Back

Aditya Arora

•

Faad Network • 1y

Meet the man from a village in Uttarakhand who built a 5000 CR bank. 1. Born in a village 40 km away from Jim Corbett National Park in Uttarakhand, Govind Singh had a tough childhood. He travelled 7 km to the nearest school daily and taught students in a 18ft x 6ft x 6ft house. He wanted to do something. 🤔 2. After completing his BCom degree, he started his career as a probationary officer in the State Bank of Patiala. Five years later, he joined Surya Fincap with the mandate to set up their Mumbai office in 1988. He then worked at the Bank of Indonesia and UTI Bank, and the year 2000 came. 👇 3. Govind joined ICICI Bank and became the business head of its microfinance department by 2006. He scripted history by becoming the first to launch the business correspondent model in India, where villagers could transact without going to a bank. 🙌 4. But Govind noticed that 400 million people could still not borrow small amounts like Rs 10,000, and the industry needed access before technology. He left his high-paying job at ICICI to start a new company in the ghats of Varanasi. In 2009, Utkarsh Microfinance began its journey. ✅ 5. The idea was simple ⏩ Finance the community where the need is limited but the service is also limited. He went after the UP and Bihar market, which comprised 40% of India's below the poverty line population, and raised 6 CR from an MFI, Aavishkar Goodwell. 💰 6. With funds, Utkarsh scaled to four branches, 8,000 customers, and an outstanding portfolio of 6.3 CR in the first year. However, Utkarsh saw a survey that said 373 million business owners do not get business loans between Rs 50,000 and Rs 3 Lakh. He had to solve this. 🤔 7. In March 2012, he introduced the Micro Enterprise Loan (MEL) scheme Samridhi, providing unsecured loans within three days in semi-urban and rural locations of UP and Bihar. By 2013, he obtained the NBFC license, scaled to 300,000 customers, and had a book of 448 CR.📉 8. Utkarsh had zero defaults as it gave loans to only joint liability groups, where 4-10 villagers combined to guarantee loan payment. By 2016, it entered the housing loan segment, and the RBI finally licensed it that year. On 23rd January 2017, Utkarsh Small Finance Bank was born. 🚀 9. By 2017, Utkarsh entered the Personal Loans, Commercial Vehicle Loans, and Construction Equipment Loans market. It grew to a loan book of 3200 CR, serving 15 lakh customers. And the big news came. 👇 10. As Utkarsh scaled to loans of 14,000 CR and deposits of 19,496 CR, it listed on the stock markets on July 21, 2023. Its 500 CR IPO was subscribed to a whopping 102 times. 🤯 11. Today, Utkarsh Small Finance Bank has a portfolio of 18,000 CR, deposits of 17,000 CR, and its highest-ever revenue of 3579 CR at a profit of 452 CR in 2023. With 888 branches and 320 ATMs in 26 states, it is worth 4708 CR. 💪 ➡️ Who would have thought that a boy from a village in Uttarakhand would build India's fourth-largest small finance bank?

Replies (3)

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 1y

Meet the man who created an 8500 CR bank for women. 1. Born in the coal city of Dhanbad in Jharkhand, Samit Ghosh was hugely inspired by his father, a World War II doctor who set up government hospitals in the city's poor coal mining areas. But lost

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who built India's third-largest bank worth 45,000 CR. 1. Born into a 60-member Gujarati joint family, Uday Kotak used to stay in a single house with his family, who shared one kitchen. He worked hard and studied master's at the Universi

