Back

Anonymous 4

Hey I am on Medial • 1y

The point about investments and assets working for you is crucial. Wealth grows when you put your money into assets that appreciate, rather than simply relying on labor. It’s about using resources efficiently, whether time or capital, to create long-term growth

Replies (2)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

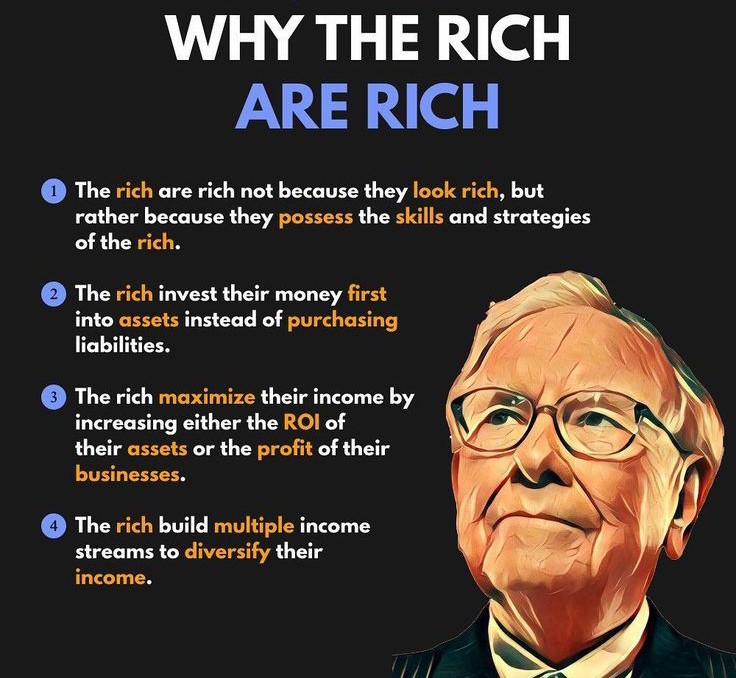

💼 Why the Rich are Rich 💼 It’s not just about looking wealthy it’s about the mindset and strategies that make a lasting difference. 💡 Here are some principles that set successful people apart 1️⃣ Skills & Strategies - True wealth comes from hav

