Back

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

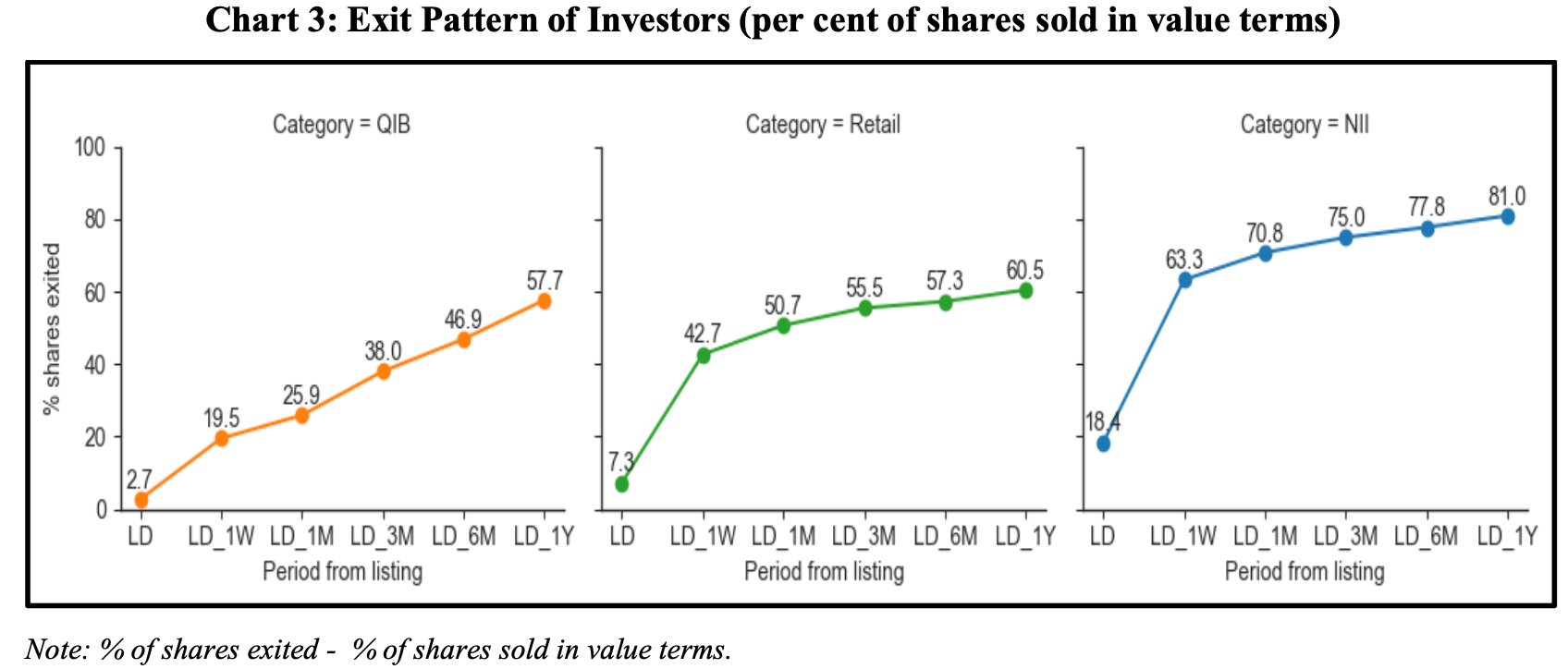

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

Rohan Saha

Founder - Burn Inves... • 1y

The Hyundai India IPO is not performing as well as expected. By the end of Day 2, it has only received 42% subscription, with the retail segment booking at just 38% so far. The GMP (Grey Market Premium) is also declining, currently at ₹35, which is j

