Back

Anonymous 1

Hey I am on Medial • 1y

Pros: Financial inclusion for those without credit Potential Cons: -Credit score risks -Potential for predatory fees -Complex liability issues -Needs SERIOUS regulatory oversight, but the core concept is innovative.

Replies (1)

More like this

Recommendations from Medial

Ashutosh Jha

Full Stack Engineer ... • 1y

If you're Planning to Start Your "Entrepreneurial Journey" What path you gonna choose and why? 1️⃣ Joining a Startup: Pros: Immersive experience, understanding of business realities, and skill development. Cons: Instability and limited resources.

See MoreRohan Kute

Business | infograph... • 10m

If you ever wonder to start a company, you should have to know this. There are three types of companies: 1) Private Limited Company Eligibility: Minimum 2 directors and 2 shareholders (at least 1 Indian resident). Pros: Limited liability protecti

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Fintech in Bangalore: Trends and Opportunities * Trends: Mobile payments, digital lending, insurtech, blockchain, wealth management, regulatory sandbox. * Opportunities: Financial inclusion, increased access to credit, personalized fina

See MoreVarad Bhagat

Love making startups... • 1y

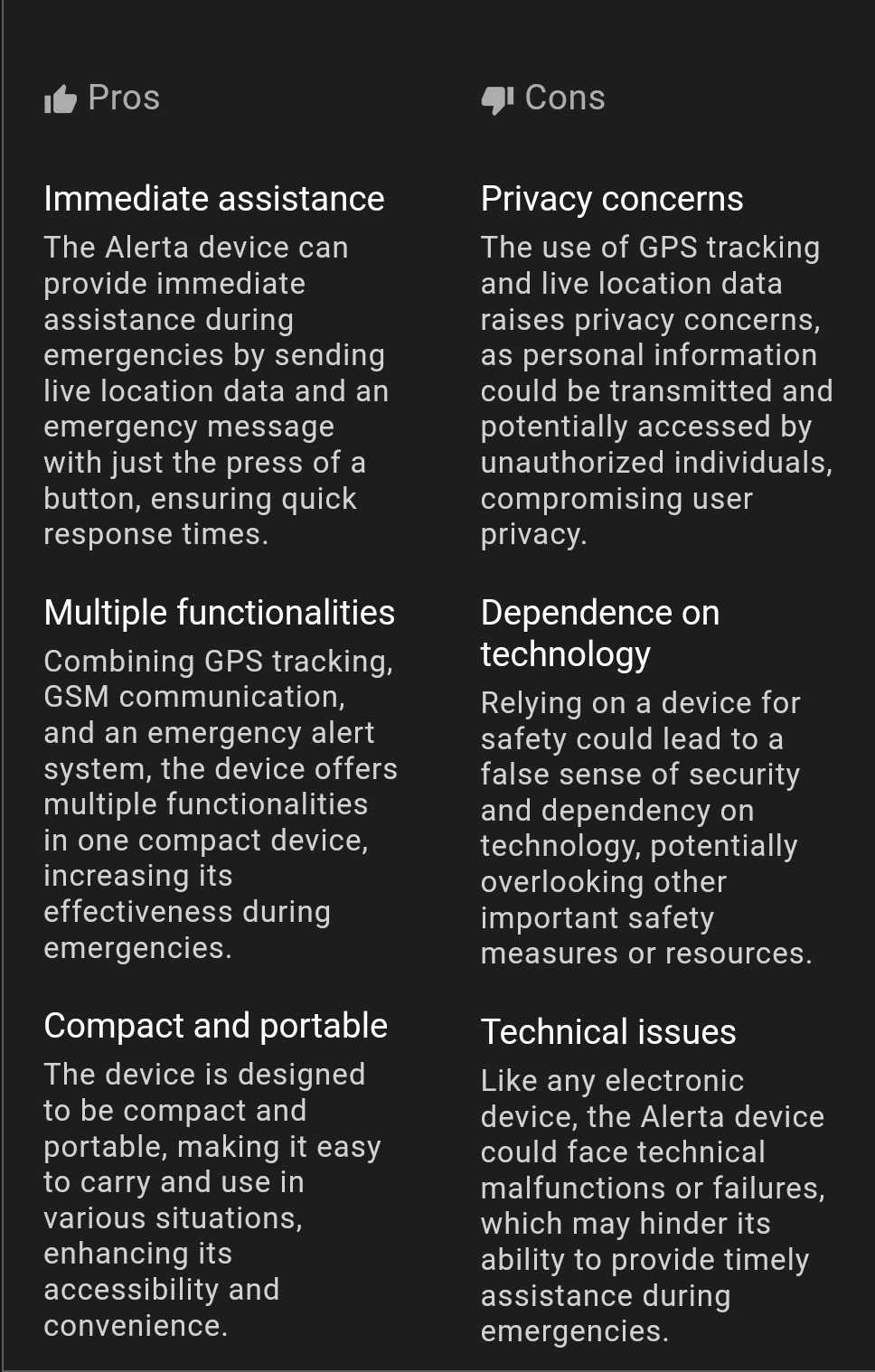

Analyzing the Pros and Cons of Alerta: A Compact Emergency Assistance Device for Women's Safety. While it offers immediate help with live tracking and multiple functionalities, concerns about privacy, dependence on technology, and potential technical

See More

Swapnil gupta

Founder startupsunio... • 8m

😱 Risks and Challenges Ahead for Facebook 1. Regulatory Scrutiny: Increasing government oversight on privacy practices. 2. Competition from Emerging Platforms: TikTok's rapid growth poses a threat. 3. Technological Barriers: Scaling AR/VR hardwa

See More

Sumit Sutariya

Hey I am on Medial • 1y

Fintech Solutions for Small Businesses Idea: Develop financial tools tailored for small businesses, such as automated bookkeeping, invoicing, or credit management systems. Revenue Potential: Fintech startups can generate revenue through subscription

See MoreJewelpik App

House of jewellery b... • 9m

Webflow vs. WordPress vs. Shopify: Choosing the Right Platform? Picking the right website platform is crucial—it shapes your site’s design, usability, and growth potential. Here's a quick breakdown of Webflow, WordPress, and Shopify to help you choo

See MoreAnonymous

Hey I am on Medial • 1y

I want to create an app to help first-year BTech students find the best YouTube courses quickly. I'll organize courses by topic and provide practice sets for each. Plus, I'll offer job help and keep the cost very low. Please let me know the potential

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)