Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

It’s crazy how Modi Govt earned a massive Rs 44k crore from Reliance and Nayara’s oil exports to Europe in the last 30 months! 🙏🙏 And this is how it played out. .. Post Ukraine war European nations shut their refineries dependent on Russian crude oil supplies. -> As that happened, it still had to find diesel, petrol and aviation turbine fuel (ATF) -> And, India stood out with a massive export-focused refining capacity, which is well more than the domestic demand Outcome? India today is the largest exporter of diesel to Europe, with a jump of a massive 58% in the first 3 quarters of 2024 alone. Overall, our exports of diesel, petrol and ATF to Europe have gone >4x versus the levels of 5yrs ago. And this has resulted in profits of >$20bn to Indian refiners (mostly Mukesh Ambani’s Reliance) as per S&P Global 🙏🙏 .. But, why did I say that Reliance benefited the most? Cuz, much of the state-owned refineries (IOCL, BPCL, HPCL) used the cheap Russian oil supplies to produce petrol and diesel for the Indian markets and could not export that out to the Europeans who pay top dollar. Margins on such exports were especially higher, because much of Indian exports of refined fuels at this time were driven by record imports of discounted Russian oil. Thus, the Modi Govt wanted a piece of it. .. This is where Nirmala Tai (read: Tax Tai) came in, introducing what many would already know about - A new tax on WINDFALL GAINS 😅😅 At peak, this was as high as $26 per barrel of diesel and $13 per barrel of petrol exported. This was huge. And based on how oil prices would change, the Govt kept changing the WINDFALL tax every fortnight. Result? Of the $20bn+ that Indian refiners earned, Rs 44k crore, or more than 25% went straight off to the Govt’s pockets. .. Oh, and mind it, this is just the windfall gains. On what profits Nayara Energy and Mukesh Ambani’s Reliance did make, after this, Govt also took away a big part as corporate tax. And overall, this turned out to be a big bonanza for the Modi Govt, playing a big role in bringing down the fiscal deficit from the Covid-driven record highs. -> The fiscal deficit was 6.9% of GDP in FY22. Fell to 6.4% in FY23 -> And then by a big fall to 5.6% of GDP in FY24 (versus a target of 5.8%) .. And none of this wouldn’t have been possible if Europe had not shot itself in the foot, shutting its own refineries, while importing diesel made from same Russian crude from India 😅😅 But, anyhow, with oil prices having stabilised and expected to further fall in coming quarters, the Govt has now abolished windfall tax. So, it was a good party, while it was :) ..

Replies (3)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 10m

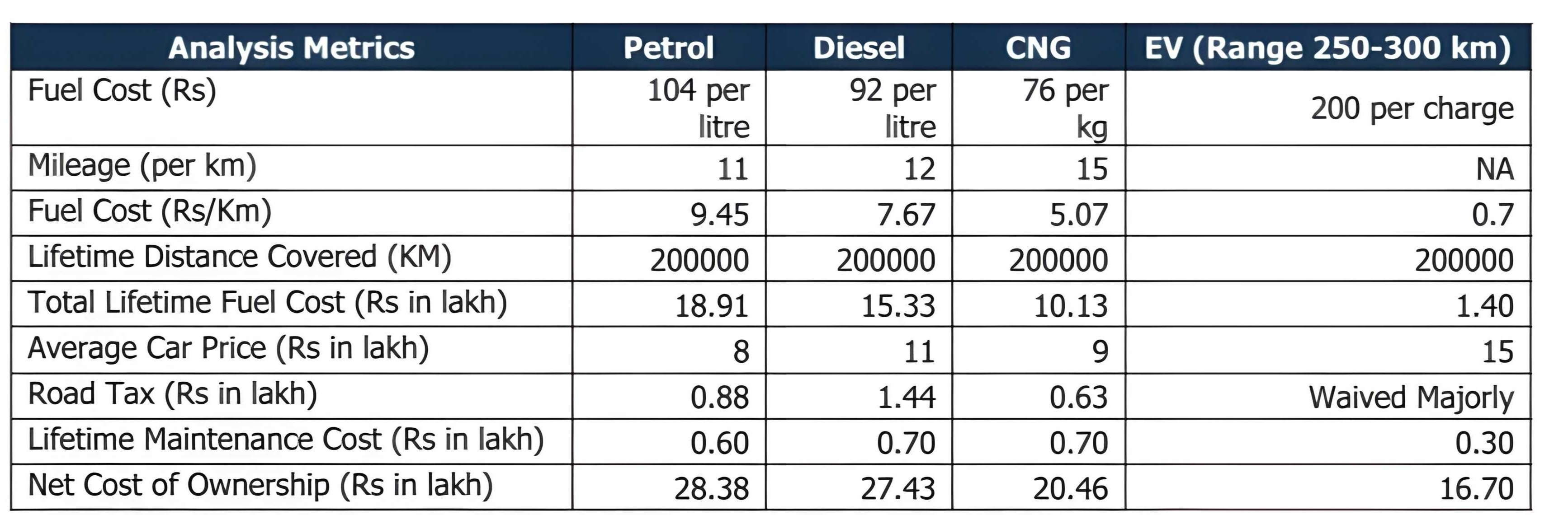

Govt did right by hiking excise duty on petrol and diesel, for now 🙏🙏 No offence to anybody, but this will only make sense to ones who weigh context over emotions. Those who read my work regularly would know, I am no fan of the present Govt. So,

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

I get that Chinese EV makers have received a lot of subsidies from the Govt there 🙏🙏 But, I don’t get why people think that Indian Govt is not raining money on Indian players. .. In February, Tata Motors CFO P Balaji publicly stated that in FY25

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)