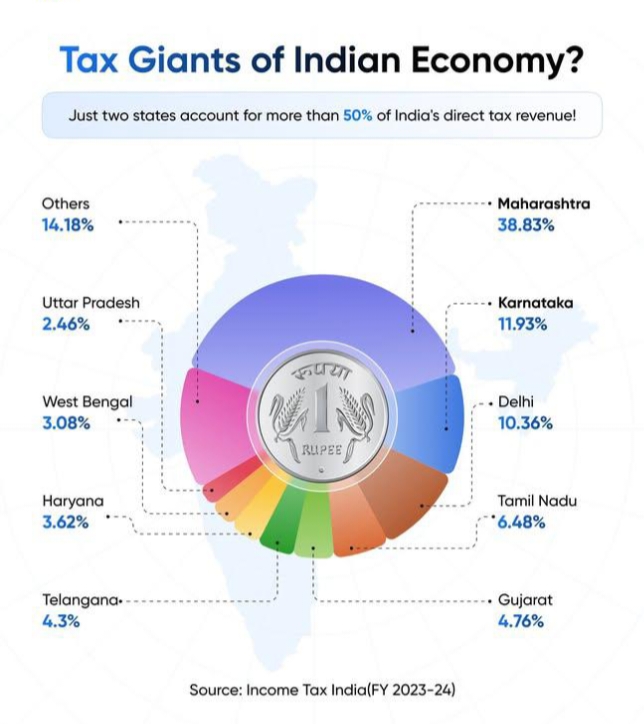

Over half of India’s direct tax revenue — from individuals, corporates, and businesses and more— comes from just two states. This revenue is the backbone funding our infrastructure, healthcare, and education. Comment below and tell us: which state do

See More

Reply

1

9

CA Kakul Gupta

Chartered Accountant... • 1y

The Central Board of Direct Taxes (CBDT) has specified that no tax deduction at source (TDS) under Section 194Q of the Income Tax Act, 1961, will be required for purchases made from units of International Financial Services Centres (IFSC), provided b

See More Reply

2

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)