Back

LIKHITH

•

Medial • 1y

Not All IPOs' are bubble, We can't bracket the word IPO for bubbles when only a few are over valued

Replies (1)

More like this

Recommendations from Medial

Ashish Singh

Finding my self 😶�... • 1y

In 2025, several companies are expected to launch significant IPOs, potentially breaking records in the Indian market. Key players include: -- Reliance Jio: Valued over $100 billion, anticipated to be India's largest IPO. -- Flipkart: Expected to

See More

Rohan Saha

Founder - Burn Inves... • 1y

PhonePe has planned its IPO in India, and Navi is also set to follow. Groww and OYO are preparing their IPO papers as well. In a few days, we will see many mainboard IPOs. Many famous startups are shifting from private funding to IPO plans. I hope th

See MoreROSTOZON

Stay with Community • 1y

Billionaire Mukesh Ambani is preparing for Reliance Jio's IPO, expected to raise Rs 35,000-40,000 crore, marking one of the largest IPOs in Indian history. Valued at $120 billion, the IPO is set for the second half of 2025. It will include both exist

See More

Rohan Saha

Founder - Burn Inves... • 8m

With NSDL IPO coming up, the next 2–3 months are set to be packed with a wave of new listings. Big names like HDB Financial, Veritas Finance and Paras Healthcare are also in line. The market is going to be buzzing with action. And these are just a fe

See MoreVIJAY PANJWANI

Learning is a key to... • 1m

About 200 Companies are either Approved or in the Pipeline for the IPO✨ ✅ About ₹2.5 Lakh Crore Potential Fundraise! ✅ Here are some Awaited Big Sized IPOs for 2026: 👉 Reliance Jio IPO - Expected by to be India's Biggest Ever IPO (₹40,000 Cr+)

See More

VCGuy

Believe me, it’s not... • 1y

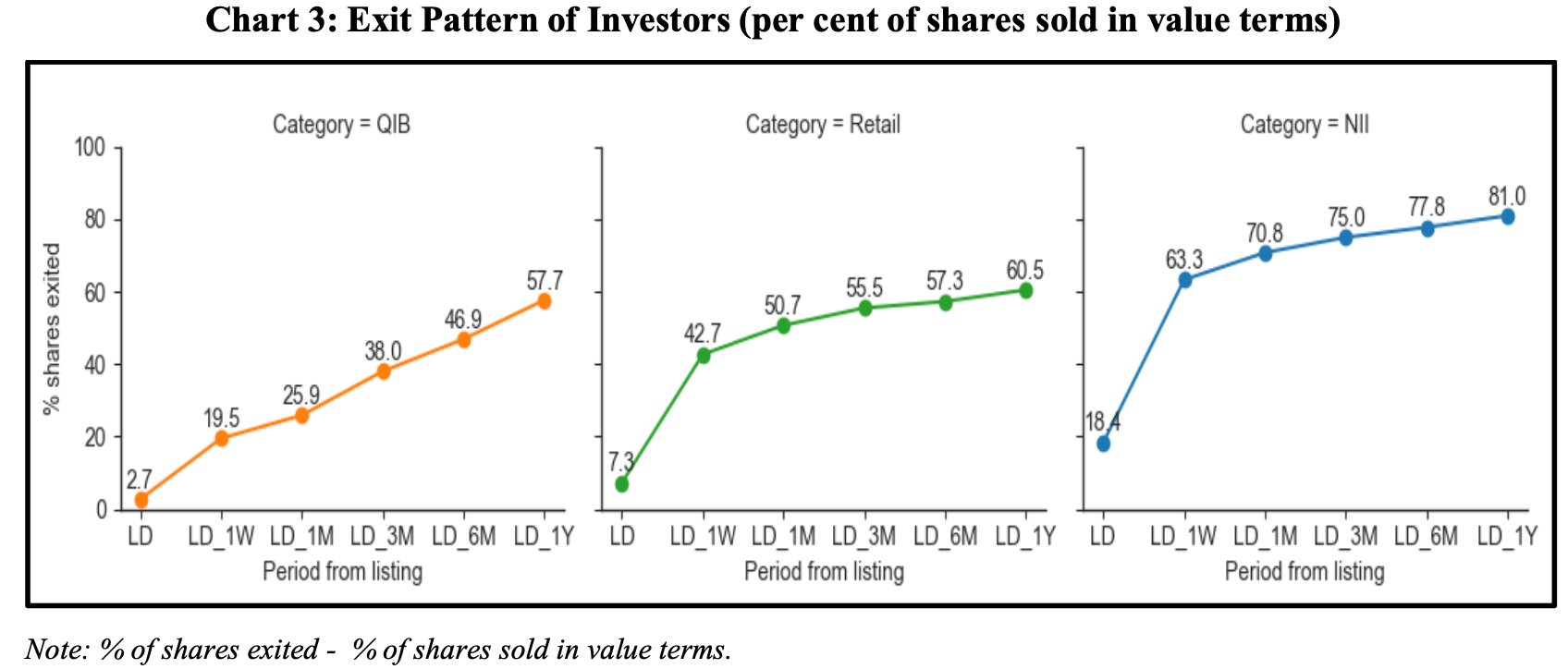

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)