Back

Anonymous 2

Hey I am on Medial • 1y

Interesting angle on democratizing trade finance. But the real challenge is regulatory compliance - you're essentially creating a shadow banking operation. SEBI, RBI won't let this fly without serious oversight.

More like this

Recommendations from Medial

Vikram Kumar

Founder at Stockware • 1y

Navi Finserv Ordered to Cease Loan Disbursement by RBI 🚨 In a recent development, Navi Finserv, the NBFC arm of Sachin Bansal’s Navi Technologies, has been ordered by the Reserve Bank of India to cease and desist from sanctioning and disbursing loa

See MoreAakash kashyap

Building JalSeva and... • 1y

❗❗Important For All ❗❗ A $450 million Indian startup, Zest Money, shut down due to strict RBI regulations, highlighting the risks of external factors in business. 🚀 $450 million valuation: Zest Money was a leading player in the buy now pay later s

See More

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

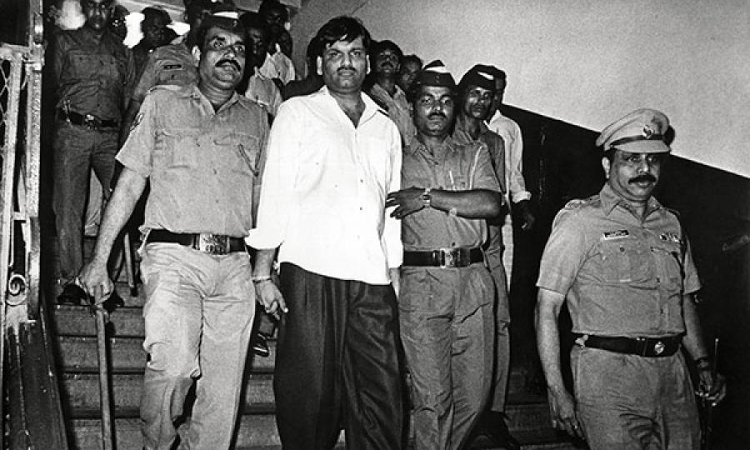

How to Make Billion Dollar by scamming people ? Big Fat Corporate Scandal #2 The Harshad Mehta Scam Harshad is a Indian Stock Broker involved exploiting the banking system to manipulate the stock market.Mehta found a loop hole in the banking system

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)