Back

Saksham

•

Bebyond • 1y

Top Management Exits in M&As (Smooth transitions, not rough landings) Mergers and acquisitions often spell change at the top. Here's how to handle it: 1. Plan early: Don't wait for deal closure. Start exit discussions during due diligence. 2. Review existing contracts: Golden parachutes? Non-competes? Know what you're dealing with. 3. Craft tailored transition agreements: One size doesn't fit all. Customize for each executive. 4. Communicate strategically: Timing is everything. Plan your announcement carefully. 5. Manage knowledge transfer: Departing execs hold valuable insights. Capture them systematically. 6. Handle with empathy: It's business, but it's also personal. Show respect and professionalism. 7. Mitigate legal risks: Consult employment lawyers to avoid costly disputes. 8. Align incentives: Structure packages to support a smooth transition. 9. Plan for continuity: Who steps up? Have a clear succession plan. 10. Learn from the process: Each exit is a lesson. Refine your approach for future deals. Remember: Handled well, top management transitions can add value to your M&A.

Replies (3)

More like this

Recommendations from Medial

IncorpX

Your partner from St... • 9m

Warren Buffett’s Strategic Succession: A Masterclass in Leadership Transition In a move that combined meticulous planning with theatrical flair, Warren Buffett, the 94-year-old CEO of Berkshire Hathaway, announced his intention to step down at the e

See More

SamCtrlPlusAltMan

•

OpenAI • 1y

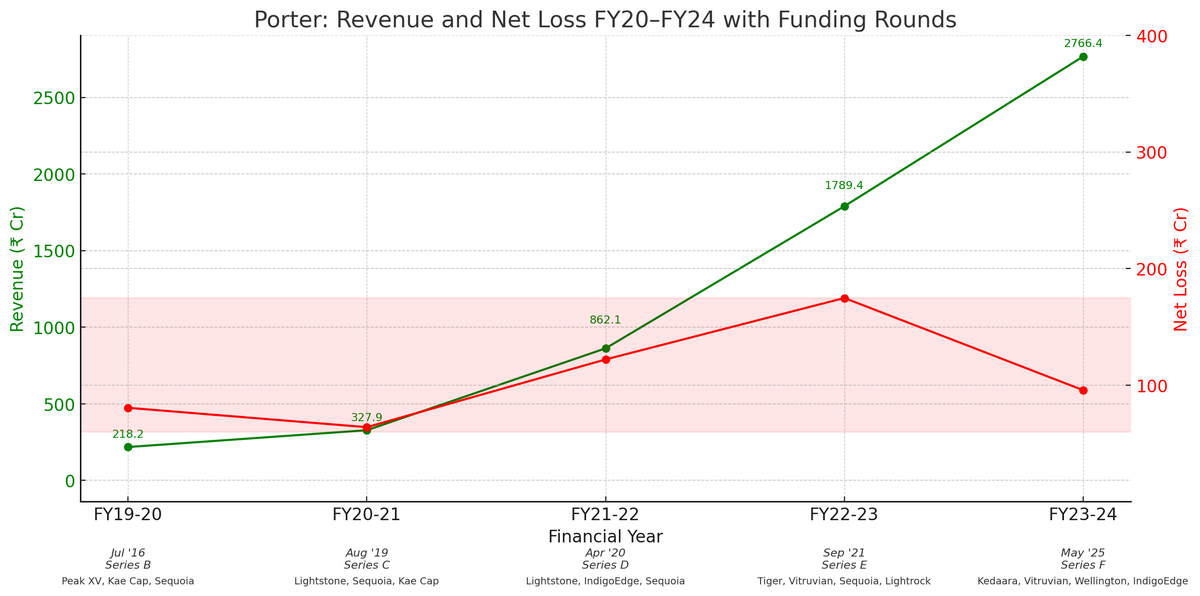

Sweet short summary: Bain 2024 Indian VC insights. • India's VC scene in 2023 was a rollercoaster. Funding dropped from $25.7 billion to $9.6 billion year-over-year. Despite this, India held onto its spot as the second-biggest VC destination in Asia

