Back

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

AVISHEK NAYAK

It's all about the e... • 1y

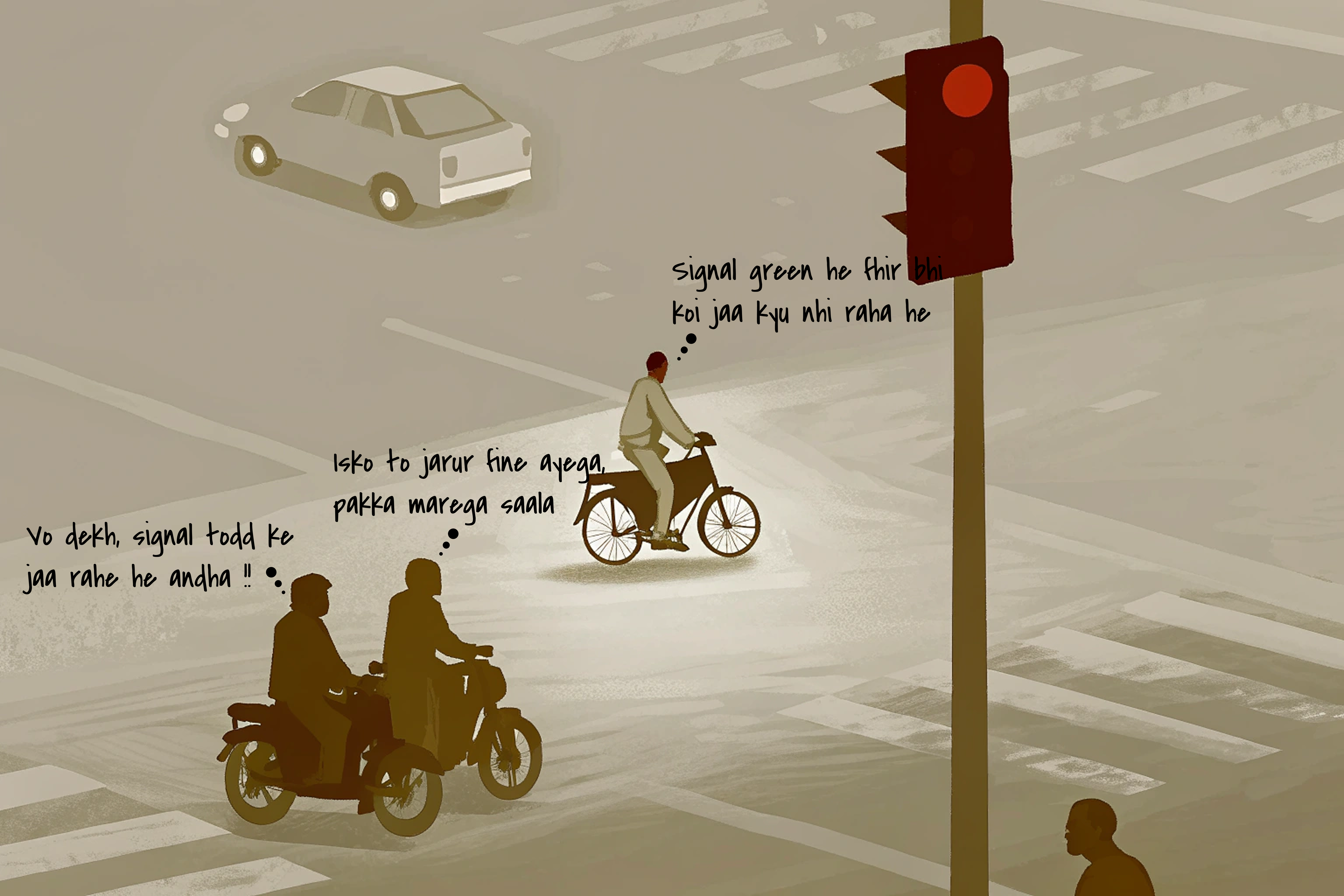

Garrett Morgan’s Traffic Signal Legacy . Garrett Morgan invented the traffic signal, but one key scientific point that got completely missed was that red-green is the most common form of color blindness in humans. Almost 8% of men are color blind due

See More

Only Buziness

Everything about Mar... • 3m

Colors don’t just decorate—they dictate decisions. Red excites hunger, blue builds trust, and green calms the mind. That’s why brands like McDonald’s use red to trigger appetite and Paytm uses blue to symbolize safety. Color psychology is silent pers

See More

Anonymous

Hey I am on Medial • 1y

Color isn’t just about wavelength; context plays a crucial role too. For instance, an image of strawberries might appear red to us even if there are no red pixels. Our brains perform color correction based on lighting and familiar colors. This phenom

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)