Back

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 2m

Top Mutual Fund Holdings in IndiGo! Here are the latest mutual fund investors holding major stakes in InterGlobe Aviation (IndiGo) as of October 2025. From ICICI Prudential to SBI, HDFC, Axis, Nippon & more — see who holds the biggest share in Indi

See More

VIJAY PANJWANI

Learning is a key to... • 4d

Flexi Cap Mutual Funds – Smart Investing Made Simple Market kabhi Large Cap chalta hai, kabhi Mid Cap, kabhi Small Cap… Lekin ek cheez constant hai — Market Rotation. 💡 Flexi Cap Funds give flexibility to invest across Large, Mid & Small Caps — so y

See More

VIJAY PANJWANI

Learning is a key to... • 23d

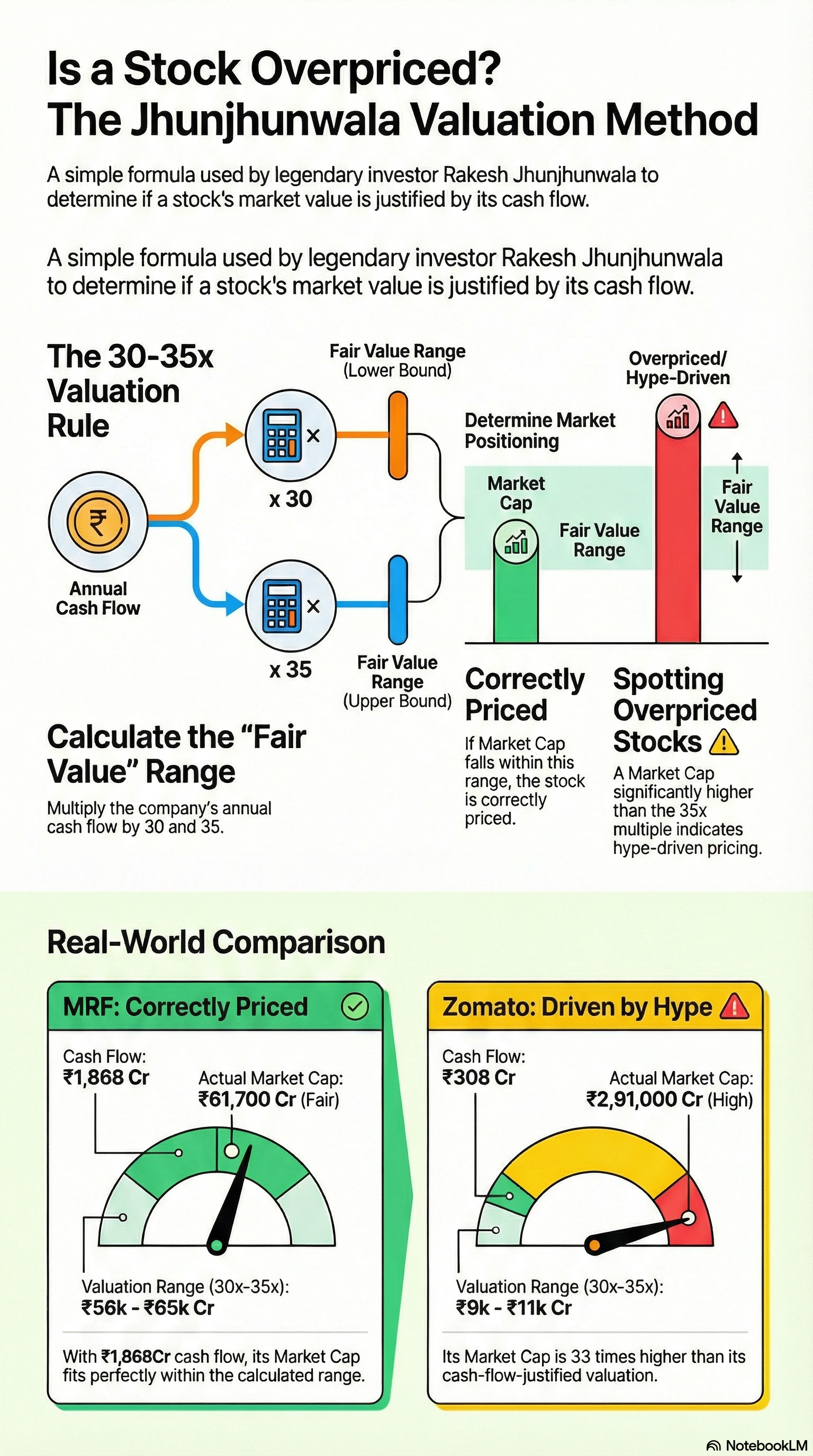

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

financialnews

Founder And CEO Of F... • 1y

"Sebi Permits Mutual Funds to Invest in Overseas Funds Holding Indian Securities for Enhanced Transparency" Sebi Permits Mutual Funds to Invest in Overseas Funds with Limits on Indian Securities Exposure The Securities and Exchange Board of India (

See MoreDr Sarun George Sunny

The Way I See It • 3m

SEBI’s New Rule: Mutual Funds Must Say Goodbye to Pre-IPO Deals The Securities and Exchange Board of India (SEBI) has recently stepped in to bring a meaningful change in the way mutual funds invest in the IPO space. From now on, mutual funds can no

See More

financialnews

Founder And CEO Of F... • 1y

"How to Build ₹5 Crore in 20 Years: Top Mutual Fund Schemes to Consider" How to Build ₹5 Crore in 15-20 Years: Best Mutual Fund Investment Strategy If you aim to accumulate ₹5 crore in 15-20 years, it’s crucial to choose the right mutual fund schem

See MoreMohd Rihan

Student| Passionate ... • 11m

Everyone should know 19 financial terms before any investment... Stock: A security that represents the ownership of a fraction of the issuing corporation. IPO: The first sale of the company's share to the public allowing it to raise capital by listin

See More

Dhipan Karthick

Founder/Entrepreneur... • 1y

Have you ever thought why stock will go up when bought and down when sold. If demand rise......uhhh😮💨 Heard a lot of times Shall we enter with this knowledge 🤔 Sure if you want 100% risk and 1% return. Then how to pick a stock 😵💫. Understand

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)