Back

Three Commas Gang

Building Bharat • 1y

By wording I think maximum gst that can be collected on one transaction is 2000 i.e. upto 2k. So if the transaction is 10k or above, maximum you'll be charged is 2k.

Replies (2)

More like this

Recommendations from Medial

Abhishek Kumar

Co-founder and COO • 7m

KwikMedi is hiring for multiple on-site roles in Gurgaon. Location: 7th Floor, Unit 708, ILD Trade Centre, Gurgaon Apply: abhishek.kumar@kwikmedi.com (mention role in subject) People in Delhi NCR can walk in directly for interviews BD Intern (UPTO 1

See More

LetsConnect Mind care technology pvt ltd

•

Signitycs • 1y

In india Upto 18% GST Is Applicable - Education sector. Medical Industries - GST is Applicable. Luxury cars - Low ROI Tractors, - High ROI This Rules are Correct What is your opinion. its just an Question.. Because we stopped questionings..??

See MoreAshutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See MoreAccount Deleted

Hey I am on Medial • 9m

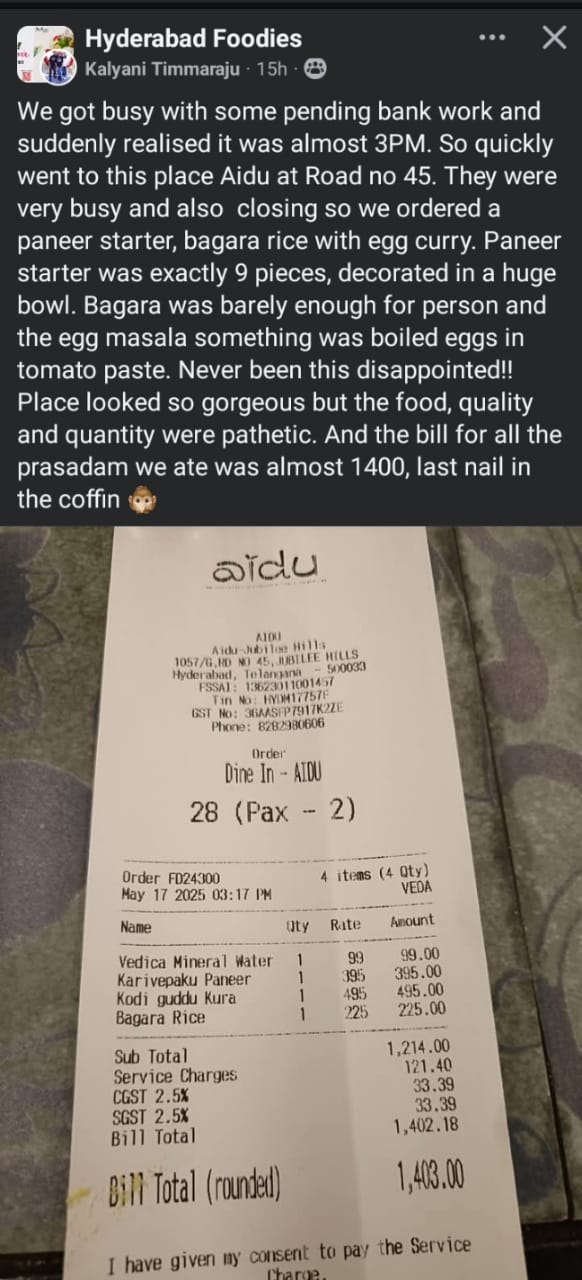

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

Ashutosh Mishra

Chartered Accountant • 1y

When I posted the poll yesterday for GST, I thought 20-30 people at max would vote and will see accordingly. But 100 people have voted so far. By this I have felt that people know GST through headlines i.e tax collection, GST notices to different co

See MoreNitin Jakhar

Hey I am on Medial • 1y

hi i am a student of b. pharmacy but my intrest in finance as stock market I have some experience but more then many people I have a strategy to work on in commodity to sl till 2000 points but target is 5 times of it i.e 8k to 10k points on which I w

See MoreGyana Ranjan Dash

•

Gameberry Labs • 1y

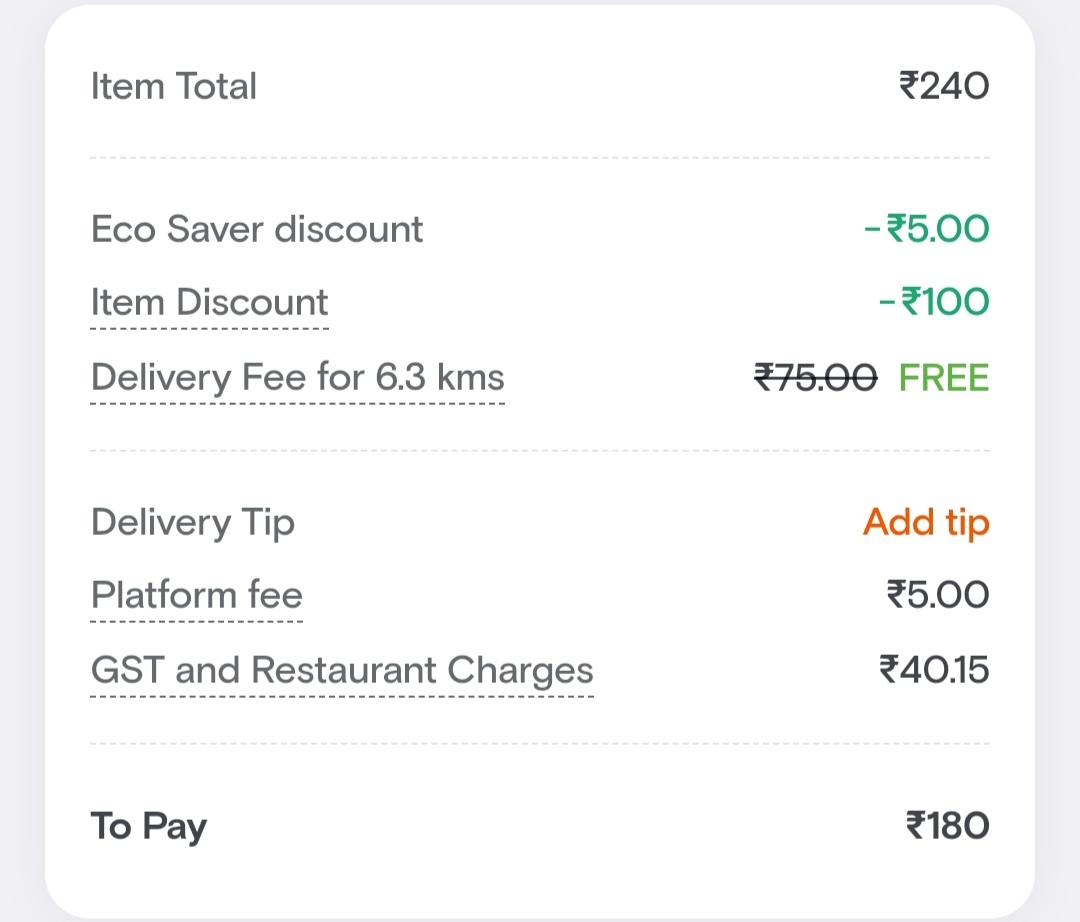

Yo, I'm a bit confused about something. I'm ordering a packaged food item, and the MRP (Maximum Retail Price) is supposed to include all taxes, right? But why is Swiggy charging me GST (Goods and Services Tax) on top of that? There's also a platform

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)