Back

Anonymous 1

Hey I am on Medial • 1y

Above 2000 also gst is applicable no?

Replies (1)

More like this

Recommendations from Medial

LetsConnect Mind care technology pvt ltd

•

Signitycs • 1y

In india Upto 18% GST Is Applicable - Education sector. Medical Industries - GST is Applicable. Luxury cars - Low ROI Tractors, - High ROI This Rules are Correct What is your opinion. its just an Question.. Because we stopped questionings..??

See Moregray man

I'm just a normal gu... • 9m

The Finance Ministry has dismissed reports suggesting that the government is considering imposing Goods and Services Tax (GST) on UPI transactions exceeding INR 2,000. In an official statement, the ministry clarified, “The claims that the government

See More

CA Kakul Gupta

Chartered Accountant... • 4m

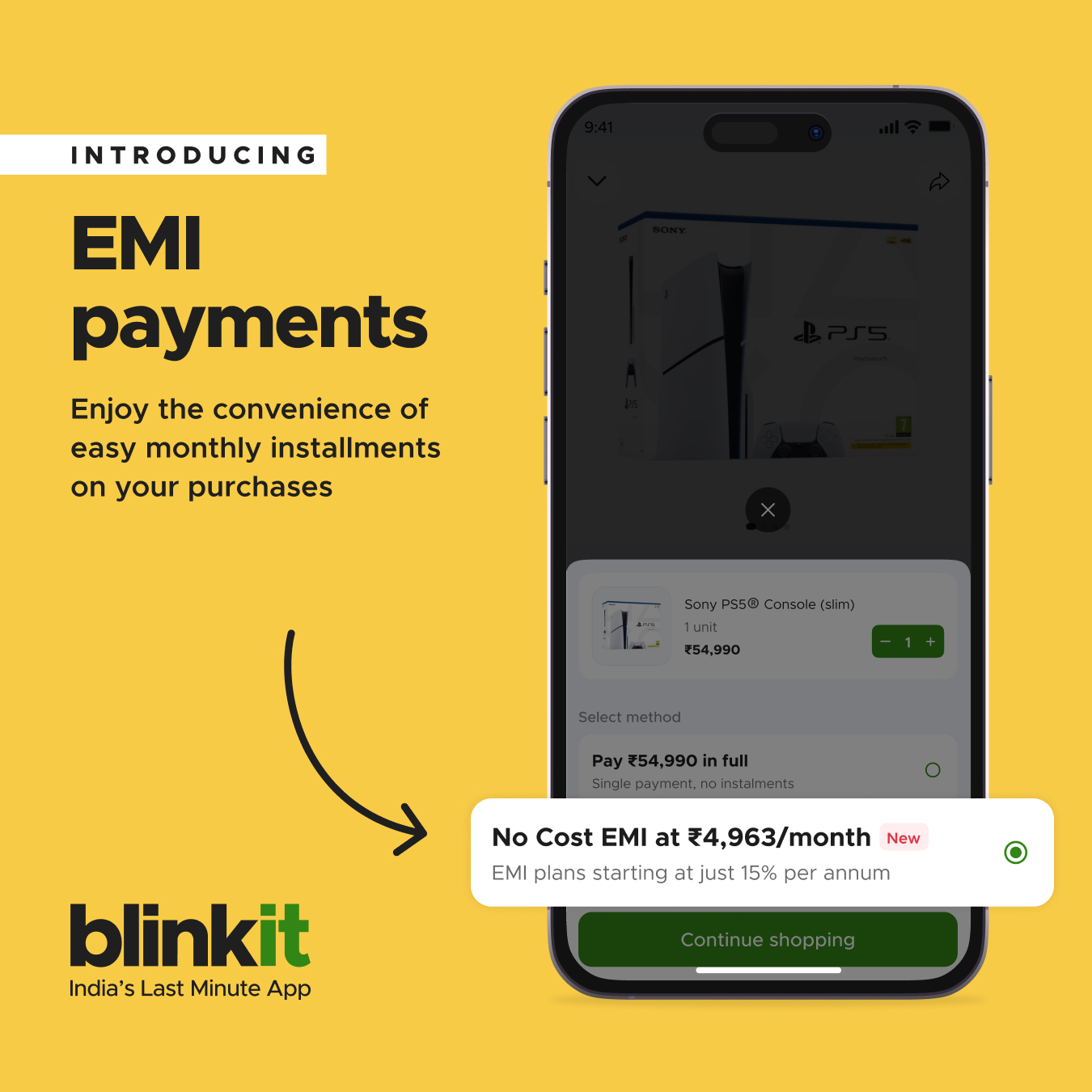

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreAshutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)