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

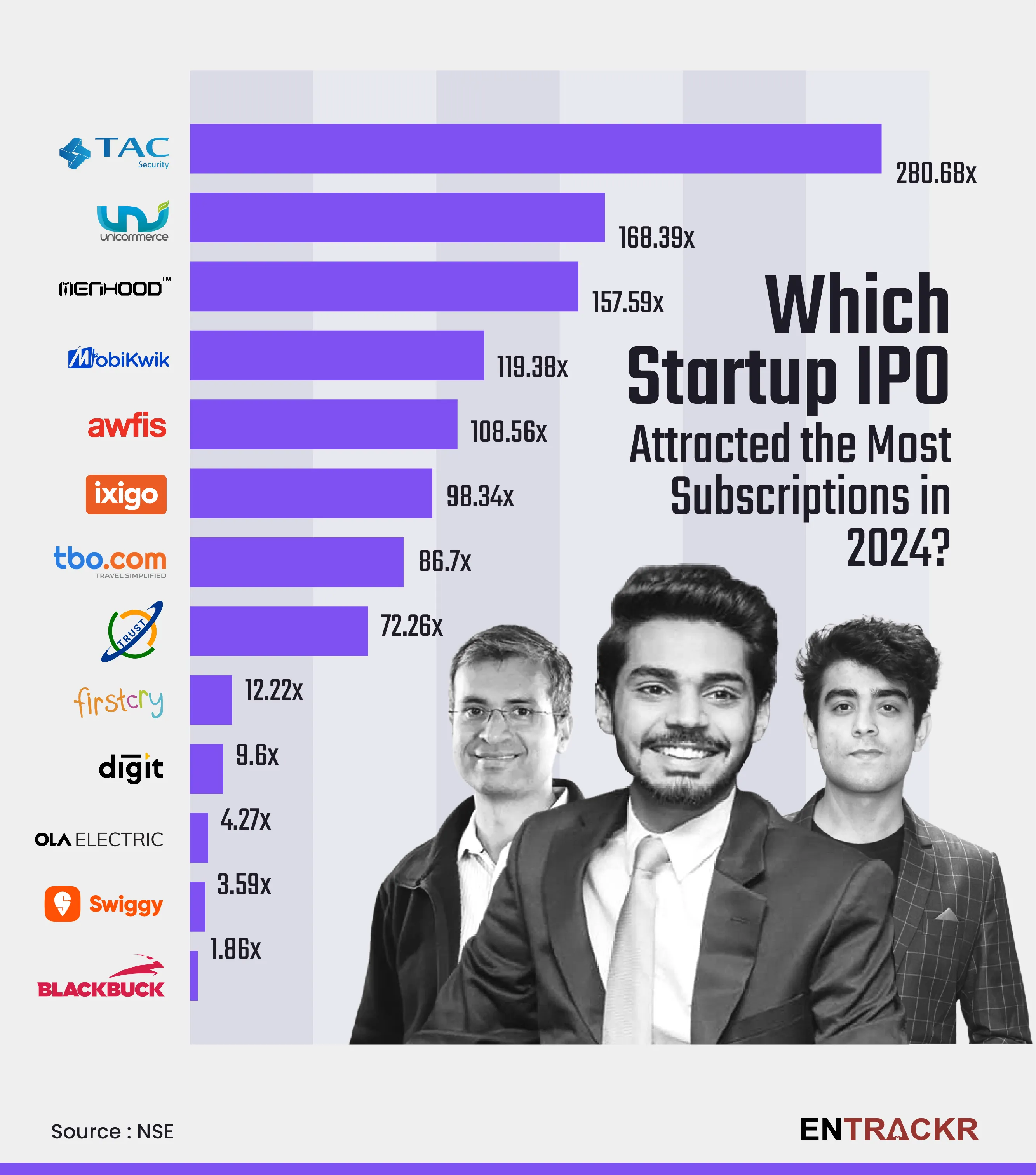

2024 IPO Highlights! 🚀 This year has seen 13 IPOs across a variety of sectors, including fintech, SaaS, logistics, proptech, electric vehicles, e-commerce, foodtech, and traveltech. In total, these companies successfully raised an impressive ₹29,24

See More

Rohan Saha

Founder - Burn Inves... • 1y

PhonePe has planned its IPO in India, and Navi is also set to follow. Groww and OYO are preparing their IPO papers as well. In a few days, we will see many mainboard IPOs. Many famous startups are shifting from private funding to IPO plans. I hope th

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)