Back

Dr Sarun George Sunny

The Way I See It • 1y

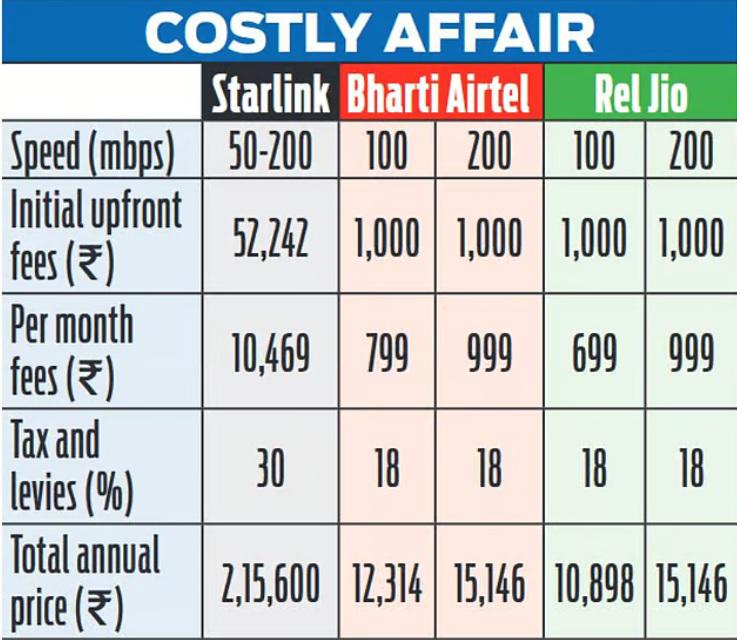

The Battle for India’s Internet Elon Musk’s Starlink is entering India, challenging Mukesh Ambani’s Reliance Jio, which dominates the internet market. Last year, Musk tried to launch Starlink, offering satellite-based internet, but the Indian government denied his company a license. Meanwhile, Reliance Jio teamed up with Luxembourg-based SES to create Jio Space Technology Ltd., providing satellite broadband services. Ambani pushed the government to auction the satellite spectrum to give Jio an edge. Musk, however, argued that satellite spectrum should be equally allocated since it’s a shared resource that can’t be divided into exclusive blocks. Auctioning satellite spectrum is difficult, and countries like the U.S. have shifted to allocation models. This method is now globally accepted. The Telecom Regulatory Authority of India (TRAI) recently announced that the satellite broadband spectrum would be allocated rather than auctioned. Following this, Musk confirmed Starlink’s entry into India. Currently, Reliance Jio holds 60% of India’s internet market share, but Starlink could disrupt its monopoly. Laying fiber optic cables to remote areas is expensive and impractical, making satellite internet a more viable option. Starlink’s satellite internet operates with small satellites orbiting around 350 miles above Earth, providing high-speed, low-latency internet, especially for underserved regions. Already in over 65 countries, Starlink aims to capture a share of India’s growing satellite broadband market, which could reach $1.9 billion by 2030. Despite its technological advantage, Starlink faces challenges in pricing. Jio offers unlimited data plans at ₹471 per month, while Starlink’s plans cost about ₹10,000 per month, plus a ₹50,000 equipment fee. Indian consumers are highly price-sensitive, and Jio’s affordable rates have won over millions. Additionally, Jio has an edge in terms of sovereignty and national security. Control over communication infrastructure is crucial, and Indian data being routed through foreign servers, as with Starlink, raises security concerns. Jio, as an Indian company, ensures that India remains in control of its networks, aligning with the country’s AtmaNirbhar Bharat campaign, which emphasizes self-reliance in technology. While Starlink could transform internet access in remote areas, its high cost and concerns about national security make it tough to compete with Jio’s low prices and strategic advantages. As Musk and Ambani face off, the future of India’s internet market is at stake. Can Starlink break Jio’s monopoly, or will Jio maintain its dominance through pricing and national interest? The competition between two of the world’s wealthiest men is just beginning, and it will shape the future of India’s internet landscape.

Replies (4)

More like this

Recommendations from Medial

Ansh Kadam

Founder & CEO at Bui... • 9m

Why does Elon Musk and his SpaceX own over half of all the satellites ? Over 11,000 satellites are currently orbiting the earth, and SpaceX owns over 7400 of them. Why ? Because SpaceX is launching all these satellites for Starlink. Starlink is E

See More

TheGangestoday

Providing The Best N... • 9m

Elon Musk's Starlink has been granted a key licencee from the Department of Telecommunications, reports said, in a boost to the satellite company's dreams to capture the market. https://thegangestoday.blogspot.com/2025/06/elon-musk-starlink-india-li

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)