Back

Niket Raj Dwivedi

•

Medial • 1y

Starting a list of early stage Venture Capital Investors you can approach for pre-seed funding - 1. FAAD Capital: (https://www.faad.in/) 2. Better Capital: (https://bettercapital.vc/) 3. Capital A: (https://www.capitala.in/) 4. Point One Capital:(https://www.pointone.capital/) 5. Bharat Founders Fund: (https://bharatfounders.com/) 6. All In Capital: (https://allincapital.vc/) 7. Gemba Capital: (https://gembacapital.in/) 8. Eximus Capital: (https://eximus.vc/) 9. 100X VC: (https://www.100x.vc/) 10. Antler: (https://www.antler.co/) 11. DeVC: (https://www.devc.io/) 12. Athera Ventures: (https://www.atheraventures.com/) 13. Fundamental VC: (https://www.fundamental.vc/) 14. WeFounder Circle: (https://www.wefoundercircle.com/) 15. Ah Ventures:(https://www.ahventures.in/) 16. 2AM VC: (https://www.2am.vc/) 17. FirstCheque: (https://www.firstcheque.vc/) 18. We Work Labs: (https://www.wework.com/labs) 19. Fluid Ventures:(https://www.fluidventures.co/) 20. Atrium Angels: (https://www.atriumangels.com/) SaaS-focused Funds: 1. Neon Fund: (https://neon.vc/) 2. Uppekha: (https://www.uppekha.com/) Student-focused Funds: 1. GradCapital: (https://www.gradcapital.in/) 2. Campus Fund: (https://www.campusfund.in/) This is a rolling list, we will keep editing and adding more names to it. Please comment down below the good funds you have come across and we will keep adding them! Let’s make the most comprehensive list of early-stage VCs in India!

Replies (73)

More like this

Recommendations from Medial

Arslan

Business owner | Bus... • 6m

List of Angel Investors and VC; Category wise. There are links directly on their wbpage to Pitch. SaaS VC Name: Nexus Venture Partners https://www.nexusvp.com Angel name:100X.VC https://www.100x.vc/ Food/Consumables VC :Fireside Ventures https

See More

Adithya Pappala

Busy in creating typ... • 1y

🤫Only 1 Secret to raise funds from VC'S but sadly no-one is talking about It's very often that we show these 👇 to the Investors when raising funds: Problem Solution Product Market Gap Team Customers Revenue Achievements Etc... Even tho

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-2 😳Only 21 Indian VC Firms are there in 2013 So, Today’s VC topics are: 🎯Who Invests in Venture Capital? 🎯Definition & Difference between Private Equity & Venture Capital? 🎯Investors-VC also raises, We also raise but the di

See MoreAdithya Pappala

Busy in creating typ... • 1y

Only 1 Secret that you must know to raise funds from VC'S but sadly no-one is talking about.. It's very often that we show these 👇 to the Investors when raising funds: Problem Solution Product Market Gap Team Customers Revenue Achievements Et

See More

Adithya Pappala

Busy in creating typ... • 10m

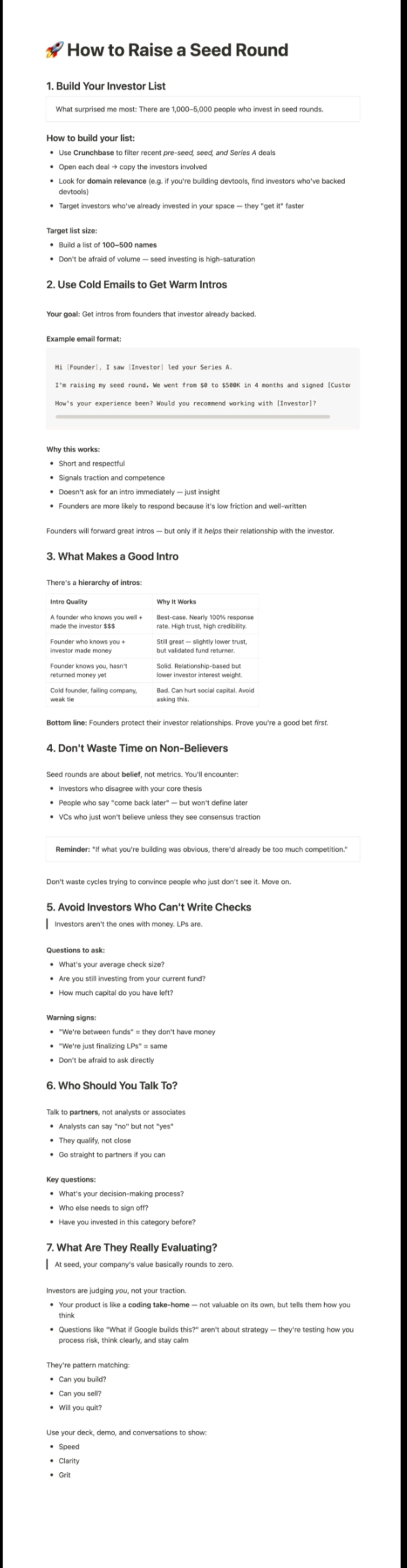

Raise the funds within 2 months! No more B.S Fundraise Advices.. So, I grabbed a doc that I wish I had this to my portfolio of founders on day 1. This list isn't a feel of good-tips. It's the actual playbook that raised more than $2M+ What's in

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)