Back

LIKHITH

•

Medial • 1y

Bank should hold less Cash 💸 to boost circulation and lending among public These were their good policies

Replies (1)

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 7m

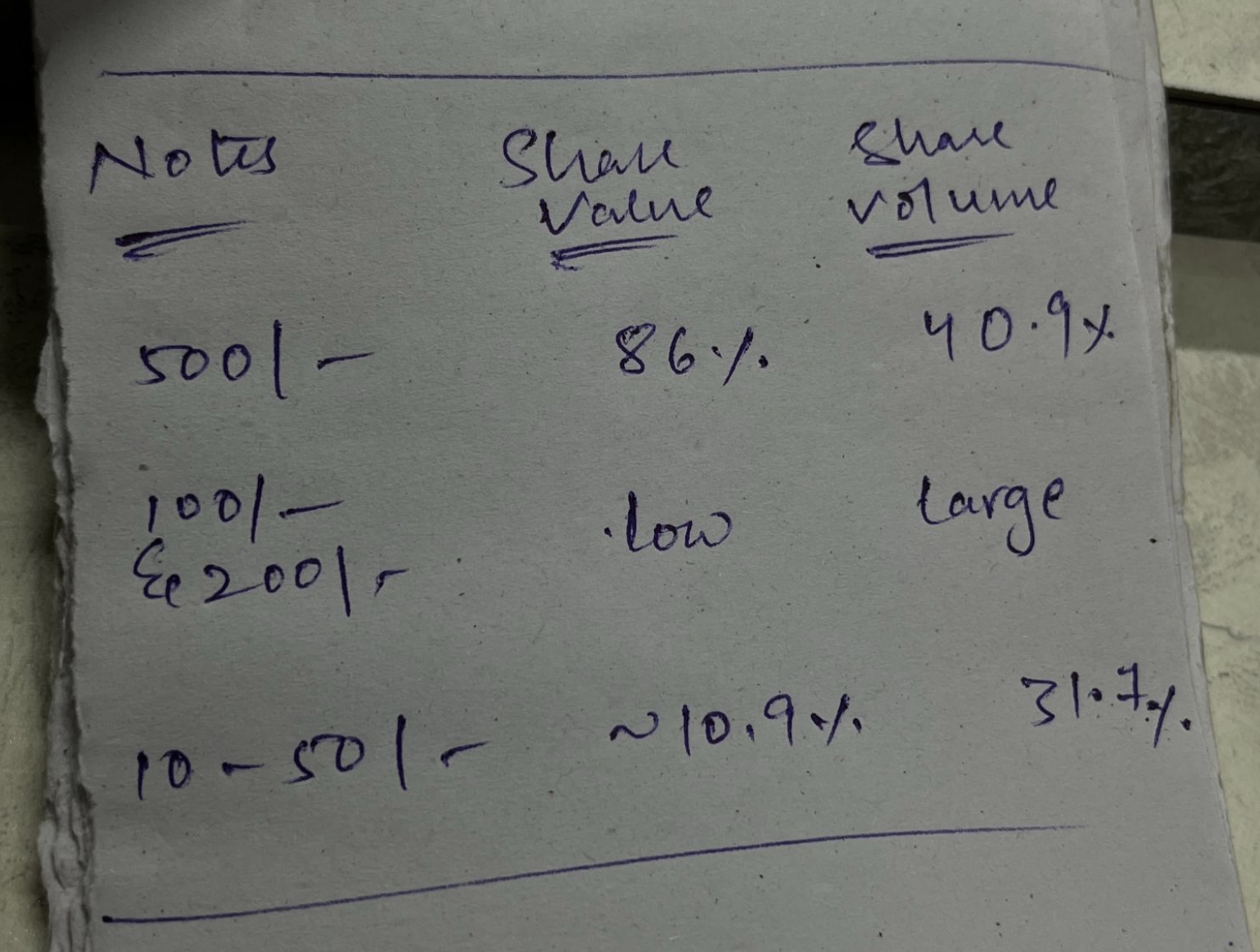

As of 2025, ₹500 notes dominate India’s cash system, making up 86 percent of the total value and 40.9 percent of all notes by volume. But while they’re everywhere, they’re not always practical. For everyday use, smaller denominations like ₹100 and ₹2

See More

Karnivesh

Simplifying finance.... • 28d

A finance leader once said something that changed how I look at businesses. “We were profitable on paper, but cash was always tight.” That’s when the cash conversion cycle started making sense to me. A company may sell today, wait weeks or months

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

The Funding Chase: Why Raising Money Won’t Solve Your Problems Chasing funds to start your dream? Hold up. Early branding beats a cash grab every time. Share your vision online—raw, real, relentless. It pulls in customers, partners, even ta

See MoreGreat Yash

Making India Great a... • 1y

Attention⚠️ Former congress Spokesperson made an allegation again on SEBI chief Ms. Madhvi buch as even after quitting job from ICICI bank and joining SEBI she used to take some shot of pension from the bank was about 16 crores more or less .

See More

Vedant Patel

Hammer it until you ... • 8m

🚀 3 AM. Coffee Cold. Burn Rate Unknown. It was the third time that week I asked myself: "Where’s all the cash going?" We were building a startup with passion. Clients were trickling in. Revenues were rising. But somehow — the bank balance told a di

See More

Anonymous

Hey I am on Medial • 1y

Another electric vehicle manufacturer has declared bankruptcy. 😞 Electric car startup Fisker, founded by Henrik Fisker, has filed for bankruptcy. The company attempted to revive its business model of contract manufacturing cars through outsourcing

See More

Vikram Kumar

Founder at Stockware • 1y

Navi Finserv Ordered to Cease Loan Disbursement by RBI 🚨 In a recent development, Navi Finserv, the NBFC arm of Sachin Bansal’s Navi Technologies, has been ordered by the Reserve Bank of India to cease and desist from sanctioning and disbursing loa

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)