Back

Account Deleted

Hey I am on Medial • 1y

There could be cultural differences in how VCs approach investments. Indian VCs might be more cautious

Replies (1)

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

How can Indian startups strategically expand into global markets, leveraging their unique strengths, navigating international competition, and overcoming challenges related to regulatory frameworks, cultural differences, and market dynamics, to achie

See MoreVivek Joshi

Director & CEO @ Exc... • 6m

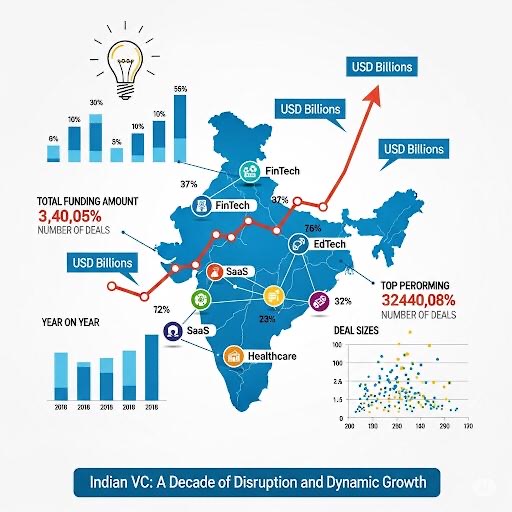

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Chakravarti Rajadhiraj Omi

Straight From Herita... • 1y

Dear Indian Praja!! How are you all? This is Chakravarti Rajadhiraj Omi ( Omi Kushwaha). So, here i am for a special regards . To safeguard our cultural from modernisation. You know we as Indian lost our 60-80% of cultural integrity. This might see

See MoreRohan Saha

Founder - Burn Inves... • 7m

How Trump Tariff Move Could Hit Indian Exports If Trump actually comes and slaps tariffs on Indian products things could get tricky fast Indian exporters might start feeling the heat straight away stuff like clothes, medicines, auto parts all that m

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)