Back

VCGuy

Believe me, it’s not... • 1y

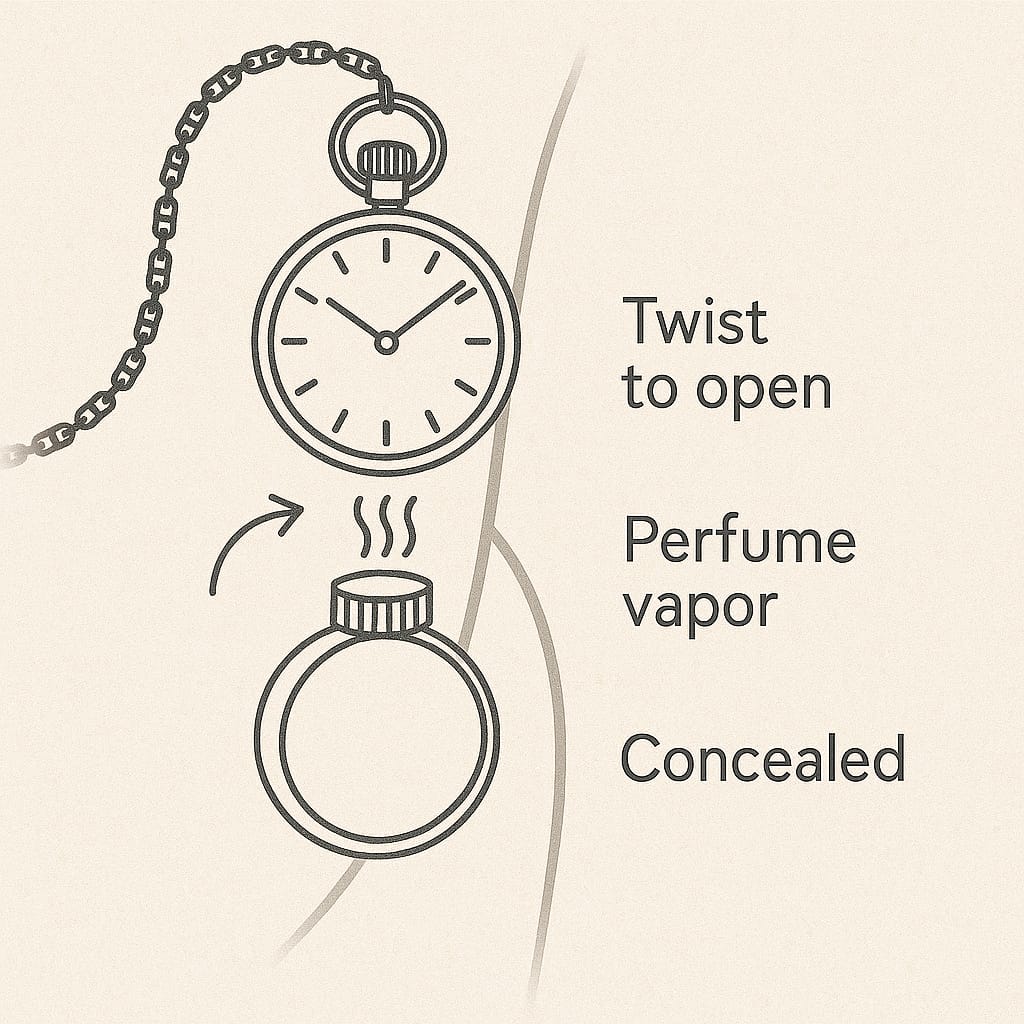

In India, billions of dollars are managed on excel and pen/paper. Brokers, small distributors, and family offices lack comprehensive software to manage data and client portfolios. A company looking to solve this: Centricity picked up $20 M in a seed round. ⏩Investors include: Lightspeed, Paramark VC, and Family offices of M.S. Dhoni and NB Ventures. 💡Centricity offers - - Analytics, reporting and insights for Single Family Offices and HNIs via Invictus platform - OneDigital: A discovery platform that provides -> a). Comprehensive list of products from asset management companies b). Access to PMS managers c). AIF's - listed/private equities, and debt opportunities d). Digitally onboarding for distributor's customers, transaction and reporting tools. 📄As per a SEBI report -> AMCs are unwilling to focus on distribution channels outside the Top 200 districts by GDP. The AUM earned for every rupee spent is not economically viable(89.75% of all the distribution costs by AMCs are incurred in the T-15 cities). ⏯️Startups like Centricity will help improve the under-penetrated asset management market.

