Back

Aditya Arora

•

Faad Network • 1y

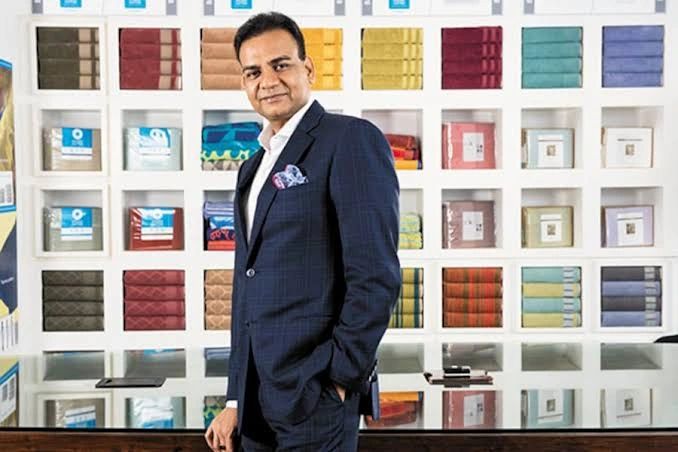

Meet the man who created an 8500 CR bank for women. 1. Born in the coal city of Dhanbad in Jharkhand, Samit Ghosh was hugely inspired by his father, a World War II doctor who set up government hospitals in the city's poor coal mining areas. But lost him when he turned 10. 2. Shattered but not down, he studied hard and was admitted to the prestigious Wharton School in the USA. Post-MBA, he developed a deep interest in financial services and joined Citibank in 1975. ✅ 3. Starting as a management trainee, he worked in all the bank's departments for five years before re - joining the bank as Vice President, where he started as a trainee. In 1985, Samit joined Citibank again to set up their consumer business in India, UAE, and Bahrain,. 🙌 4. After a successful stint, Samit was appointed CEO of Bank Muscat in 1998. The bank merged with Centurion Bank of Punjab and later sold to HDFC Bank for 9510 CR, making it the biggest acquisition of the Indian financial sector of its time. ✅ 5. After three decades of a glorious banking career, Samit realised a wish he made when he lost his father—the desire to help the poor. At 56, he left it all behind to start a microfinance company in Bangalore. On 1st November 2005, Ujjivan Financial Services was born. 🚀 6. Ujjivan started as a non-deposit NBFC, lending to working women in urban and semi-urban areas who wanted to set up small businesses at 23% when industry standard was 24.5%. By 2008, Ujjivan scaled to 160 CR loan disbursals across 165,000 borrowers in eight cities, and a big milestone came. 👇 7. It opened its 100th branch in Nanjungud, Karnataka, on 22nd November 2008. It even profitably survived the 2010 microfinance crisis and was granted the NBFC—MFI status by RBI in 2013. But something was happening. 🤔 8. Samit realised it was time to expand and make Ujjivan a bank. He first took the company public through an IPO of 887.69 CR, which oversubscribed by 40.66 times in May 2016, when public sector banks failed. But the big news came six months later. 👇 9. On 11th November 2016, Ujjivan received the final license from RBI to set up a small finance bank. Samit converted Ujjivan's 464 microfinance centres across 24 states into bank branches. On 1st February 2017, Ujjivan Small Finance Bank commenced operations. 🚀 10. Samit Ghosh finally lived his father's dream but started operations four months after demonetisation. Even while his credit cost shot up to Rs 310 CR, he managed to run the bank profitably. By March 2020, Ujjivan had served 52.5 lakh customers across 575 branches. 📉 11. Today, Ujjivan manages loans of 23,389 CR with a default rate of just 0.3%. At a profit of 1281 CR, it is one of India's leading small finance banks worth 85,960 CR. 💪 ➡️ Samit Ghosh may have retired in 2020, but he continues to open the bank accounts of over 150,000 urban poor women through his NGO at 75 years. 🙏

Replies (3)

More like this

Recommendations from Medial

Aditya Arora

•

Faad Network • 1y

Meet the man from a village in Uttarakhand who built a 5000 CR bank. 1. Born in a village 40 km away from Jim Corbett National Park in Uttarakhand, Govind Singh had a tough childhood. He travelled 7 km to the nearest school daily and taught students

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who built India's third-largest bank worth 45,000 CR. 1. Born into a 60-member Gujarati joint family, Uday Kotak used to stay in a single house with his family, who shared one kitchen. He worked hard and studied master's at the Universi

