Back

More like this

Recommendations from Medial

Havish Gupta

Figuring Out • 2y

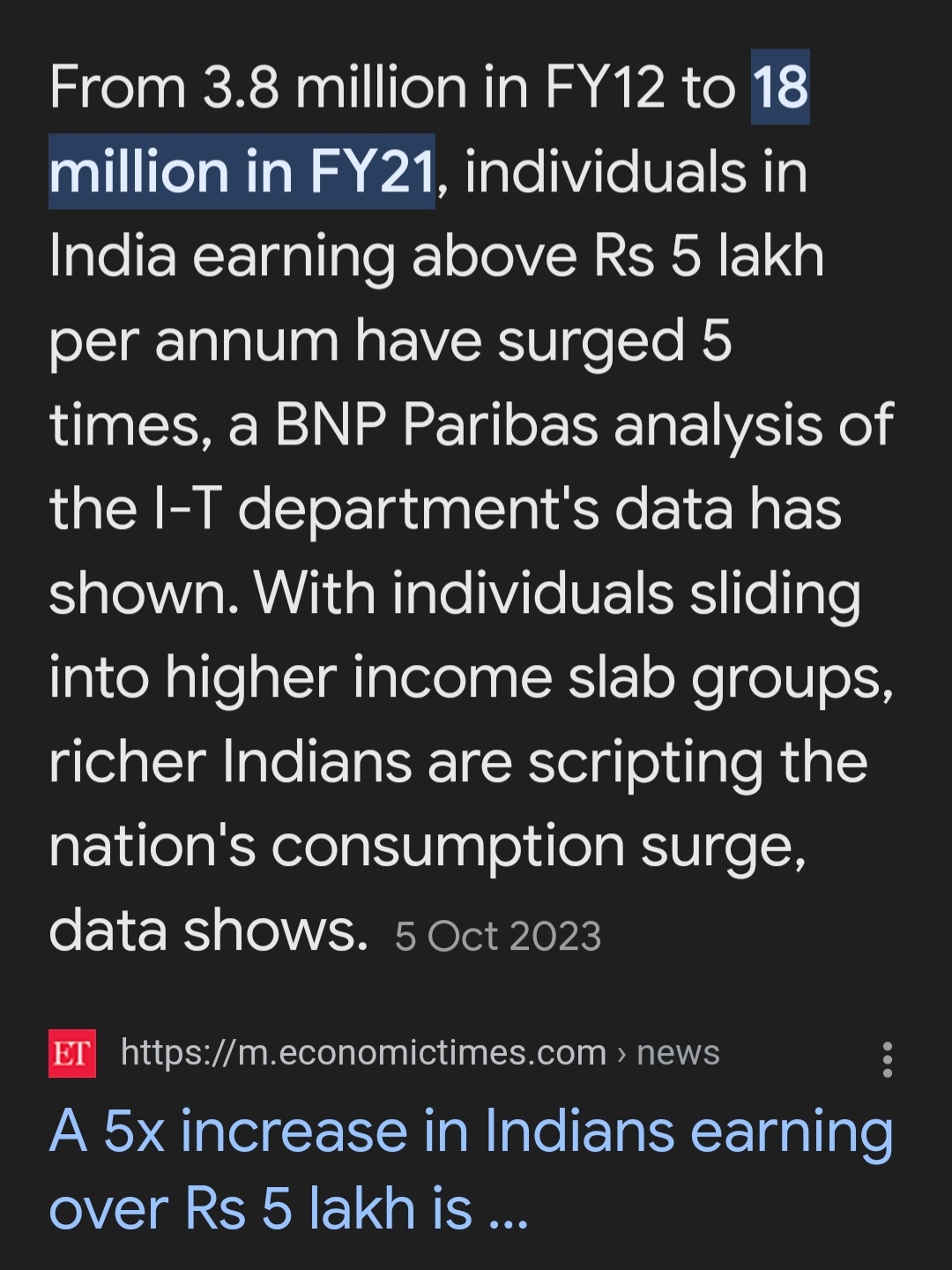

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

Should I make an app where people's can list there body parts, organ's, and blood . People's will sell at any price and needed will pay as their requirement. India have 140 crore population and we can worldwide. Even dead people can sell their organ'

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)