Back

Anonymous 4

Hey I am on Medial • 1y

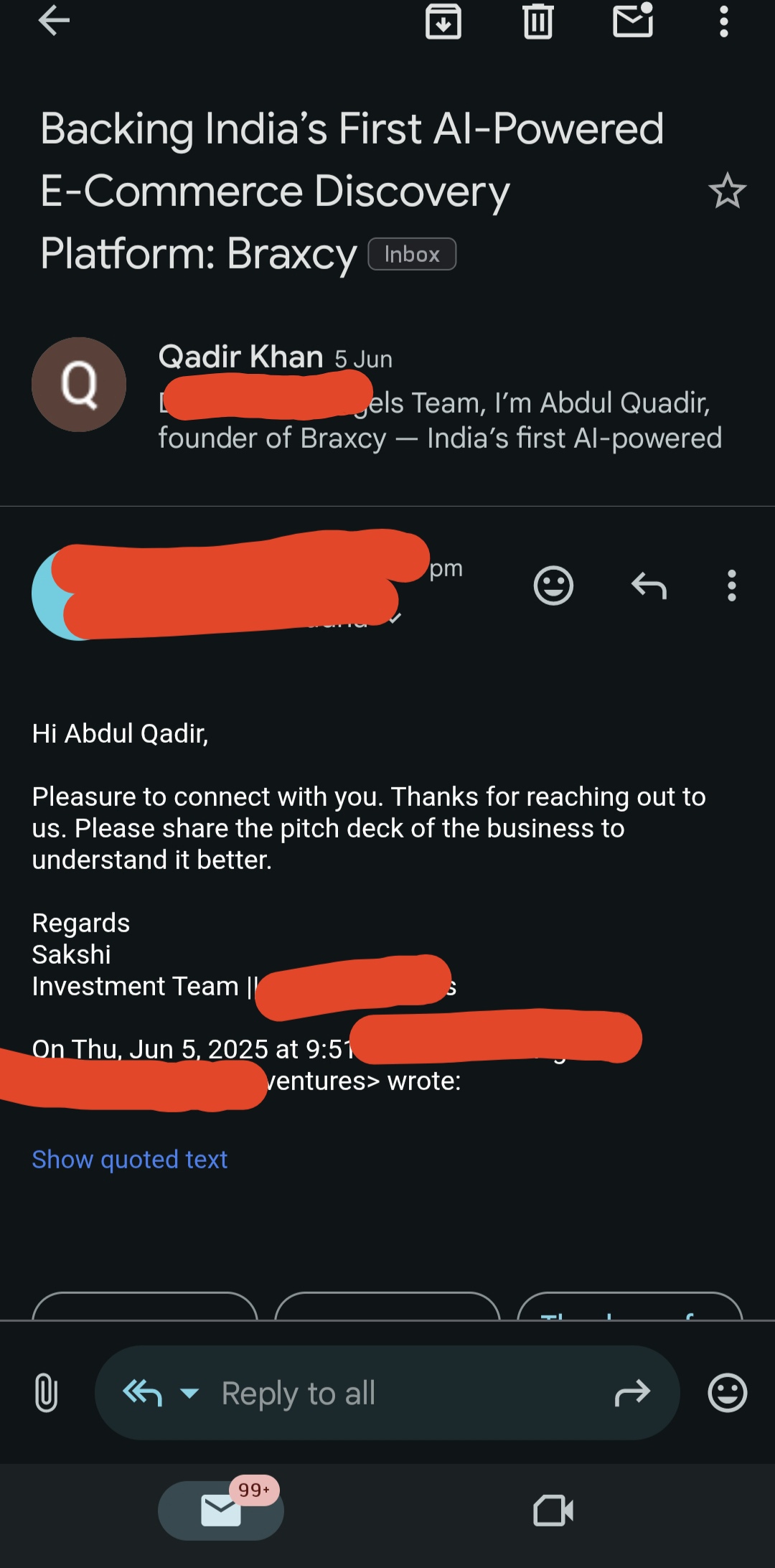

VCs like Sequoia Surge or Accel Atoms claim to invest early, but they’ll still ask for some traction. POC stage funding is more angel investors' territory than traditional VCs.

More like this

Recommendations from Medial

Mohd Talib

Senior Full Stack AI... • 1y

Had an insightful meeting with investors today it's clear that VCs and angel investors are heavily focused on AI-driven innovations. Many are steering away from EdTech and traditional sectors, prioritizing disruptive AI applications instead. The fut

See MoreArslan

Business owner | Bus... • 5m

List of Angel Investors and VC; Category wise. There are links directly on their wbpage to Pitch. SaaS VC Name: Nexus Venture Partners https://www.nexusvp.com Angel name:100X.VC https://www.100x.vc/ Food/Consumables VC :Fireside Ventures https

See More

Sanjoli Khurana

Helping only serious... • 7m

🚀 Startup Founders! If you're building an *AI tool or SaaS product* and struggling to raise capital, here’s the hard truth: You’re probably pitching to the wrong people. Early-stage VCs often require traction, product-market fit, and market comps.

See MoreAshis Bhakta

Tech Entrepreneur • 1m

We’re two founders building VayuFres, a deep-tech climate startup working on localized air pollution reduction at urban choke points. This is not an app, not a consumer gadget, and not a traditional filter-based solution. We have: • A validated pr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)