Back

PRATHAM

•

Medial • 1y

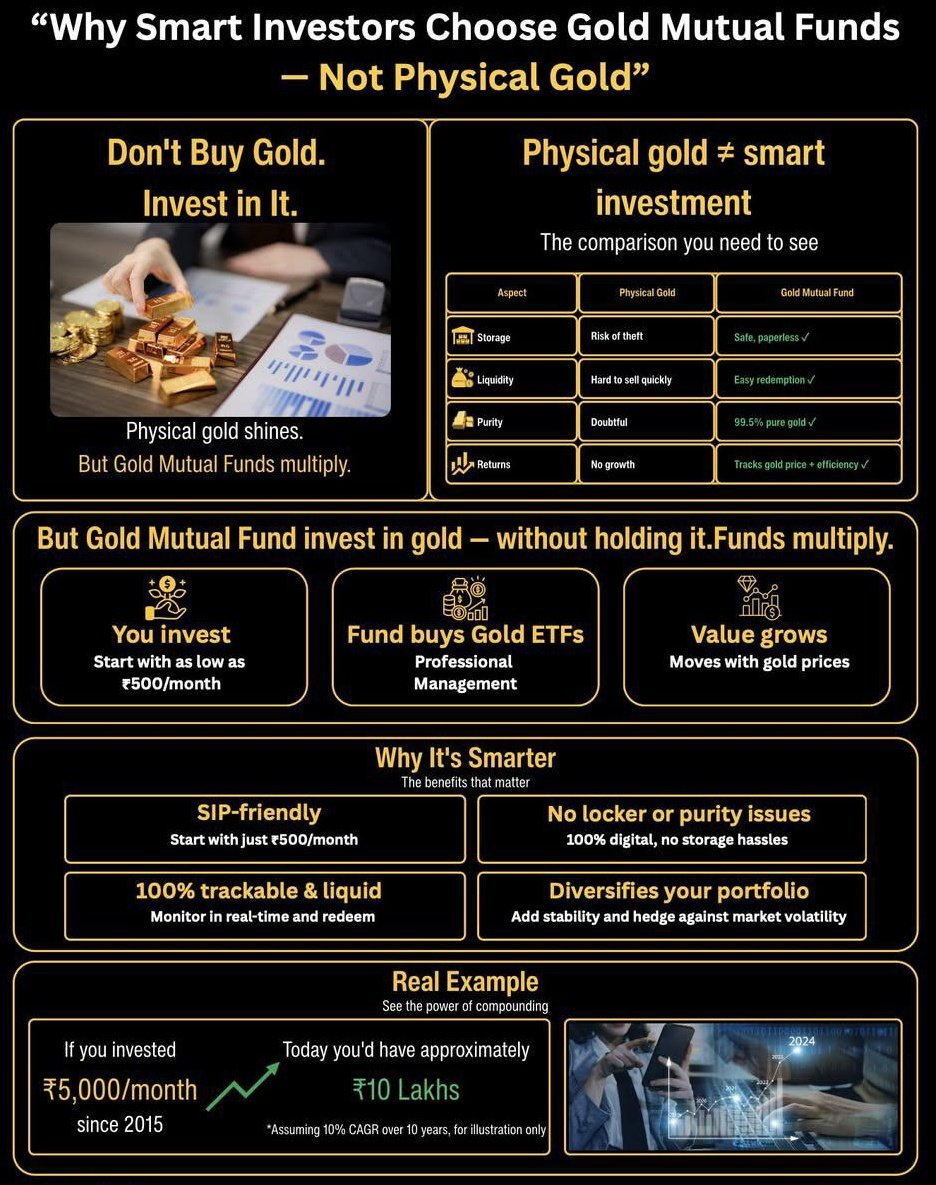

I don't agree, here's why! Why needed too much information when mutual funds and index funds are there. Early investment give return Equal to nothing where investing in yourself gives exponential Growth which is Guaranteed Investing your time in finding out good stocks is shit where you can buy mutual fund's units according to your risk appetite. The time can be invested on ownself.

Replies (1)

More like this

Recommendations from Medial

Mohd Rihan

Student| Passionate ... • 11m

Everyone should know 19 financial terms before any investment... Stock: A security that represents the ownership of a fraction of the issuing corporation. IPO: The first sale of the company's share to the public allowing it to raise capital by listin

See More

Krunali Jain

Actively looking for... • 1y

As a beginner with NO knowledge in stocks/mutual funds, what should my first step be to get into investing? How can I start? Should I - 1) Study Stocks (also, please suggestbest resources to get strted with) OR 2)Practically start with mutual funds

See MoreDr Sarun George Sunny

The Way I See It • 3m

SEBI’s New Rule: Mutual Funds Must Say Goodbye to Pre-IPO Deals The Securities and Exchange Board of India (SEBI) has recently stepped in to bring a meaningful change in the way mutual funds invest in the IPO space. From now on, mutual funds can no

See More

Anonymous

Hey I am on Medial • 1y

Hi i am a fresher earning 60k a month and want to start investing in mutual funds i have slight knowledge about them but am confused where to start how to set goals and what is personal finance can someone please help me understand where to start and

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)