See More

Yash Barnwal

Gareeb Investor • 1y

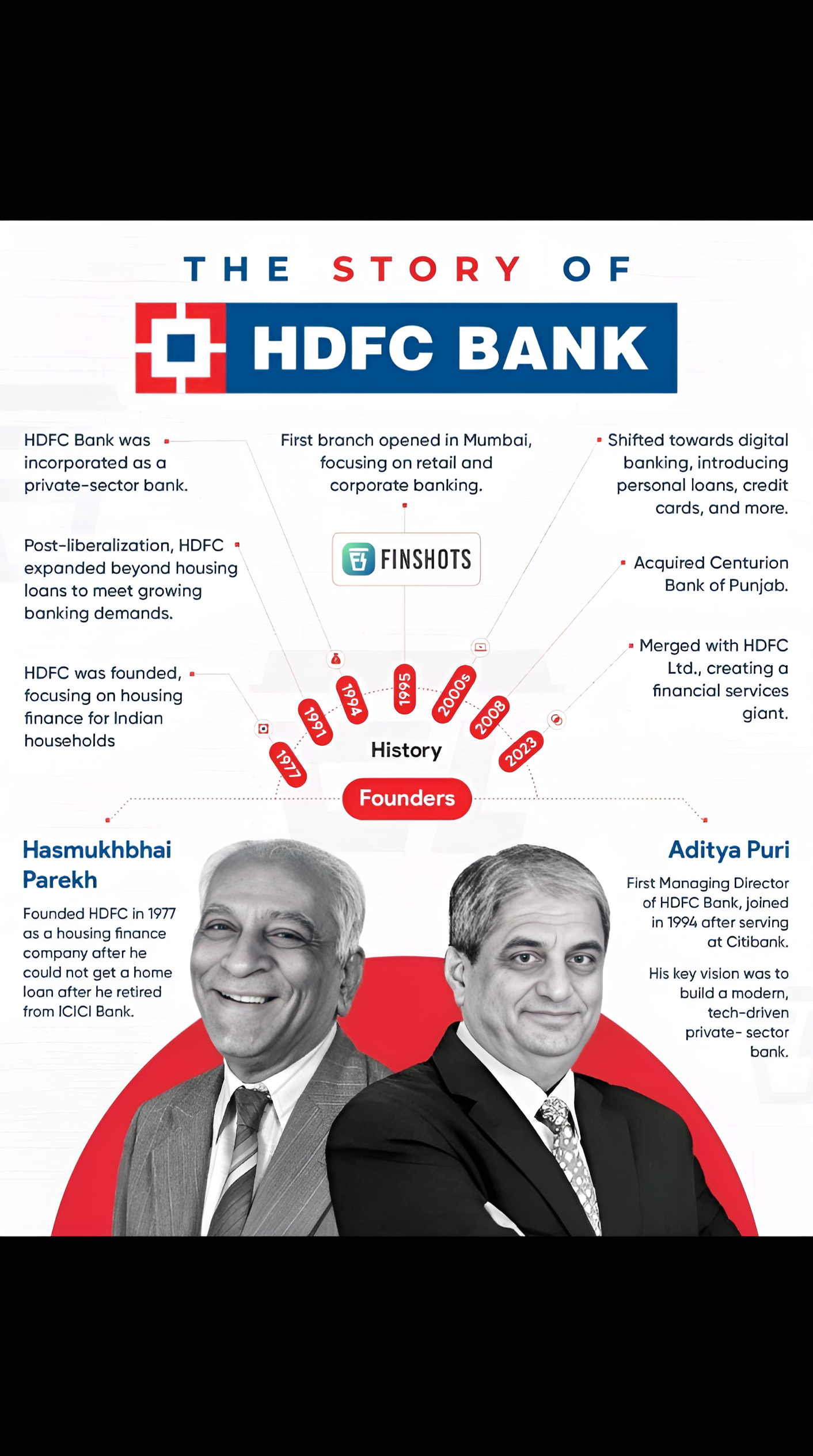

🏦 The Story of HDFC Bank 📈 Founded by Hasmukhbhai Parekh in 1977, HDFC Bank started as a housing finance company and grew into a leading private-sector bank. Under the leadership of Aditya Puri, who joined in 1994, the bank expanded into retail and

See More

Aditya Arora

•

Faad Network • 7m

Started from a village in Tamil Nadu and built an 8500 CR company. 1. Born in the rural foothills of Pachamalai in Tamil Nadu, Arulmany Duraiswamy used to manage oilseeds orchards, helping villagers overcome financial gaps. Honing his knowledge furt

