Back

HatchLegal

You Build the Dream,... • 1y

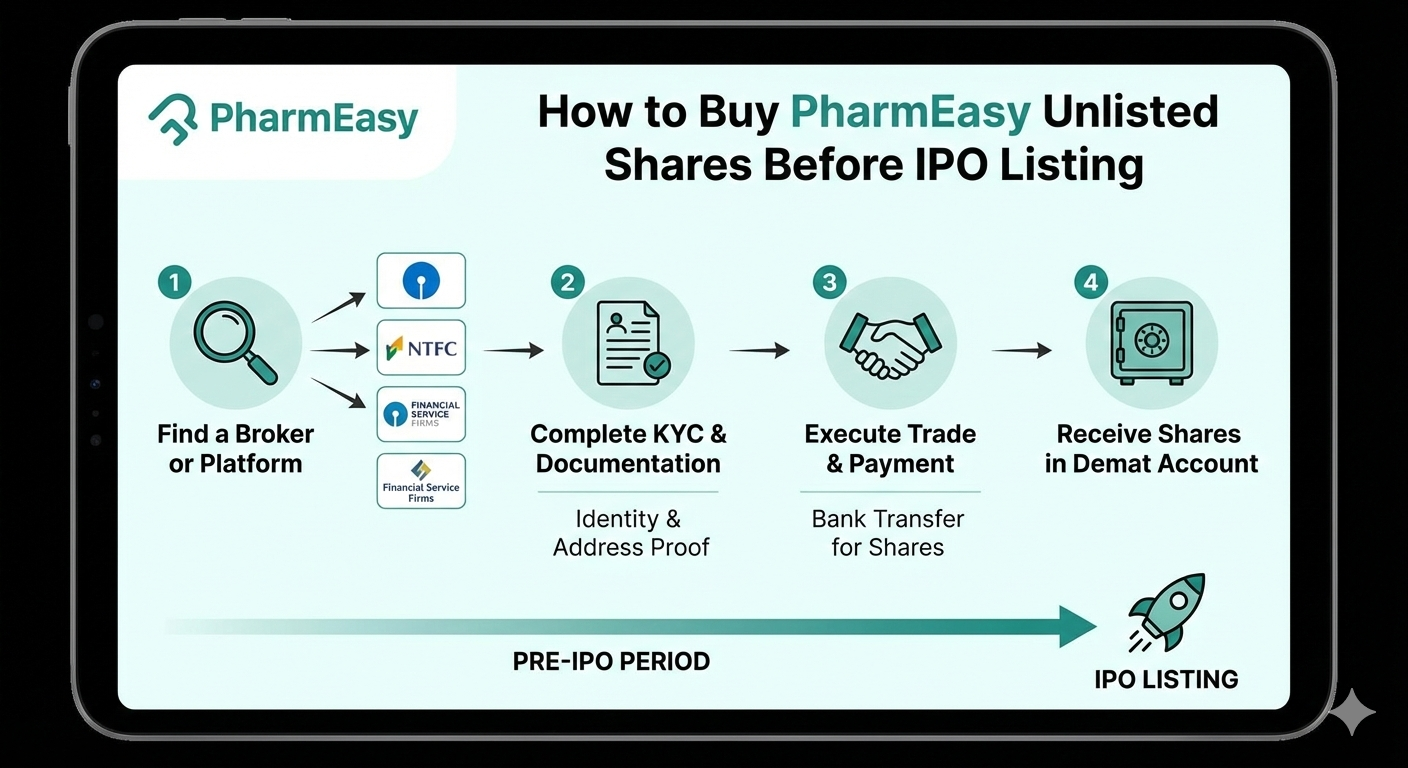

𝐔𝐧𝐥𝐢𝐬𝐭𝐞𝐝 𝐒𝐡𝐚𝐫𝐞𝐬 𝐚𝐧𝐝 𝐏𝐫𝐞-𝐈𝐏𝐎 𝐁𝐮𝐳𝐳: 𝐓𝐡𝐞 𝐑𝐢𝐬𝐤𝐬 𝐘𝐨𝐮 𝐍𝐞𝐞𝐝 𝐭𝐨 𝐊𝐧𝐨𝐰! The allure of investing in unlisted shares from well-known companies like OYO, Chennai Super Kings Cricket Limited, Swiggy, NSE India, or Bira 91 is undeniable. These investment opportunities, often marketed as pre-IPO shares on online platforms, promise the chance to get in early—before these companies go public. However, as with all investment opportunities, the greater the potential reward, the higher the risk. And in the world of pre-IPO and unlisted shares traded on these platforms, the risks are significant. 𝐖𝐡𝐚𝐭 𝐘𝐨𝐮 𝐍𝐞𝐞𝐝 𝐭𝐨 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝: 1. 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐁𝐥𝐢𝐧𝐝𝐬𝐩𝐨𝐭: SEBI has issued a crucial warning about platforms trading in unlisted shares. These platforms operate without the protection and oversight provided by Indian stock exchanges. They bypass the Securities Contract Regulation Act, 1956, leaving investors exposed to unregulated trading. 2. 𝐋𝐚𝐜𝐤 𝐨𝐟 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐏𝐫𝐨𝐭𝐞𝐜𝐭𝐢𝐨𝐧: Unlike public stock exchanges, which are safeguarded by SEBI’s investor protection framework, unlisted share platforms offer no such safety net. In case of disputes or fraudulent activity, there is no clear path for recourse or compensation. 3. 𝐎𝐩𝐚𝐪𝐮𝐞 𝐏𝐫𝐢𝐜𝐢𝐧𝐠: Unlisted share prices are driven by supply and demand, with hidden markups and unclear valuations. Unlike stock markets with transparent pricing, these shares can experience unpredictable price fluctuations. 4. 𝐌𝐚𝐫𝐤𝐞𝐭 𝐕𝐨𝐥𝐚𝐭𝐢𝐥𝐢𝐭𝐲: In 2023, Reliance Retail’s unlisted share price plunged from ₹2,700 to ₹1,362 overnight after the company canceled public shares, offering lower compensation. Investors faced significant losses with no legal recourse. 5. 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐑𝐞𝐥𝐢𝐚𝐛𝐢𝐥𝐢𝐭𝐲: Many unlisted share platforms hold funds and securities during transactions. If a platform fails or operates dishonestly, you, the investor, bear the consequences. 