Back

Arcane

Hey, I'm on Medial • 1y

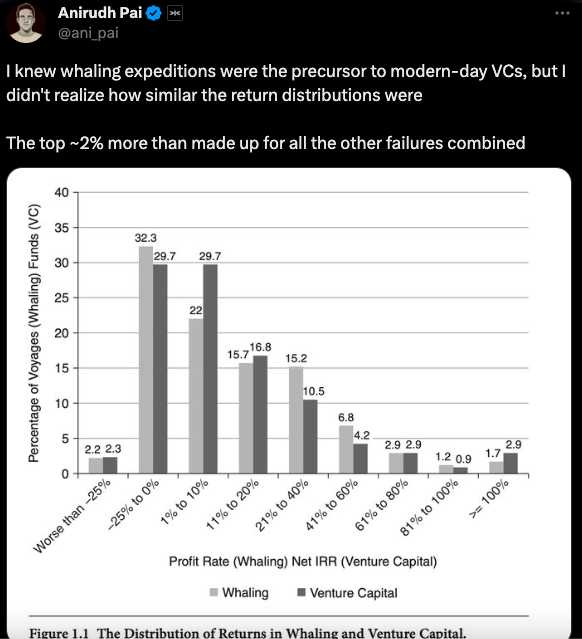

THE ORIGINS OF VC The origins of Venture Capital can be traced back to whaling expeditions from the 1800s. And you will be astonished to see how SIMILAR are the distribution of returns between the two (check image) Just like VC is today, whaling depended on rare but highly profitable catches. There was a financial backer for these expeditions, who took the risk. The sailors would receive a decent stipend and their profit share. But, this was ONLY AFTER the financier got back the principal and his share of profit. Only a few ventures made big money, but those few were so profitable that they kept the industry going, proving who could effectively deploy capital and who could not. And American whaling agents MASTERED how to make money out of this risky business in the mid 1800s, as almost 75% of the ships used for these expeditions were American.

Replies (5)

More like this

Recommendations from Medial

Shrrinath Navghane

•

NexLabs • 4m

Books that will help you understand startups, VC and tech a lot better: - Zero to One: Why competition is for losers - Hard Things about Hard Things: Reality of running startup - Power Law: Why VC works the way it does - Alex Ferguson: How to man

See MoreAccount Deleted

Hey I am on Medial • 1y

Trump announces the Stargate Project – a $500 billion "minimum" American investment in AI infrastructure. - 100,000 new American jobs - One of America's most ambitious technology initiatives, indicates a serious focus in being the world leader in A

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)