Back

Replies (1)

More like this

Recommendations from Medial

Maniraj N G

Marketing & Systems ... • 1y

Why Being Innovative Beats Relying on Luck Every Time 🔍 The Problem: Luck might bring you a viral moment or an unexpected win, but relying on it is like building a house on sand—unsustainable and unstable. 🌟 The Solution: Innovation is your bed

See Morefinancialnews

Founder And CEO Of F... • 1y

“Nifty Smallcap Stocks: 50% Trading 20-42% Below 52-Week Highs – Investor Strategies” “Dalal Street Small-Cap Stocks: Investor Interest Wanes Amid Weak Earnings, Geopolitical Tensions, and Profit-Taking” Investor interest in small-cap stocks on Dala

See More

Ankush Yadav

मैं एक विचार हूं (I ... • 10m

One more interesting idea....... If American and European companies can't make profit they can sell their stake to our Gujju and Marwari bhai......... They can make profit without harming nature....... Gujju in the house 🤣 🤣 🤣 ......Vepaar ma pa

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

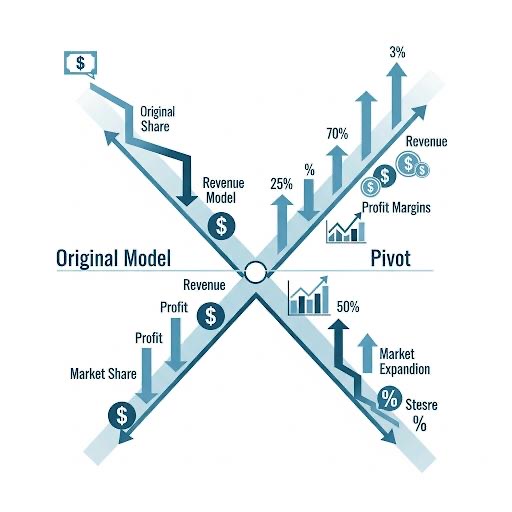

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Vedant Patel

Hammer it until you ... • 7m

cash clarity tool I recently built a simple tool called Cash Clarity – it's designed for freelancers, solopreneurs, and startup founders who want to get a clear picture of their monthly inflows, outflows, and how long their cash will last. ✅ Track

See More

Download the medial app to read full posts, comements and news.