See MoreDhiraj Karalkar

•

PremitiveKey • 11m

The Art of SaaS Product Development: Why Premitivekey Stands Out Building a successful SaaS (Software-as-a-Service) product is more than just coding. It requires the right architecture, security, and scalability to handle growth. At Premitivekey, we

See More

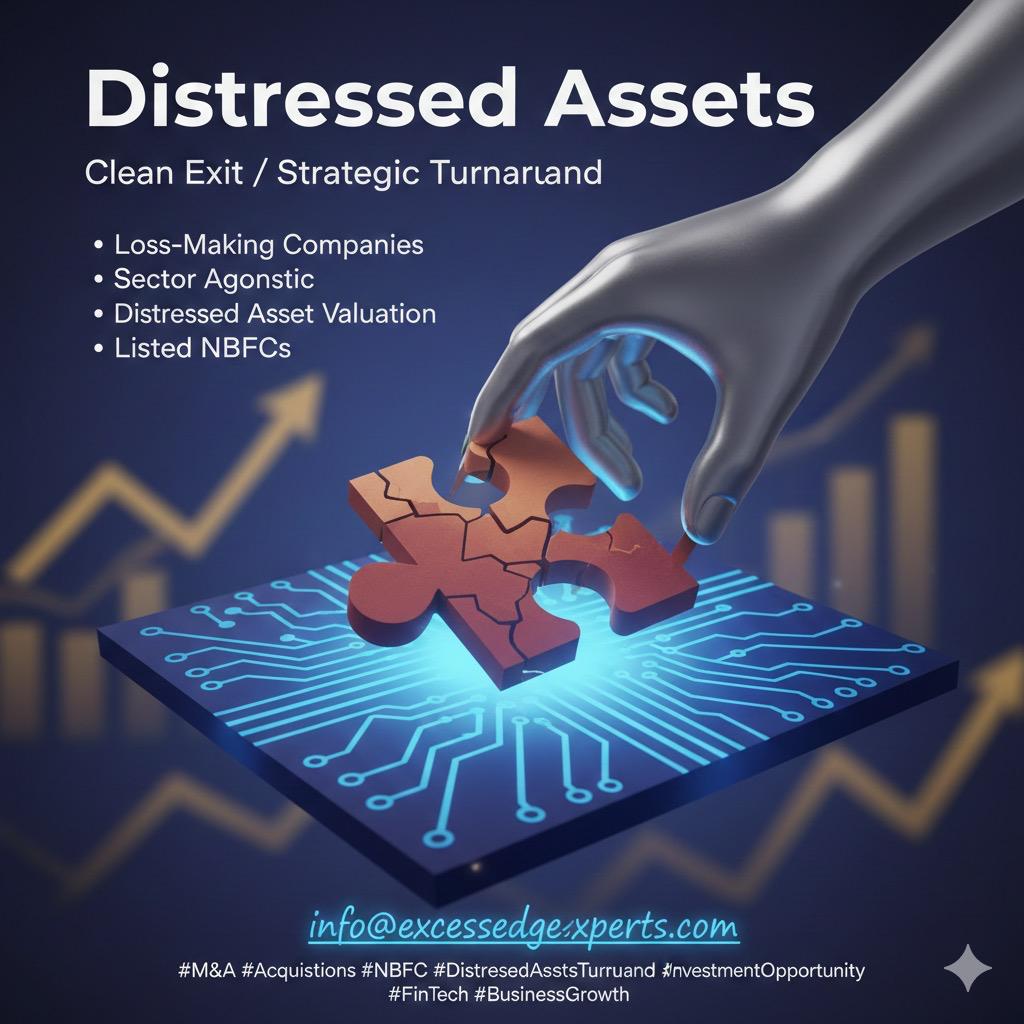

Vivek Joshi

Director & CEO @ Exc... • 2m

Distressed Assets Are you looking for a clean exit or a strategic turnaround for a struggling entity? We are actively expanding our portfolio and are on the lookout for specific acquisition opportunities. We are currently interested in: • Loss-Making

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)