See More

Tushar Aher Patil

Trying to do better • 1y

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Suman solopreneur

Exploring peace of m... • 1y

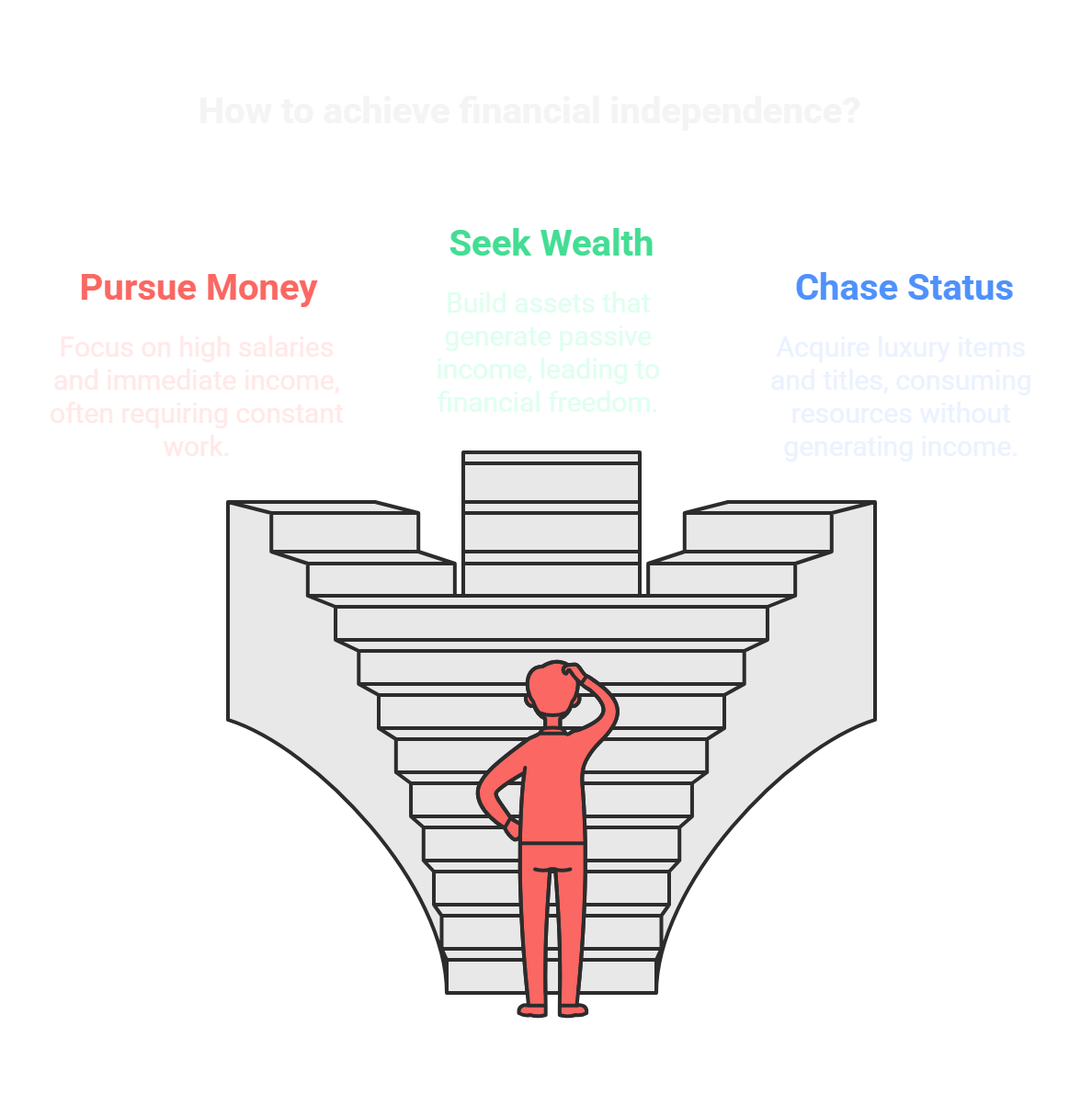

Wealth isn’t about money or status—it’s about owning assets that work for you. Build specific knowledge that feels like play to you but is valuable to others. Partner with intelligent, energetic, and ethical people. Learn to sell and build—master bot

See MoreTushar Aher Patil

Trying to do better • 1y

Day 6 About Basic Finance and Accounting Concepts Here's Some New Concepts 3. Tangible Assets Physical assets that have a physical form and can be touched. Examples: machinery, real estate, vehicles, inventory, and office supplies. 4. Intangibl

See More

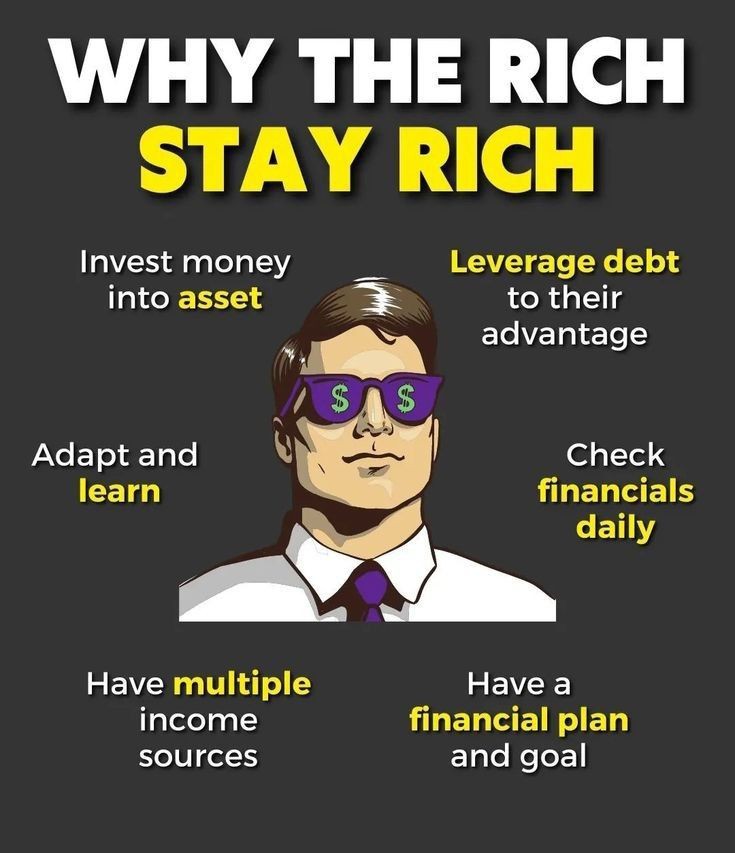

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

Why the Rich Stay Rich 💰 💼 Invest in assets, not just income. 📈 Leverage debt smartly. 📊 Review finances daily. 📚 Never stop learning and adapting. 💡 Diversify with multiple income streams. 🎯 Set clear financial goals and plans. Wealth isn't

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)