Back

Karunakar

1% Better • 1y

Motivational Quote for the Day "An investment in knowledge pays the best interest." – Benjamin Franklin Story Format: The Tale of Arjun's Investment Journey Arjun was a 22-year-old who had saved ₹10,000 from his part-time job. One day, his mentor Ravi asked him, "What do you plan to do with your money?" Arjun replied, "I’ll keep it in my savings account and let it grow." Ravi smiled and said, "That’s a good start, but do you know how much your savings account will give you after 10 years with 3% annual interest?" Arjun did some math and found it would grow to about ₹13,439. Ravi then explained, "If you invested that money wisely, it could potentially grow far more over time." Ravi introduced Arjun to the basics of investment: Time Value of Money (TVM): Money today is worth more than the same amount in the future due to its earning potential. This is why investments grow over time. Types of Investments: Stocks: Buying ownership in companies; high risk, high return potential. Bonds: Lending money to governments or companies; lower risk than stocks but with moderate returns. Mutual Funds: A pool of money invested in various stocks or bonds, managed by experts. Real Estate: Buying property for rental income or future resale. Gold and Commodities: Assets that hold value during economic uncertainty. Fixed Deposits (FD): Low-risk savings plans with guaranteed returns. Risk vs. Return: Ravi emphasized that high returns often come with high risk. He taught Arjun to balance investments using the Rule of 100: Subtract your age from 100 to determine the percentage of your portfolio to allocate to stocks. For Arjun, that was 78% stocks and 22% safer options like bonds. Start Early and Compound Growth: Ravi showed Arjun how ₹10,000 invested in a mutual fund with a 12% annual return would grow to ₹30,000 in 10 years and ₹100,000 in 20 years due to compounding (earning interest on your interest). Follow Our Medium blog for Finance and Business insights like this: https://medium.com/@FoundrBite

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 3 About Basic Finance Concepts Here's Some New Concepts 4. Investment Stocks: Shares in a company that give investors ownership rights and potential dividends. Bonds: Debt securities where investors loan money to companies or governments in re

See More

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

Ways to Multiply Money 🤯 Investments: 1. Investing in the Stock Market: You can multiply your money by investing in the stock market, but it involves risks. 2. Mutual Funds: By investing in mutual funds, you can diversify your money into differen

See MoreThree Commas Gang

Building Bharat • 1y

Imagine instead of keeping your money in boring savings account, you could simply do an FD of it and get good interest rates, but also get a steady no interest credit line upto FD amount to be used by you for daily expenses? Basically your money will

See MoreRohan Saha

Founder - Burn Inves... • 9m

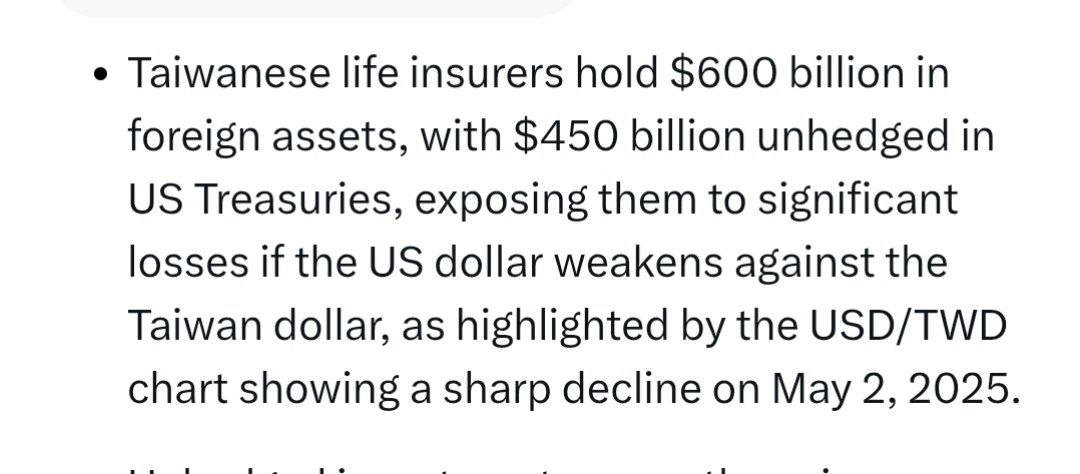

Oh, we didn't even think of this the dollar can fall further because the companies that have made some investments in the USA will definitely see a decline in their portfolios if the dollar drops. To prevent this, companies might sell US bonds or st

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)