Back

Saksham

•

Bebyond • 1y

Intellectual Property Audit: The Overlooked Key to Accurate Valuation! Intellectual property (IP) is a critical driver of business success in today’s knowledge-driven economy. Properly valuing IP is essential for strategic decision-making, transactions, and maintaining a healthy financial outlook. But here’s what many miss: Before diving into the valuation process, a crucial step often overlooked is the Intellectual Property Audit! What is an Intellectual Property Audit? An IP audit is a systematic examination of your business’s intellectual assets. It identifies, organizes, and assesses the true value of these intangible assets, serving multiple critical functions: 1. Identifying and Cataloguing IP Assets - Create a comprehensive inventory of your IP, including patents, trademarks, copyrights, designs, and trade secrets. - Ensure no asset is overlooked or undervalued! 2. Legal Compliance - Verify that all IP is properly registered and legally protected. - Detect potential **infringements** or risks that could damage your IP rights. 3. Assessing Commercial Viability - Analyze the market relevance and commercial potential of each asset. - Identify underutilized IP and areas for strengthening protection. 4. Risk Mitigation - Pinpoint any litigation risks or challenges to your IP and address them before valuation. Why an IP Audit is Essential for Accurate Valuation The information from the IP audit forms the foundation of the valuation process, making it: - Accurate: Informs about the scope, strength, and potential risks of each asset. - Strategic: Helps align the IP valuation with the company’s financial standing and market position. Without an audit, IP valuation becomes unreliable and may lead to flawed decision-making. The Takeaway: Don’t Skip the Audit! Before valuing your IP, ensure a comprehensive IP audit is conducted. It’s a strategic move that: - Safeguards your assets - Mitigates risks - And provides a clear pathway for informed business decisions!

Replies (3)

More like this

Recommendations from Medial

PRATHAM

Experimenting On lea... • 10m

WTF is an IP ( Intellectual Property ) ⁉️ IP is basically your ideas, creations, logos, code, designs, music ; protected under law. Not just protected... owned. Like literally. Aapka maal, aapki rules. But why's it important? Because ideas are c

See MoreShivam Singh

"Igniting My Startup... • 1y

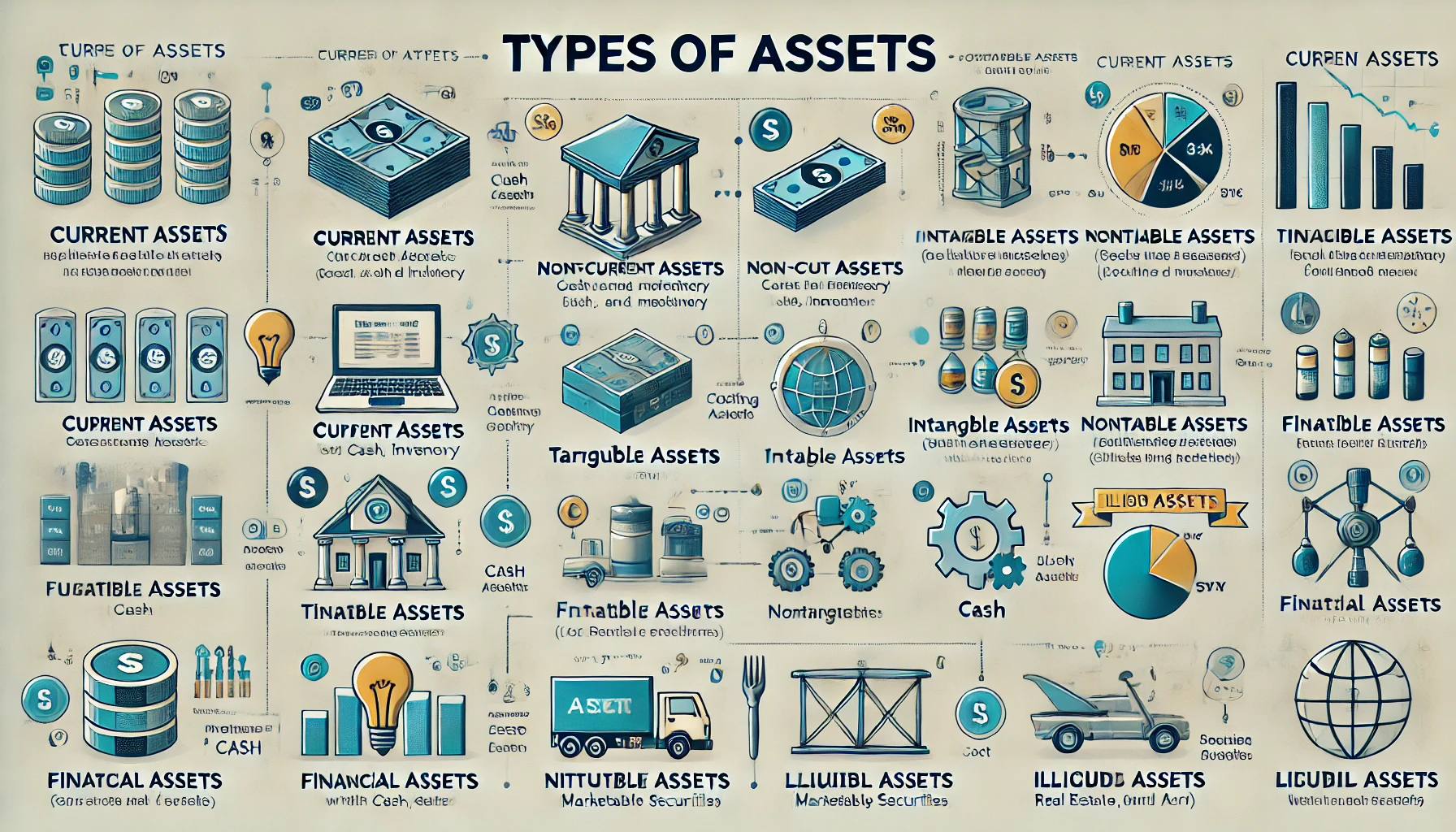

Fundamental Challenges of Finance #Valuation . How are financial assets valued? How should financial assets be valued? How do financial markets determine asset values? How well do financial markets work? #Management . How much should I save

See MoreTushar Aher Patil

Trying to do better • 1y

Day 6 About Basic Finance and Accounting Concepts Here's Some New Concepts 3. Tangible Assets Physical assets that have a physical form and can be touched. Examples: machinery, real estate, vehicles, inventory, and office supplies. 4. Intangibl

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)