Back

Replies (1)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Future of Fintech in India India's fintech sector has experienced rapid growth, driven by technological advancements, increasing smartphone penetration, and government initiatives. The country's large population and diverse demographics offer a s

See MoreNIKUNJ TULSYAN

Building Flex Aura |... • 10m

Day 7 of building SAAS in public No Code Tools are for building simple apps but if your app is even a bit complex no code is a nightmare. Just trying to integrate voice api for a voice chat bot feature in my app has been a nightmare. Let's hope for

See MoreBusiness Insider

Let's grow together!... • 1y

📍 The Indian startup culture has indeed been hyped up to some extent, fueled by success stories and investment frenzy. However, the reality often differs from the glossy image portrayed. Challenges like fierce competition, regulatory hurdles, and fu

See MoreJagan raj

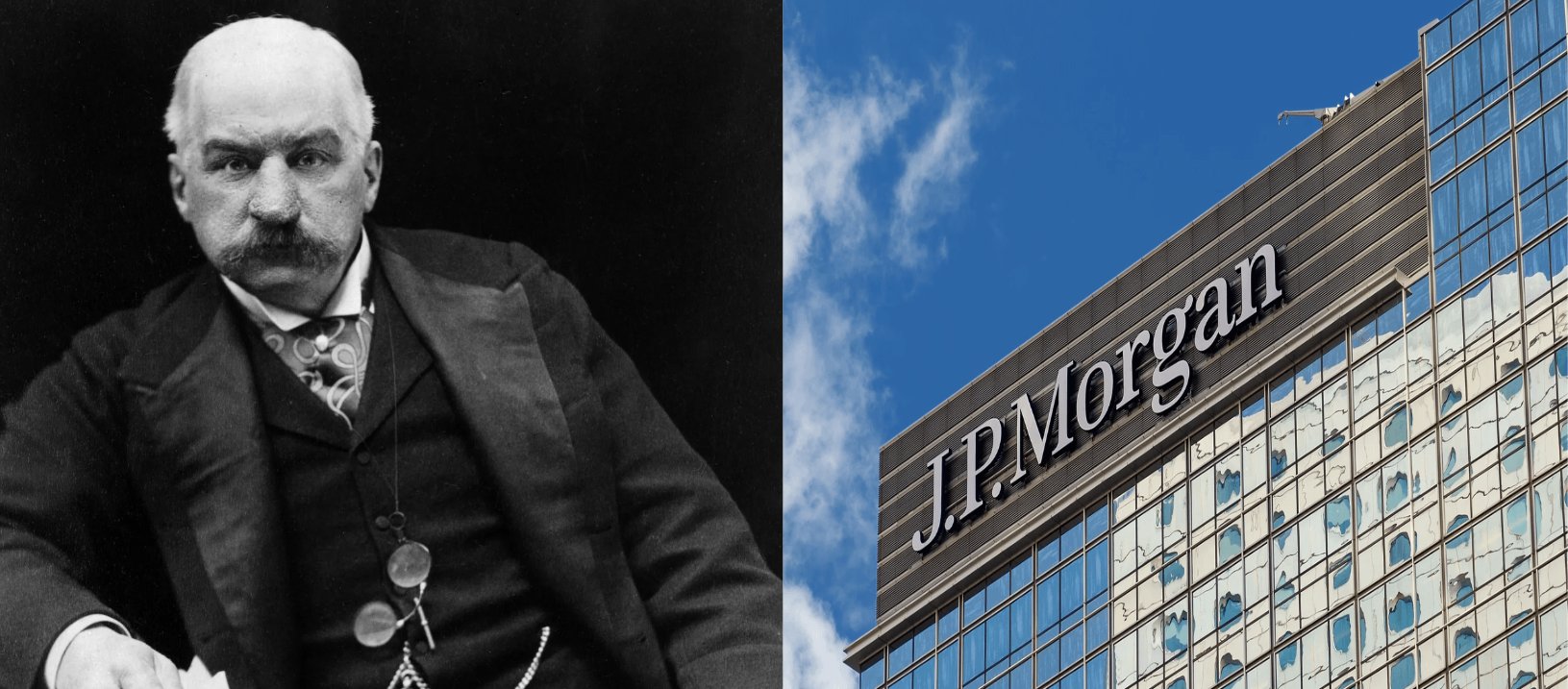

Founder & CEO of Tec... • 1y

This man revolution the banking industry I have one question why normal people don't even think about starting a bank business i know it's high startup costs and highly regulated my question is why people don't even think about starting a ban

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)