Replies (8)

More like this

Recommendations from Medial

Sagar Vadadoriya

Idea hamster 💡 • 1y

India now has more than 300 family offices, up from 45 in 2018, revealed a latest report by PWC India. The report further highlighted that family offices are increasingly investing in startups, diversifying their portfolios, and seeking higher retur

See MoreVivek Joshi

Director & CEO @ Exc... • 4m

The Direct Comparison Family Offices vs. VCs: The Investor Showdown When you're a startup founder seeking capital, not all money is created equal. While both family offices and institutional VCs provide crucial funding, their impact and approach coul

See More

Akshat Khandelwal

Fulfilling my vision... • 1y

Hey medial family!! "Looking for an Excel wizard to streamline your data management? I specialize in data analysis, organization, and reporting to help your business thrive. From dynamic dashboards to error-free spreadsheets, I can deliver tailored

See MoreAltamash Zia

Building Strategies ... • 1y

Azim Premji and Ranjan Pai's family offices are set to invest approximately $100 million in Akasa Air, acquiring a minority stake, according to The Economic Times. This investment is part of a larger funding round worth $130-$140 million, which value

See More

Murtaza ali Bohara

Creativemind , HR , ... • 1y

Just a quick question what will happen when Family business take a step in startup world? Answer: 1)The cashflow problem will be solved,the customer retention is so great that competitor will not compete also 2) The investment will in the asset and

