Back

More like this

Recommendations from Medial

Abdul Samad Pathan

Business Enthusiasti... • 1y

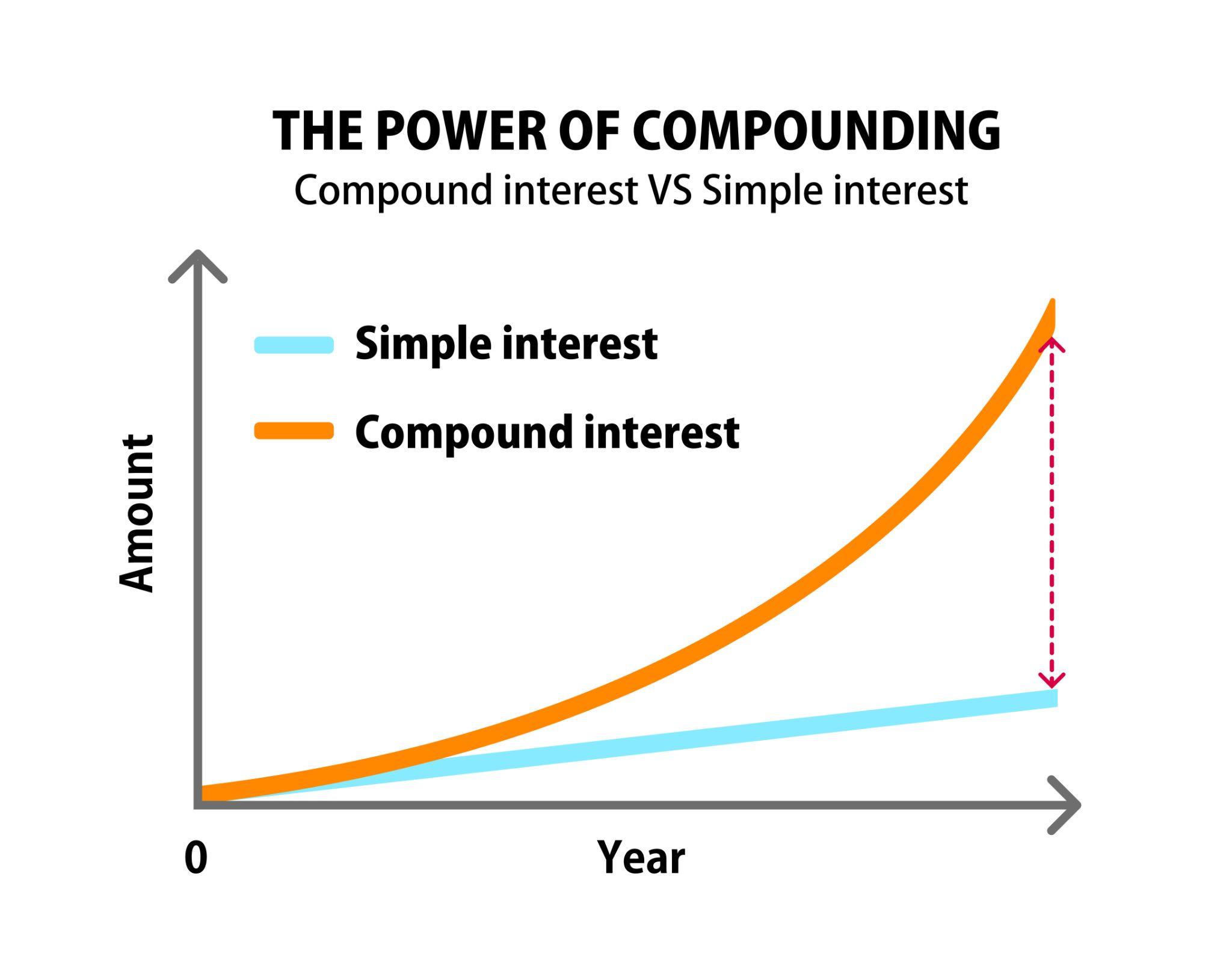

Hardcore Crypto Investing – Seeking Serious Investors We are launching a new cryptocurrency with a high-growth potential designed for serious investors who want to double or even triple their investments. This is a calculated opportunity with minima

See MorePoosarla Sai Karthik

Tech guy with a busi... • 6m

India’s biggest family businesses like Reliance worth ₹28.23T and Adani worth ₹14T are massive players. Together they are valued at ₹134T and add about ₹7,100 crore in value every day. They create huge numbers of jobs, control major industries such a

See MoreRohan Saha

Founder - Burn Inves... • 8m

These days, as more retail investors step into the bond market, high yield bonds are getting harder to find. I remember being able to buy AA rated bonds on the exchange with returns as high as 24% to 30%. Now, those same bonds hardly go beyond 12% or

See MoreDr Sarun George Sunny

The Way I See It • 3m

SEBI’s New Rule: Mutual Funds Must Say Goodbye to Pre-IPO Deals The Securities and Exchange Board of India (SEBI) has recently stepped in to bring a meaningful change in the way mutual funds invest in the IPO space. From now on, mutual funds can no

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)