See More

VIJAY PANJWANI

Learning is a key to... • 4m

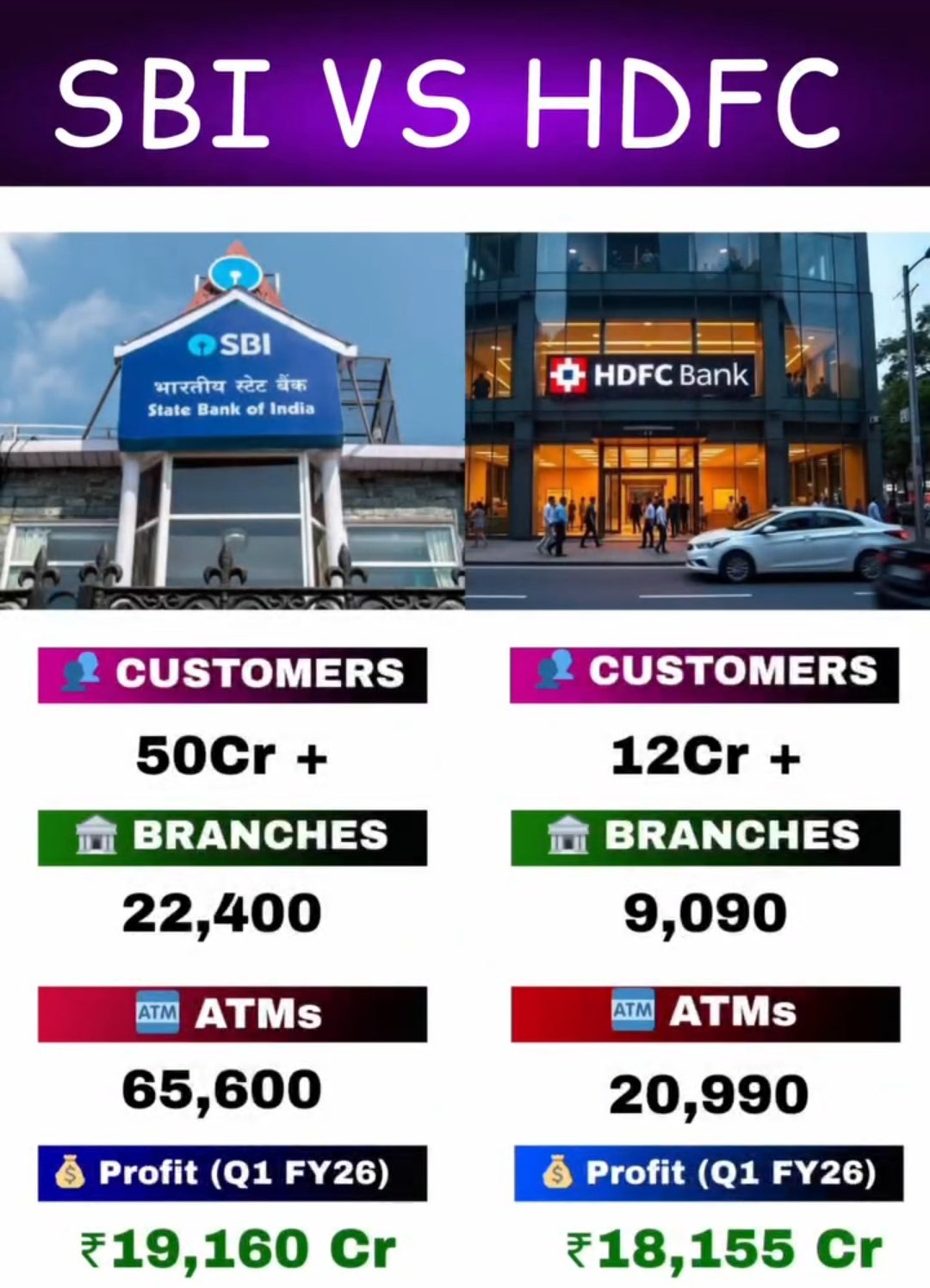

SBI vs HDFC Bank – The Battle of India’s Banking Giants! 🇮🇳 SBI: 50 Cr+ customers | 22,400 branches | ₹19,160 Cr profit 🏦 HDFC Bank: 12 Cr+ customers | 9,090 branches | ₹18,155 Cr profit 👉 Who’s the real king of Indian banking? Comment your o

See More

Aditya Arora

•

Faad Network • 1y

Meet the doctor from Punjab who built a 30,000 CR company. 1. Born in the ancient city of Batala in Punjab to a gynaecologist mom and ENT specialist father, Naresh Trehan always wanted to be a doctor. His dream came true when he completed his MBBS

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who started at 19 and built a 17,000 CR business empire. 1. Born into a Marwari family in Hisar (Haryana), Balkrishan Goenka (BKG) was born to a father who traded and exported food grains. But he wanted to do something of his own. At 16

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)