See MoreShuaib p

Innovation thought • 3m

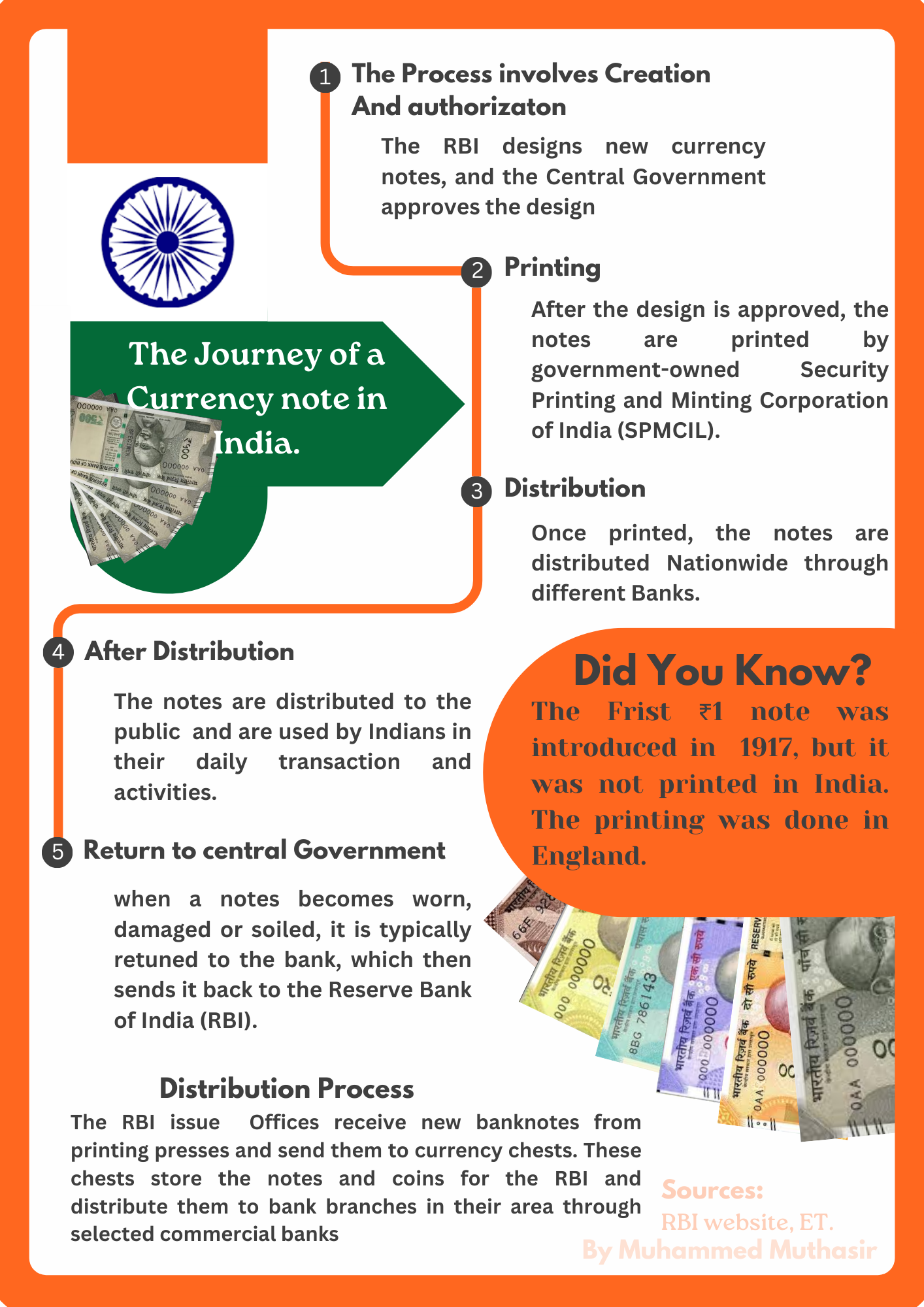

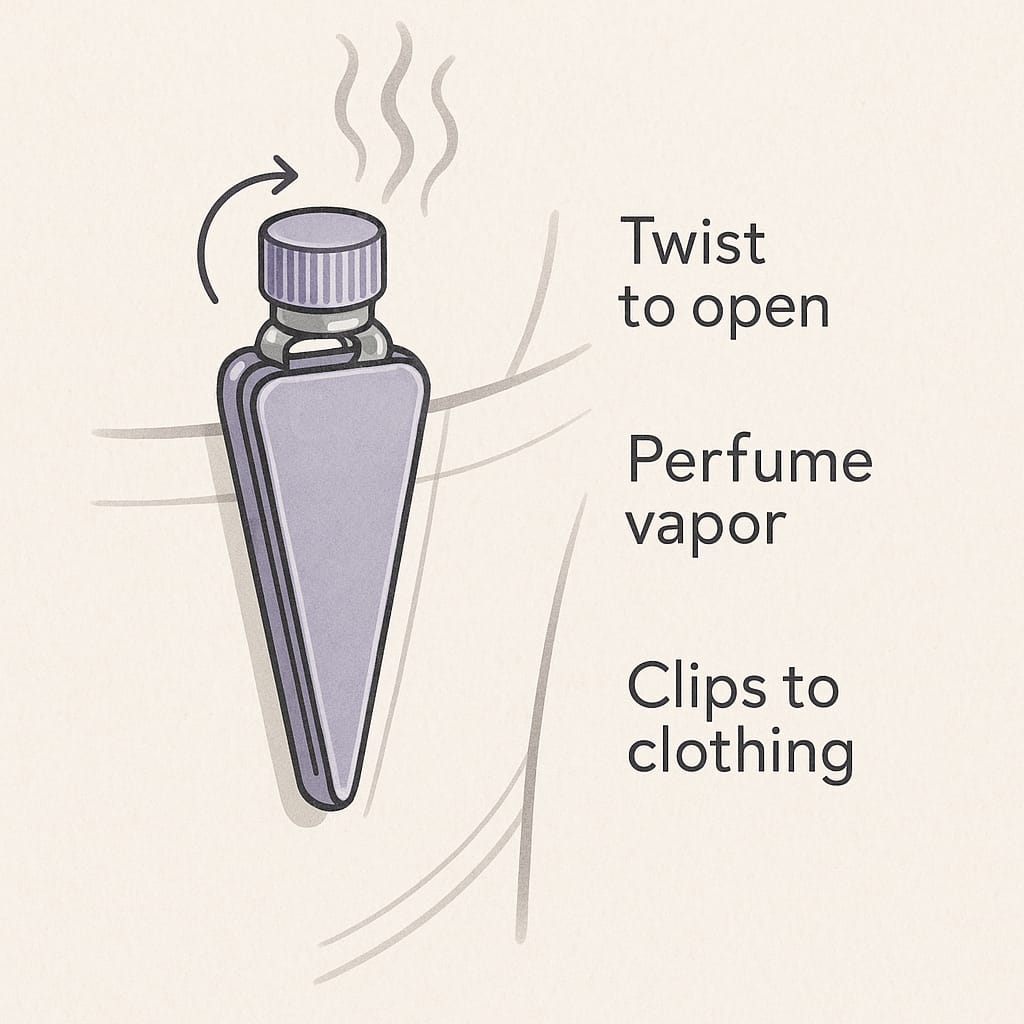

hi my idea is I was traveling in the car with my family, and I had applied a strong-smelling perfume. Because of that, some family members started feeling uncomfortable. So, I wrapped my shirt in a polythene bag, and that’s when the idea of a Perfum

See More

Download the medial app to read full posts, comements and news.