Back

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 10m

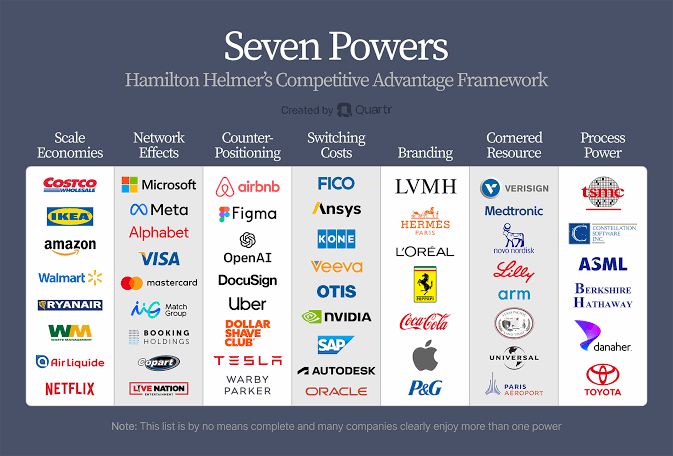

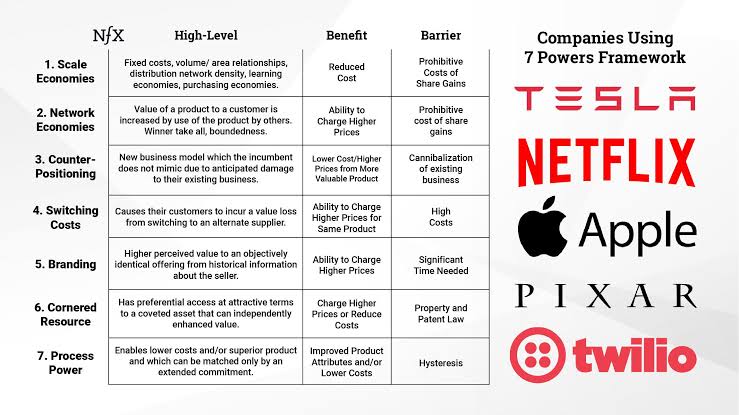

A quick short read one should must explore. Purpose: To build enduring, compounding business value ("Power" = sustainable differential advantage). Few build Power while other chase growth. #Hamilton Helmer breaks it down into 7 defensible advanta

See More

8 Replies

7

23

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)