Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

📖 DAILY BOOK SUMMARIES 📖 🚀 12 Lessons from 👉 🔥 Essentials Of Economics 🔥 ✨ By N - Gregory Mankiw ✨ 1. Ten Principles of Economics Mankiw starts by introducing the ten basic principles that form the foundation of economic thinking • People Face Trade-offs: Choosing one option often means giving up another • The Cost of Something is What You Give Up: Opportunity cost is key to decision-making • Rational People Think at the Margin: Small, incremental adjustments help maximize outcomes • People Respond to Incentives: Behavior changes in response to incentives • Trade Can Make Everyone Better Off: Specialization and trade improve efficiency • Markets Are Usually a Good Way to Organize Economic Activity: The "invisible hand" of markets helps allocate resources • Governments Can Sometimes Improve Market Outcomes: Especially in the presence of market failures • A Country’s Standard of Living Depends on Its Production: Productivity determines economic growth • Prices Rise When the Government Prints Too Much Money: Inflation is linked to money supply • Society Faces a Short-run Trade-off Between Inflation and Unemployment: A key relationship in macroeconomic policy 2. How Markets Work • Supply and Demand: Explains the basic mechanics of markets and how supply and demand set prices • Elasticity: Importance of understanding how quantity demanded or supplied reacts to changes in price, income, etc • Market Efficiency: How the equilibrium price maximizes total welfare and allocates resources efficiently 3. Market Failure • Externalities: When market outcomes affect third parties, like pollution. Government intervention may be necessary • Public Goods and Common Resources: Public goods (non-excludable and non-rivalrous) can lead to free-rider problems, while common resources (like fisheries) may be overused 4. Government’s Role in the Economy • Taxes: How taxes impact supply and demand, create deadweight loss, and reduce efficiency • Subsidies and Price Controls: Minimum wage, rent controls, and subsidies can distort markets, often with unintended consequences 5. The Economics of the Public Sector • Government Spending and Taxes: Examines how governments collect revenue (taxation) and the impact on the economy • Budget Deficits: How borrowing affects future generations and the economy’s long-term growth 6. Firm Behavior and the Organization of Industry • Costs of Production: The difference between fixed and variable costs, and how firms decide on output levels to maximize profit • Market Structures: Overview of different types of markets: perfect competition, monopoly, oligopoly, and monopolistic competition. • Monopoly Power: When one firm dominates the market, leading to inefficiency and higher prices 🔗 You can download whole book freely from comment section and read other points of this summary 🔗

Replies (2)

More like this

Recommendations from Medial

Shriyam jha

Building the future,... • 7m

Curious to know how experienced founders validate ideas and study markets. What tools/sites do you use for market + competitor research? How do you understand customer pain points? Any underrated hacks or resources? Would love your insights! 🙌

See MoreSanskar

Keen Learner and Exp... • 1y

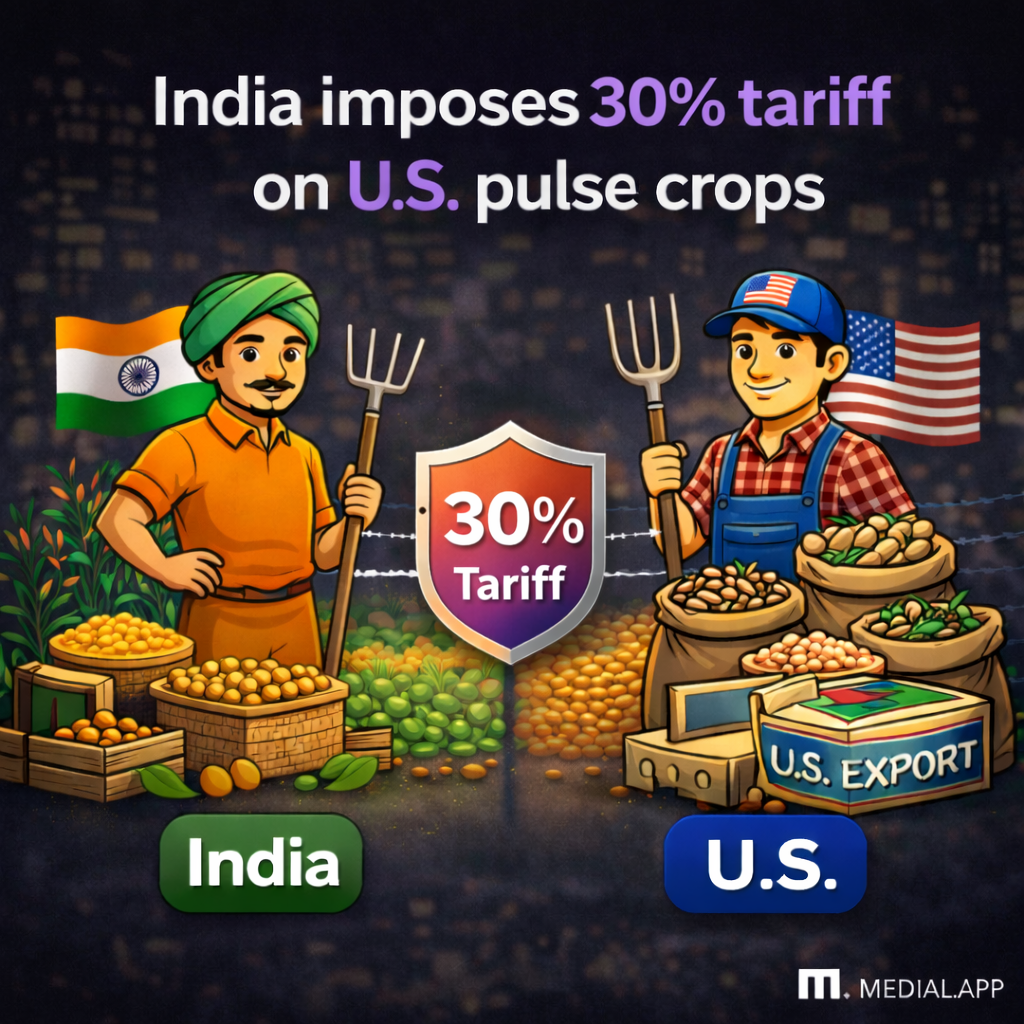

There exists a market whose value is estimated to range between 20% to 30% of India's GDP. Yes, I am talking about the Black market (it refers to illegal trade and transactions that occur mainly to Avoid taxes or to trade illegal goods.) But do you

See MoreVedant SD

Finance Geek | Conte... • 1y

Day 70: Bengaluru's Startup Ecosystem: A Global Stage Bengaluru's startup ecosystem has evolved into a global powerhouse. Here's how to leverage this international exposure: * Tap into Global Talent: Recruit top talent from around the world to fuel

See MoreVedant SD

Finance Geek | Conte... • 1y

Day 66: Bengaluru's Startup Ecosystem: A Global Stage Bengaluru's startup ecosystem has evolved into a global powerhouse. Here's how to leverage this international exposure: * Tap into Global Talent: Recruit top talent from around the world to fuel

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)