Back

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC- DAY-8 🎯Who are Custodians in VC? 🎯What is Net Asset Value? 🎯Custodians:Custodians are for security but also safekeeping the Investments.Custodians needs to give & accept delivery securities of dematerialised Investment Funds which needs to reflect correct position at any time. Additional activities such as settlement tax, corporate actions such as dividends, bonus & rights in companies.Custodains also serve NAV as part of their Job. Sponsors or Managers compulsorily have to appoint custodians for safekeeping securities. Custodial Agreement is entered between them.They should not be relatives with the Sponsors. 🎯NAV tells us how much the fund is valued by subtracting all liabilities from its assets,then dividing by the number of outstanding units,it is a key metric used to assess the performance and current value of an AIF for investors. For more detailed & clear information, I wrote chapter wise in 9TDAYVC Newsletter👇 Follow Adithya Pappala for more VC!!

Replies (1)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-5 Who is Sponsor & Investment Manager in VC? 🎯Sponsors: Sponsor means a person who Setup AIF & Invests in. The Application to SEBI is made by the Sponsor.The sponsors should have to satisfy the criteria of Fit & Proper Person as pe

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-2 😳Only 21 Indian VC Firms are there in 2013 So, Today’s VC topics are: 🎯Who Invests in Venture Capital? 🎯Definition & Difference between Private Equity & Venture Capital? 🎯Investors-VC also raises, We also raise but the di

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC- DAY-14 🎯What is Hurdle Rate? 🎯What is Carry Fees? 🎯The preferred returns are also called as “Hurdle Rate” in VC & P.E Funds. It is the threshold return that LP’S should receive prior GP’S receive. In developed markets, The hurdle

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 🎯Types of Expenses for VC? 🎯What is a Self-Managed Fund? 🎯Organisational Expenses: These are costs for VC Funds which includes such as Incorporation Costs, Statutory Compliance Cost of the Funds, Placement Commissions, Distri

See MoreAdithya Pappala

Busy in creating typ... • 1y

🚫 9TDAYVC is Shutting Down🙏 For those who don't know, 9TDAYVC is a pre-launching India's first Venture Capital attached to the Venture Studio Fund launching by May'25. And also, It is a 90 Days VC Campaign covering everything about VC'S from it

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-4 Types of AIF’S Suitable for Startups? What is Mezzanine Capital? 🎯Types of AIF’S: These are divided based on Investment Strategies & AUM(Asset Under Management).VC's are defined as investments in Unlisted securities such as S

See MoreAdithya Pappala

Busy in creating typ... • 1y

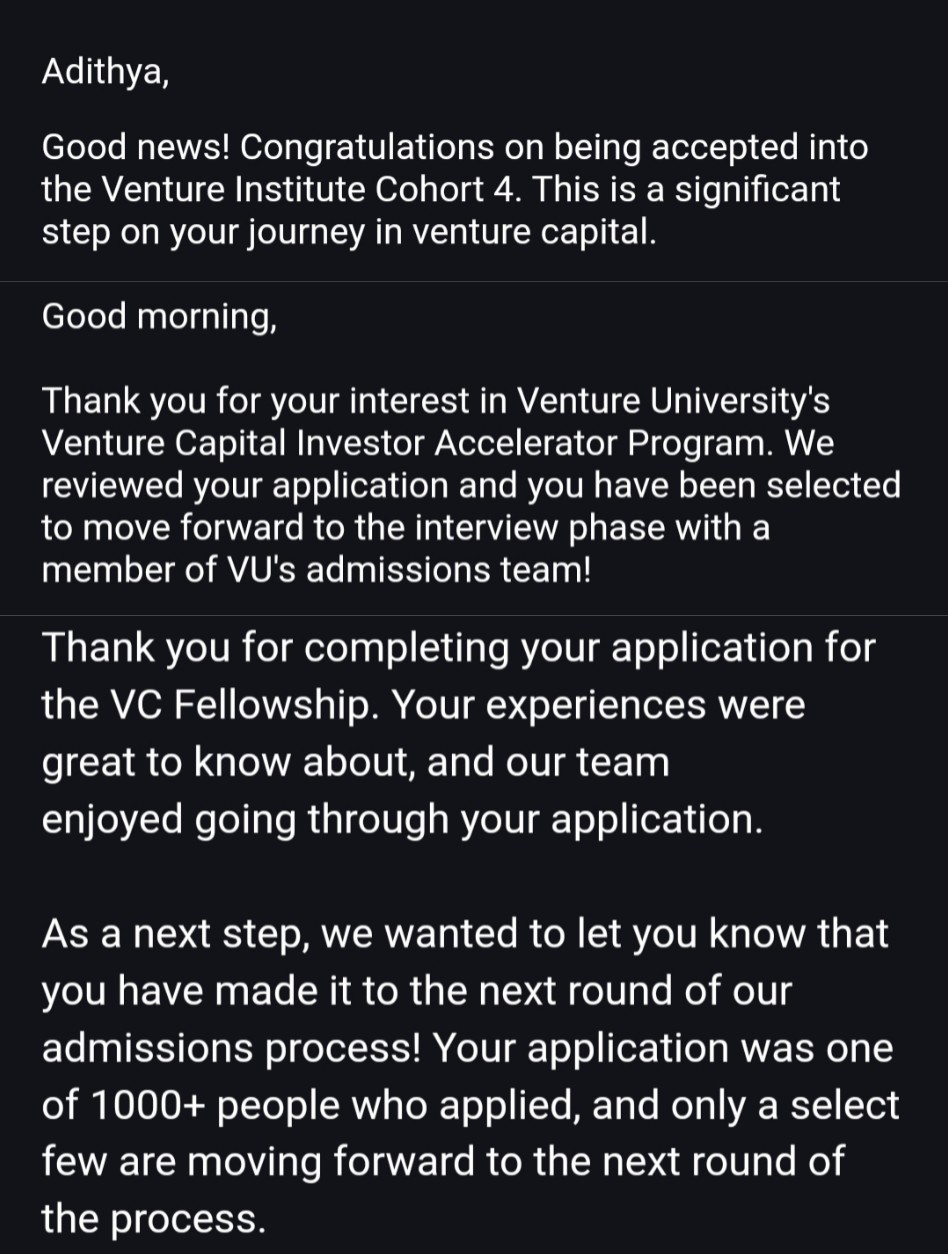

🔥 I have been Selected for the Top VC Accelerators in the world & India, But not for 1 or 2, It's 3🎯 This Week is a Mind-Blowing🤯 7 Days Back, I got a Shortlisting Mail of VC Lab Cohort based out of the USA(World's largest VC Accelerator) 3

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-15 What are Additional Returns? What is the Catch-Up Clause? In Developed Markets, The structure is in 2-20% where 2 is Management Fees & 20 is Additional Returns.Additional Returns & 2-20 structure is not ideal in Indian AIF Market

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)