𝐖𝐡𝐲 𝐭𝐡𝐞 𝐁𝐮𝐳𝐳 𝐀𝐫𝐨𝐮𝐧𝐝 𝐔𝐧𝐥𝐢𝐬𝐭𝐞𝐝 𝐒𝐡𝐚𝐫𝐞𝐬? Online trading platforms have simplified investing in unlisted shares, but these largely unregulated markets are highly volatile and risky for uninformed investors. 𝐒𝐄𝐁𝐈 𝐑𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞: SEBI's December 2024 press release warns against unauthorized platforms trading unlisted securities, citing legal violations and lack of investor protection. Read more: https://lnkd.in/g6FNeEBx 𝐈𝐧𝐯𝐞𝐬𝐭𝐢𝐧𝐠 𝐢𝐧 𝐔𝐧𝐥𝐢𝐬𝐭𝐞𝐝 𝐒𝐡𝐚𝐫𝐞𝐬: 𝐏𝐫𝐨𝐜𝐞𝐞𝐝 𝐰𝐢𝐭𝐡 𝐂𝐚𝐮𝐭𝐢𝐨𝐧 Unlisted shares can offer great returns, but they also come with risks. With Hatch Legal by your side, you'll be better prepared to navigate the ups and downs, make smart choices, and invest with confidence.

More like this

Recommendations from Medial

planify

pre-IPO shares, ESOP... • 19d

Unlisted shares of SBI Mutual Fund represent ownership in the AMC before it becomes publicly traded. These shares are exchanged privately, often among long-term investors and institutions. visit here:- https://www.planify.in/research-report/sbi-mutua

See MoreLinkrcap Studio

A digital news platf... • 22d

Shares of online brokerage platform Groww remain under pressure for the second straight trading session after the finance minister Nirmala Sitharaman proposed hiking securities transacation tax (STT) on F&O derivatives during her ninth Budget speech

See More

Rohan Saha

Founder - Burn Inves... • 9m

This is what happens with unlisted shares people often don’t understand the risks involved. They just buy without proper knowledge. Just because a company is trading in the unlisted market doesn’t guarantee it will go for an IPO. When or if a pre-IPO

See More

Tushar Aher Patil

Trying to do better • 1y

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Atharva Deshmukh

Daily Learnings... • 1y

The day you make the transaction is the trade date,brokers called it as the 'T Day.' On the T day, the broker generates a ‘contract note’ and emails you the copy to your registered email id. A contract note is like a bill detailing all your daily t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)