Back

Anonymous

Hey I am on Medial • 1y

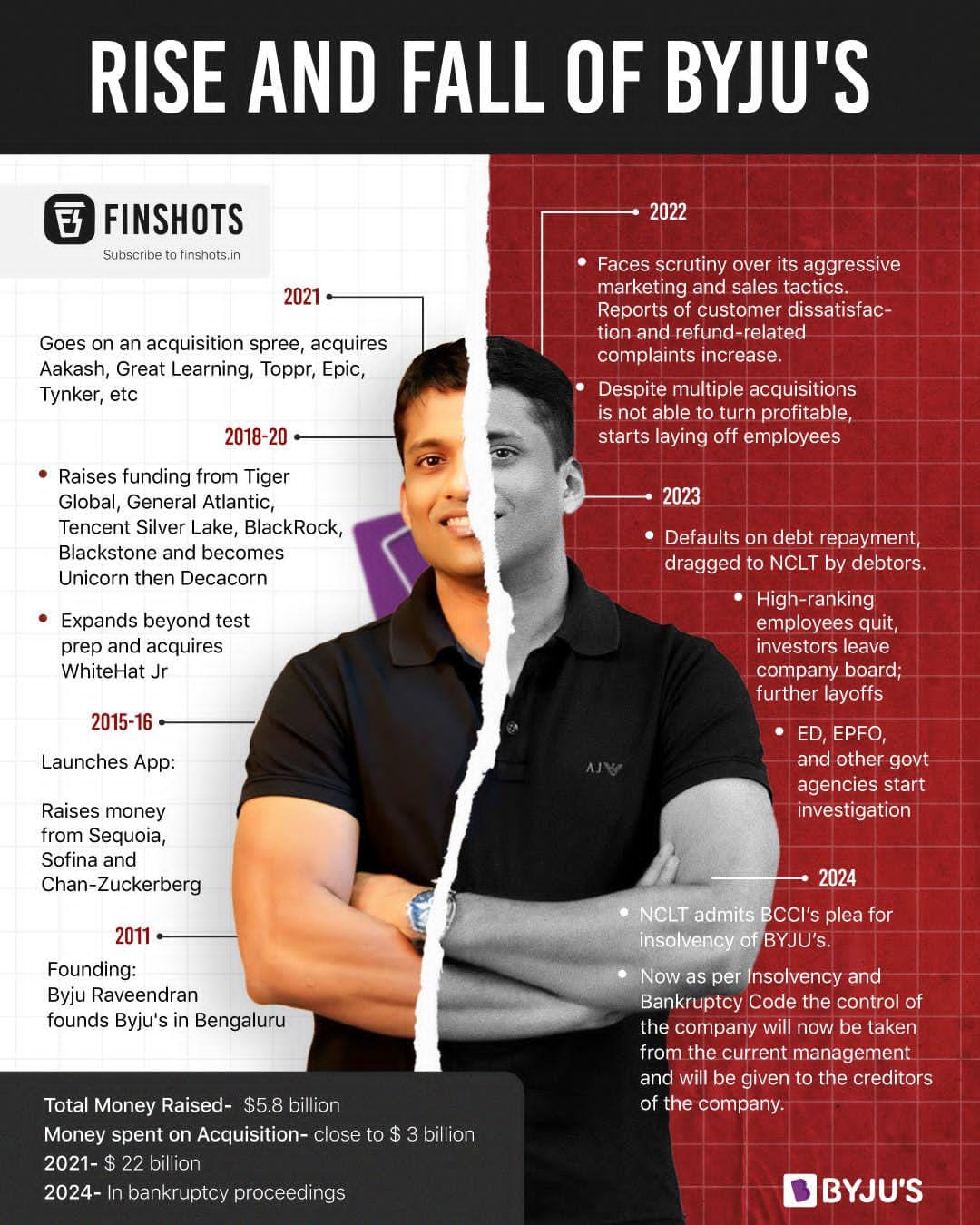

When you hear that a company went bankrupt, many of you will think is that the company sold all their assets, paid their creditors what they had and just stopped the running the company. But that's Chapter 7 bankruptcy or liquidation and that's not what takes place most of the time. When you hear a company went bankrupt, the company most probably filed for Chapter 11 bankruptcy or restructuring. In simple words, basically all the creditors of the company get a stake in the company and the company keeps running as usual. So for example a company with $500 Million in liability files for Chapter 11 Bankruptcy. Thus in this case, 1) The value of company's asset will be estimated. Every creditor and owner will come with a different figure and one of those will be finalised. Lets say $200M in our case. 2) Now creditors will be alloted stake in the company based on their seniority. This list goes something like Secured Creditors, then Unsecured Creditors, followed by Prefered Stock Holder and finally Common Shareholder. Now the stake is allotted based on who's first in the list. Common shareholders mostly get nothing to negligible stake during this. 3) The restructuring is now complete. The creditors are now the new owners of the company and now they can change the operations, hire or fire management based on their choice. So a company may get bankrupt multiple times and will still be running. This bankruptcy is widely used so the company can remain in the buisny and yeild income in the future (thats never happens tho)

Replies (1)

More like this

Recommendations from Medial

Vansh Khandelwal

Full Stack Web Devel... • 7m

In the blog titled "Bankruptcy: Understanding the Approaches," I explore essential strategies for businesses facing bankruptcy. The three primary approaches discussed are debt restructuring, deferment of payments, and emergency relief operations. D

See MoreJaswanth Jegan

Founder-Hexpertify.c... • 1y

"The Hero Who saved a Airline Twice" Bankruptcy to Billions #6 Ajay Singh returns to save SpiceJet Ajay Singh Bought ModiLuft(bankrupt Airline) and renamed as Spicejet with three leased aircraft, and Rs 10 crore of investment.SpiceJet took off on 2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)