Back

Anonymous

Hey I am on Medial • 1y

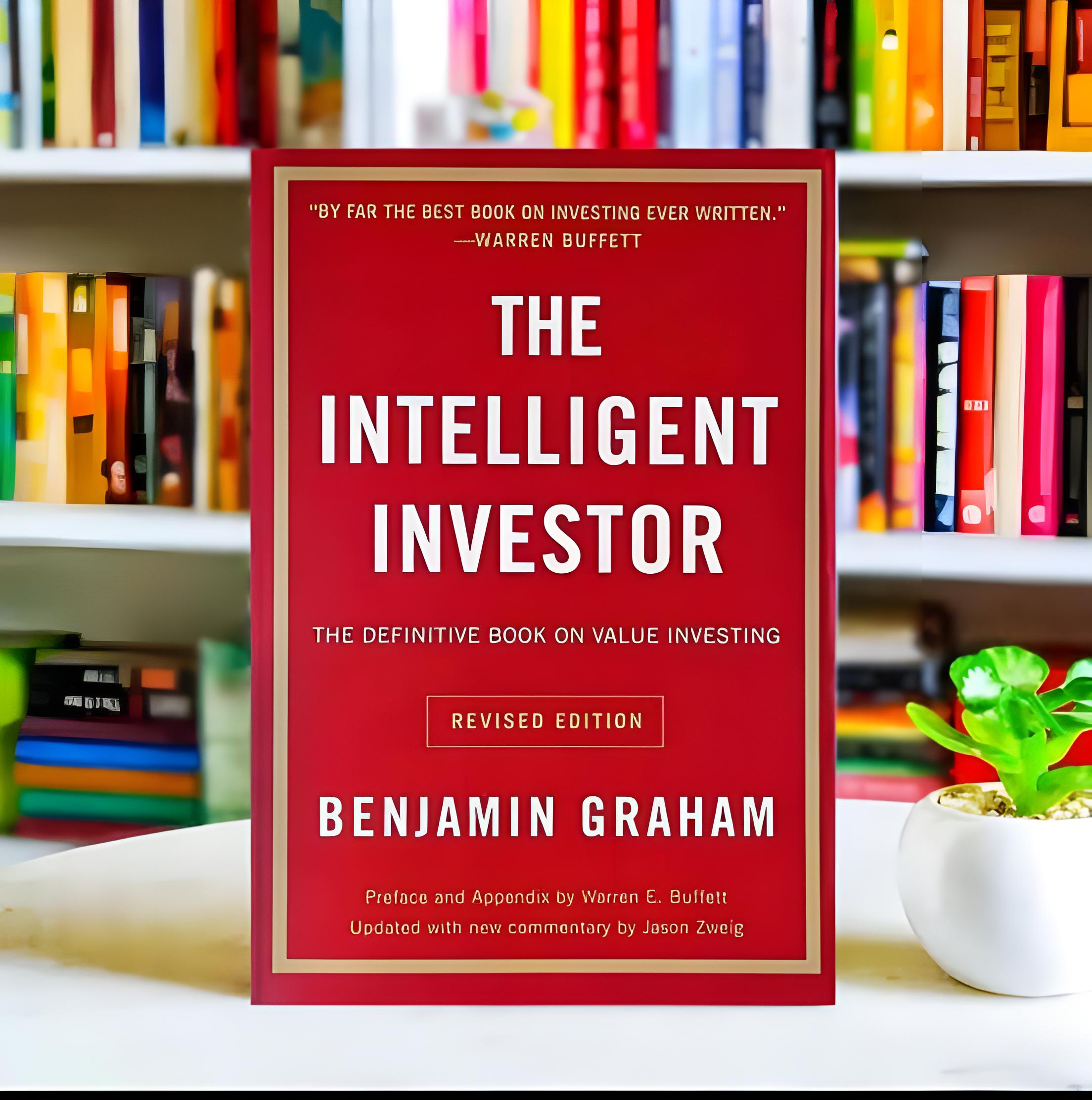

12. Efficient Market Hypothesis (EMH) Rejection: While acknowledging some validity in EMH (that all known information is priced into stocks), Graham argues that markets can and do misprice securities, creating opportunities for value investors. 13. The Importance of Financial Analysis: Investors should thoroughly analyze financial statements, earnings reports, and balance sheets to assess a company’s financial health before investing. 14. Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. It reduces the impact of market volatility and lowers the average cost of investments over time. 15. Bonds and Fixed-Income Investments: Graham advises including bonds or fixed-income securities in a portfolio to balance risk. He recommends a portfolio split between stocks and bonds, adjusted based on market conditions and personal risk tolerance. 16. Common Stock Ownership: Investors should only buy common stocks in companies with a long history of profitable operations, sound financial conditions, and a strong competitive position. 17. Growth vs. Value Stocks: Graham differentiates between growth stocks (companies expected to grow rapidly) and value stocks (companies priced below their intrinsic value). He advises focusing on value stocks for long-term stability. 18. Market Cycles: Markets move in cycles of optimism and pessimism. Investors should buy when the market is overly pessimistic (and prices are low) and be cautious when it’s overly optimistic (and prices are high). 19. Security Analysis: The book advises conducting a detailed analysis of a company's earnings history, growth potential, and competitive position before investing in its securities. 20. Beware of IPOs and Hot Stocks: Graham cautions against investing in hot, overhyped stocks and initial public offerings (IPOs), as they are often priced too high and carry excessive risk. 21. Investment Policy for the Defensive Investor: For defensive investors, Graham recommends a portfolio with a balance of high-quality bonds and stocks, investing in companies with long-term records of success. 22. Contrarian Investing: Intelligent investors often go against the crowd. When everyone else is selling, consider buying. When everyone is buying, be cautious. 23. Long-Term Patience: Successful investing requires patience and a long-term view. Ignore short-term noise and focus on the underlying value of your investments. 24. Beware of High Fees: Excessive fees from brokers or fund managers can erode returns over time. Graham advocates low-cost investing and minimizing unnecessary fees.

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 3 About Basic Finance Concepts Here's Some New Concepts 4. Investment Stocks: Shares in a company that give investors ownership rights and potential dividends. Bonds: Debt securities where investors loan money to companies or governments in re

See More

Hemanth Varma

''Money can't buy ha... • 1y

can mutual fund be a profitable investment? A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its po

See More

Account Deleted

Hey I am on Medial • 11m

The stock market is a marketplace where investors buy and sell shares of publicly traded companies. It enables companies to raise capital by issuing stocks, while investors can profit through price appreciation and dividends. Stock exchanges, like th

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)