Back

Anonymous 4

Hey I am on Medial • 1y

Overfunding can lead to issues, not sure Masa is happy with how Oyo's valuation is looking.

Replies (1)

More like this

Recommendations from Medial

The next billionaire

Unfiltered and real ... • 1y

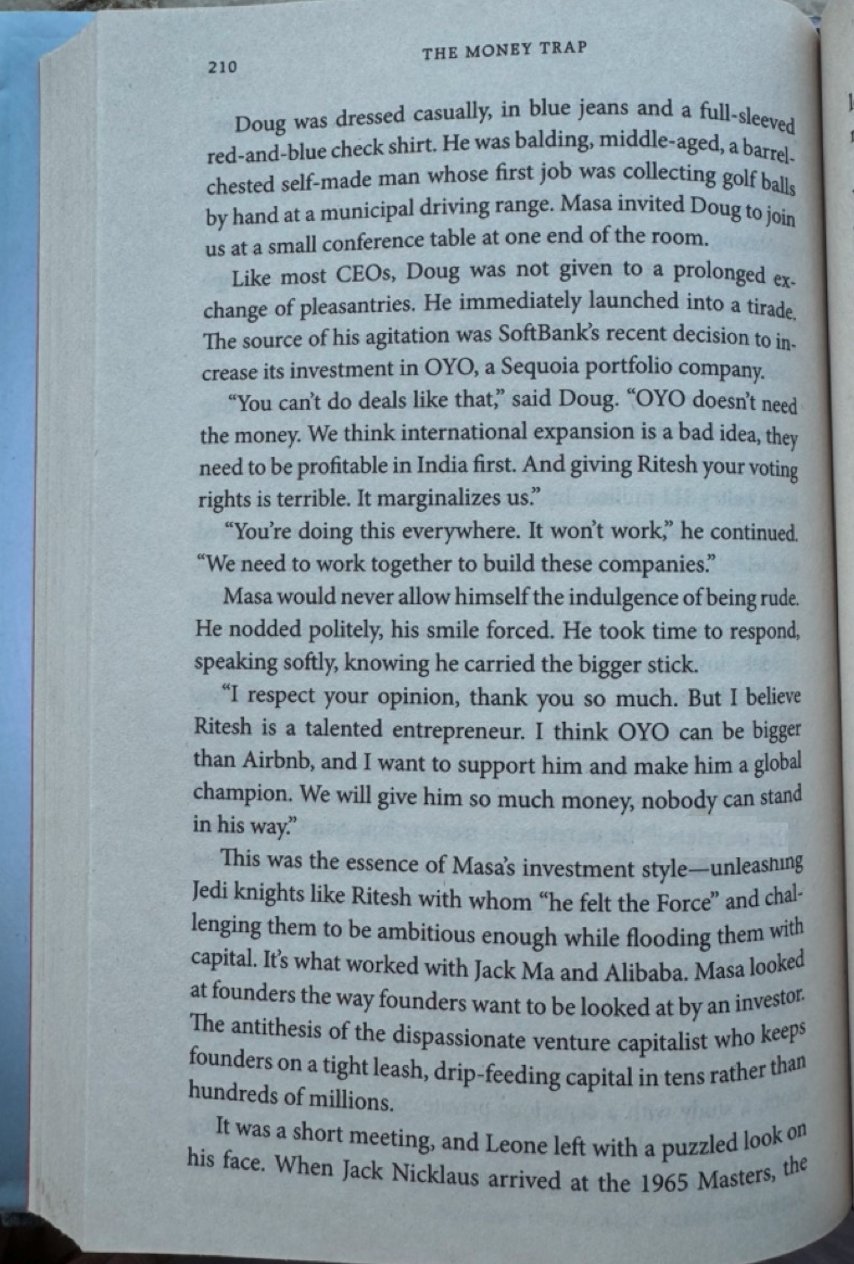

Sajith Pai recently posted TIL that Doug Leone was v unhappy w Masa for 'overfunding' Oyo, and giving their voting rights to Ritesh Agarwal. The culture clash is real: Doug Leone: "Oyo doesn't need the money" Masa: "We will give him so much mon

See More

Anonymous

Hey I am on Medial • 1y

Valuation is not just about numbers, but about understanding the biases, uncertainties, and complexities that can impact the valuation. It is important to recognize and address these factors in order to make more accurate valuations. The three big p

See MoreSunny Mattoo

We are conscious and... • 1y

Where AI will lead to the humanity or how human will go along with AI. It's still difficult however one thing is sure how we are AlterEgo consciousness it will definitely help AI to learn how we are wiring our actions on digital platform which will l

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)