Back

Vishu Bheda

•

Medial • 1y

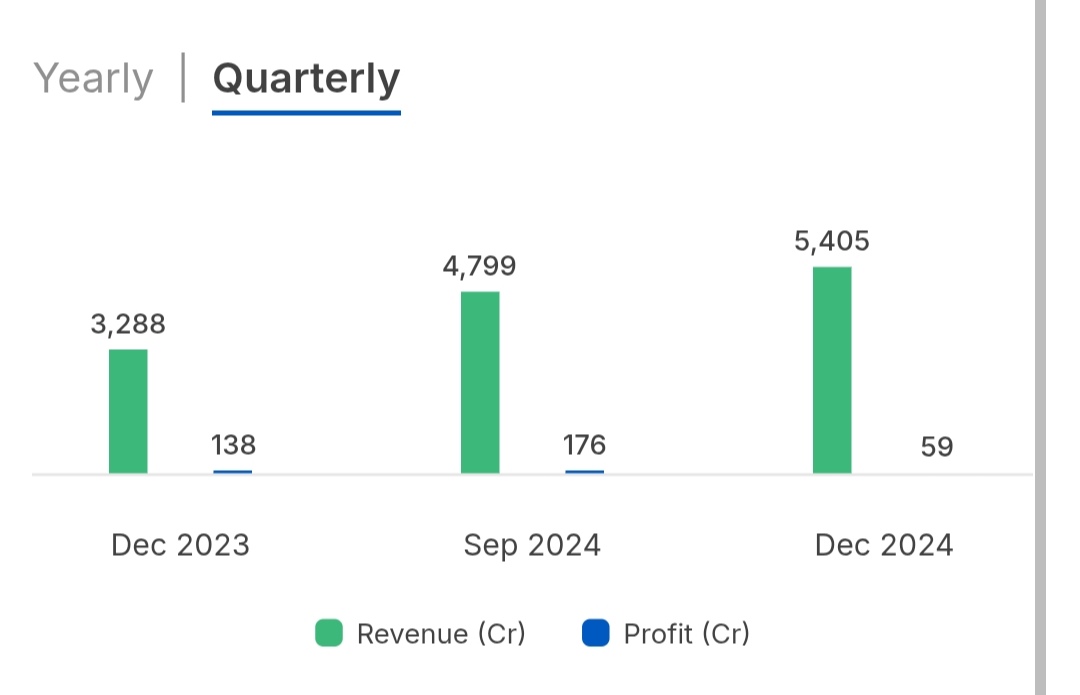

Growth Potential. Coal India has size, but Zomato has future scalability, which drives its higher valuation.

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)