See More

VIJAY PANJWANI

Learning is a key to... • 4m

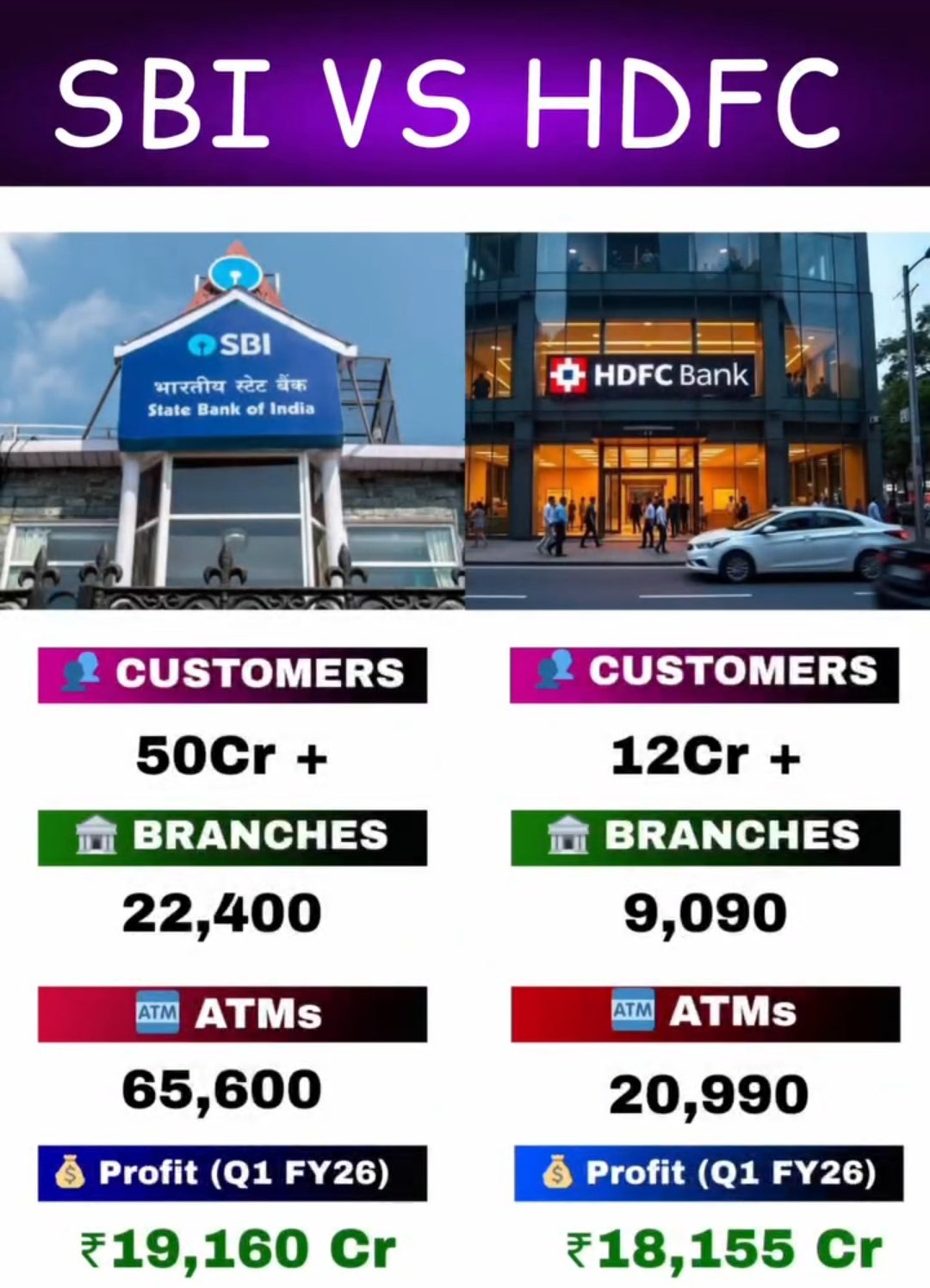

SBI vs HDFC Bank – The Battle of India’s Banking Giants! 🇮🇳 SBI: 50 Cr+ customers | 22,400 branches | ₹19,160 Cr profit 🏦 HDFC Bank: 12 Cr+ customers | 9,090 branches | ₹18,155 Cr profit 👉 Who’s the real king of Indian banking? Comment your o

See More

Aditya Arora

•

Faad Network • 4m

Left Deutsche Bank after 16 years to build a 9,000 CR company. 1. Starting in global fixed income structuring, Bhupinder Singh worked hard and became the head of investment banking and securities for Deutsche Bank's Asia Pacific region by 2013. He w

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)